WePay Review

WePay, founded in 2008 by Rich Aberman and Bill Clerico, is a US based payment service provider that offers integrated and customizable payment solutions. Built around its API driven approach WePay primarily serves platform businesses, marketplaces, crowdfunding sites and small business software providers. In 2017 the company was acquired by JPMorgan Chase expanding its reach and solidifying its position in the financial services space. Lets read more about WePay Review.

In today’s digital economy processors like WePay are essential in supporting smooth electronic transactions between businesses and their customers. They handle all types of payments; credit cards, debit cards and digital wallets; ensuring secure and efficient fund transfers. Beyond payments they also play a critical role in customer trust by providing reliable authorization, authentication and settlement processes.

Processors also offer strong security measures like encryption and fraud detection to protect sensitive financial data and help businesses comply with industry standards. They support multiple currencies and payment methods so businesses can go global and serve diverse customer bases.

Company Background: WePay History and Growth

The idea for WePay came from a personal challenge. When Aberman couldn’t collect money from friends for his brother’s bachelor party he realized there needed to be a better way to collect money from multiple people. Partnering with Clerico the two created WePay to make collecting money from multiple people easier.

In its early days WePay focused on group payments and event ticketing. Over time the company shifted to serving platform based businesses with integrated payment solutions. This allowed WePay to work with marketplaces, crowdfunding platforms and SaaS providers and offer tailored services through its APIs.

JPMorgan Chase acquired WePay in October 2017 for over $220 million. The acquisition aimed to give small businesses access to Chase’s resources through software partners while preserving WePay’s innovative Silicon Valley culture. As part of JPMorgan Chase WePay is a payments innovation hub giving partners and merchants access to Chase’s large small business client base.

Today it continues to serve platforms with customizable API based payment solutions. Clients like GoFundMe, Meetup and FreshBooks rely on WePay’s ability to provide seamless branded payment experiences that match their operational needs.

Key Features: Enhancing Payment Solutions with WePay | WePay Review

WePay is designed with platform-based businesses in mind, offering features that streamline transactions while prioritizing security and flexibility.

Integrated Payment Processing: Payments can be embedded directly within a platform’s service, avoiding external redirects and simplifying user experience.

Customizable User Experience: Through APIs, businesses can design branded checkout pages, emails, and communications, ensuring consistency across all interactions.

Fraud Detection and Risk Management: With machine learning and data analysis, it actively monitors for suspicious activity, providing merchants with a secure environment.

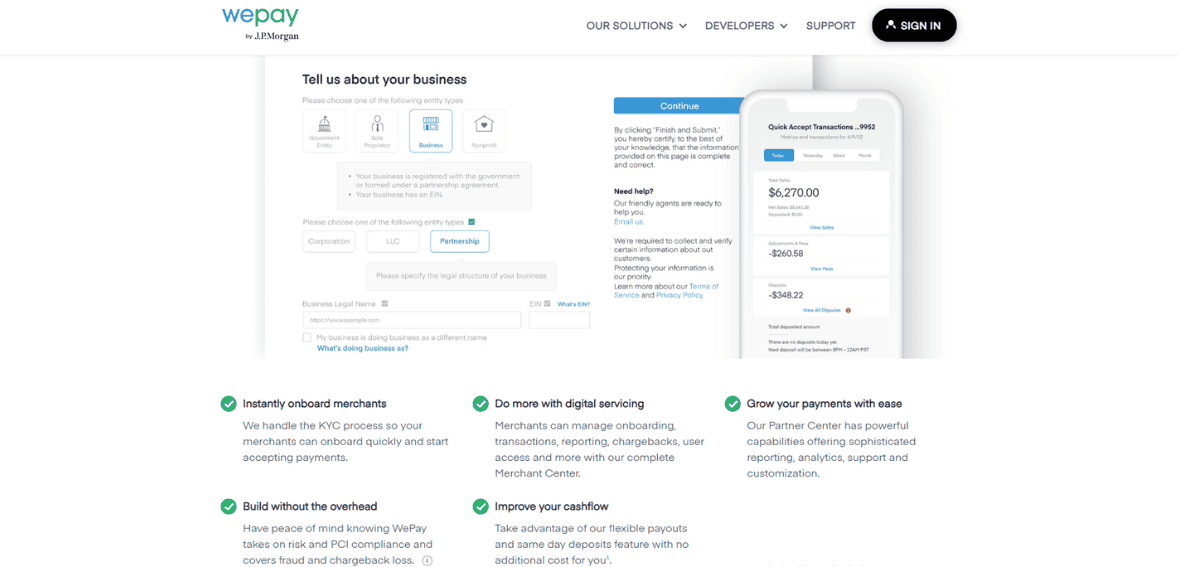

Instant Merchant Onboarding: Automated verifications and compliance checks help businesses begin processing payments quickly.

