Top 10 Best Credit Card Machines and Terminals in 2025

Choosing the best credit card machine of 2025 is critical for companies that have to make quick, secure, and flexible payments without overpaying credit card processing fees. Being a mobile retailer or small business owner, the best machines today possess price competitiveness, features of intelligence, and straightforward integration to cater your payment and ensure your customer’s satisfaction.

Key Features To Look For In a Credit Card Machine

- Multi-Payment Support – Ensure that the machine is contactless, chip & PIN, mobile payment (e.g., Apple Pay, Google Pay), and foreign card-capable.

- Connectivity Features – Choose machines with 4G embedded, Wi-Fi, or Bluetooth to facilitate easy and secure use anywhere.

- Security Compliance – Choose devices that are PCI DSS compliant and heavily encrypted for protecting customer data.

- Integration Support – It should be integratable with POS terminals, accounting software, and inventory programs for ease of integration.

- Battery Life and Portability – Improved battery life and less weight are needed to use in mobile or busy environments.

Top 10 Credit Card Machine 2025

1.Square

Square Reader is an easy, low-cost way to accept card payments on the go. Easy to use and by design, it’s mobile-compatible and has flat-rate, easy-to-calculates fees—no surprise bills or contracts. Ideal for small businesses and startups, Square also comes with helpful extras like sales, inventory, and customer tracking to help you build with confidence.

Key Features

- Facilitates contactless, chip, and swipe card payments easily

- Wireless communication with iOS and Android smart devices

- Native support for customer and inventory data management

- Appropriate security features to prevent fraud and protect transactions

- Smooth compatibility with accepted means of payment like Visa, Mastercard, Apple Pay, and Google Pay

- Thin, compact design perfect for small and convenient carrying

Pros and Cons

Pros | Cons |

Affordable upfront cost | Requires a smartphone to operate |

Includes inventory management and customer tracking | Lacks built-in cellular connectivity |

Supports contactless payments (Apple Pay, Google Wallet) | Limited advanced features for larger businesses |

Offers secure encryption | Battery life may not support extended high-volume use |

Price Structure

Cost Component | Price |

Hardware cost. | $27 per month for 12 months ($299 total) |

Transaction fee | 2.6% + 15 cents per in-person payment |

Monthly fees | None |

2.Tide Card Reader

The Tide Card Reader offers a unified payment solution that works in harmony with Tide’s business banking platform. It delivers a continuous end-to-end transaction and money handling experience. With affordable 1.5% transaction fees and built-in cellular connectivity, it allows you to take payments wherever Wi-Fi or smartphone—perfect for firms out in the countryside or with low-coverage premises.

Key Features

- Naturally integrates with Tide’s business bank account platform for hassle-free end-to-end money management

- Compatible with different kinds of payments, i.e., contactless, chip, and PIN payments, etc.

- Standalone device with built-in cellular connectivity—no smartphone or external internet necessary

- Charges just 1.5% transaction fee and no monthly service fee

- Offers instant payment processing and has 99.8% uptime for maximum reliability

- Has been developed with leading security and encryption features to avoid fraud

- A new special deals and discounts for the owners of a new Tide business account

Pros and Cons

Pros | Cons |

Integrated with Tide’s business banking | Limited third-party POS integrations |

Competitive 1.5% transaction fee | Not ideal for businesses outside Tide’s ecosystem |

Standalone cellular connectivity | Fewer advanced features compared to competitors |

Promotional offers for new users | No manual card entry option |

Price structure

Cost Component | Price |

Hardware cost | £59 + VAT |

Transaction fee | 1.5% per transaction |

Monthly fees | None |

3.Revolut Reader

Revolut Reader is appropriate for companies that prefer low transaction fees and to hold global transactions. With its very competitive rate of 0.8% + £0.02 per transaction, it’s highly suited for volume-based business and foreign exchange transactions. Its under three-second faster processing time makes the payment faster and more convenient for the customer.

Key Features

- 0.8% + £0.02 per transaction very low fees

- Chip, PIN, and contactless payment functionality

- Real-time multi-currency transaction support via currency conversion

- Three-second quick payments to facilitate instant checkout

- No subscription or monthly charge

- Up to 14 hours of additional battery life with the latest 2024 update

Pros and Cons

Pros | Cons |

Industry-low transaction fees (0.8% + £0.02) | Limited third-party software integration |

No monthly subscription required | No option for printed receipts |

Multi-currency settlement support | Lacks built-in customer management tools |

Fast transactions (under 3 seconds) | Requires Revolut Business account for full feature access |

Price Structure

Cost Component | Price |

Hardware cost | £49 + VAT |

Transaction fee | 0.8% + £0.02 per transaction |

Monthly fees | None |

4.SumUp Solo

SumUp Solo is a powerful, easy-to-use card reader that puts mobility at its core. Designed for mobile traders like market stalls, food vans, and pop-up shops, it comes with a SIM and 4G connectivity, so you can process payments online or offline without needing access to Wi-Fi. Just 0.99% fees per transaction make it a cheap way for small businesses to process payments. Ergonomic and compact in design and a doddle to use with its 2.4-inch responsive touchscreen, daily use is easy and uncomplicated, whether for chip, contactless, or mobile wallet payments.

Key Features

- Ergonomic, compact design with easy-to-use 2.4-inch touchscreen

- Built-in SIM and 4G connectivity—not a dedicated smartphone or Wi-Fi needed

- Low transaction fees starting from 0.99%

- Accepts contactless, chip, and PIN card payments

- Offers next-day payouts with a free SumUp Business Mastercard

- Itelligent tipping feature to encourage customer tips

- Advanced security with encryption and anti-fraud protection features

Pros and Cons

Pros | Cons |

Built-in SIM card for 4G connectivity | No manual card entry option |

Affordable transaction fees starting at 0.99% | Limited POS system integrations |

Compact and touchscreen design | Battery life may be insufficient for high-volume use |

Excellent customer support with fast issue resolution | No receipt printer included |

Price Structure

Cost Component | Price |

Hardware cost | £79 + VAT |

Transaction fee | From 0.99% per transaction |

Optional monthly subscription | £19 (for access to lower transaction rates) |