Flexible Payout Options: Same-day deposits and adaptable schedules support healthy cash flow management.

Mobile and Wallet Support: Compatibility with Apple Pay, Google Pay, and mobile transactions meets the growing demand for digital-first payments.

These tools allow WePay to deliver flexible and secure solutions that meet the diverse needs of modern, platform-driven businesses.

Pricing Structure: Understanding WePay’s Cost Framework

WePay structures its offerings under three tiers; Link, Clear, and Core; each catering to different business requirements.

WePay Link: An entry-level option, Link allows merchants to accept payments through Chase Integrated Payments. It carries standard fees of 2.9% plus $0.25 per transaction and requires minimal integration work.

WePay Clear: A step up from Link, Clear allows for deeper integration into platforms, offering customization and risk management features. Pricing is set on a case-by-case basis.

WePay Core: Targeted at larger facilitators, Core delivers full control over user experience and lifecycle management, with fees negotiated individually.

Platforms also have the option to set their own merchant pricing by applying markups to WePay’s rates, creating an additional revenue stream. However, Clear and Core lack publicly available pricing details, which has led to concerns about transparency.

Integration and Compatibility: Seamless Payment Solutions

It emphasizes easy integration and wide compatibility, making it attractive to developers and platforms alike.

Its developer-focused APIs, with documentation in multiple programming languages, allow customization for different applications. This flexibility ensures smooth payment experiences across mobile and desktop platforms. Additionally, it supports mPOS systems for in-person transactions, broadening its usability.

Digital wallet compatibility with Apple Pay and Google Pay further enhances convenience, aligning with customer expectations for modern payment methods. This adaptability makes it suitable for platforms spanning marketplaces, crowdfunding, and SaaS.

Security and Compliance: Safeguarding Transactions

Security is at the core of WePay’s operations.

Fraud Prevention: The platform uses machine learning to detect irregular patterns, blocking unauthorized activity.

PCI DSS Compliance: As a Level 1 PCI DSS-certified provider, it undergoes regular independent audits to maintain strict security standards.

Encryption: Data in transit is secured with RSA 2048-bit keys and SHA-256 certificates, while stored data uses AES 256-bit encryption with unique keys.

By combining regulatory compliance with advanced fraud detection, It provides a secure and reliable environment for both merchants and customers.

Customer Support and User Experience

It offers support primarily through email and its online Help Center, which provides articles and guides on key topics. The “Customer Delight” team operates Monday through Friday, from 6 am to 6 pm PST. Feedback on support is mixed. Some users appreciate the available documentation, while others find the reliance on email; without phone support; slows down response times. Concerns about resolution speed and communication options are recurring themes.

From an experience standpoint, It is designed for simplicity. Merchants benefit from a smooth onboarding process, while end-users enjoy straightforward checkouts without redirection to external sites. This ease of use supports both customer satisfaction and business efficiency.

Pros and Cons

Pros

Developer-friendly APIs for seamless integration.

Customizable, branded payment experiences.

No setup or monthly fees.

Cons

Limited direct access for small businesses (only available through partner platforms).

Lack of transparent pricing for advanced tiers.

Limited support channels, with reliance on email.

Alternatives to WePay

Businesses comparing WePay should also consider Stripe, PayPal Payments Pro, and Braintree:

Stripe: Known for its robust APIs and wide range of supported payment methods, Stripe offers transparent pricing (2.9% + $0.30 per transaction) with no monthly fees. Its global reach and subscription billing features make it ideal for tech-savvy businesses.

PayPal Payments Pro: Offers customizable checkout options and broad brand recognition, but requires a $30 monthly fee plus transaction fees. Its global presence makes it appealing to businesses targeting international customers.

Braintree: A PayPal-owned service supporting multiple payment methods, including Venmo and Bitcoin, Braintree charges 2.9% + $0.30 per transaction with no monthly fees. Its flexibility makes it attractive to businesses seeking a wide range of payment options.

Compared with these competitors, It stands out for its tight integration with JPMorgan Chase and platform-first strategy, though its limited transparency and support may deter some users.

Conclusion

It is best suited for platform-based businesses seeking integrated, customizable, and secure payment solutions. Its API-driven approach and Chase affiliation give it strong credibility, while its features support smooth transactions and fraud prevention. However, potential clients should weigh concerns about pricing transparency and customer support against its strengths. For marketplaces, crowdfunding platforms, and SaaS providers, it remains a compelling option in the competitive payment processing landscape.

FAQs

Can individual small businesses use WePay directly?

No. Small businesses typically access WePay through partner platforms or ISVs rather than engaging with WePay directly.

What types of platforms work best with WePay?

It integrates most effectively with crowdfunding platforms, marketplaces, and SaaS providers, where embedded payment functionality is crucial.

Does WePay support international payments?

It’s international support is limited to merchants in the U.S. and Canada. While it accepts payments from most global cards, availability depends on the platform partner.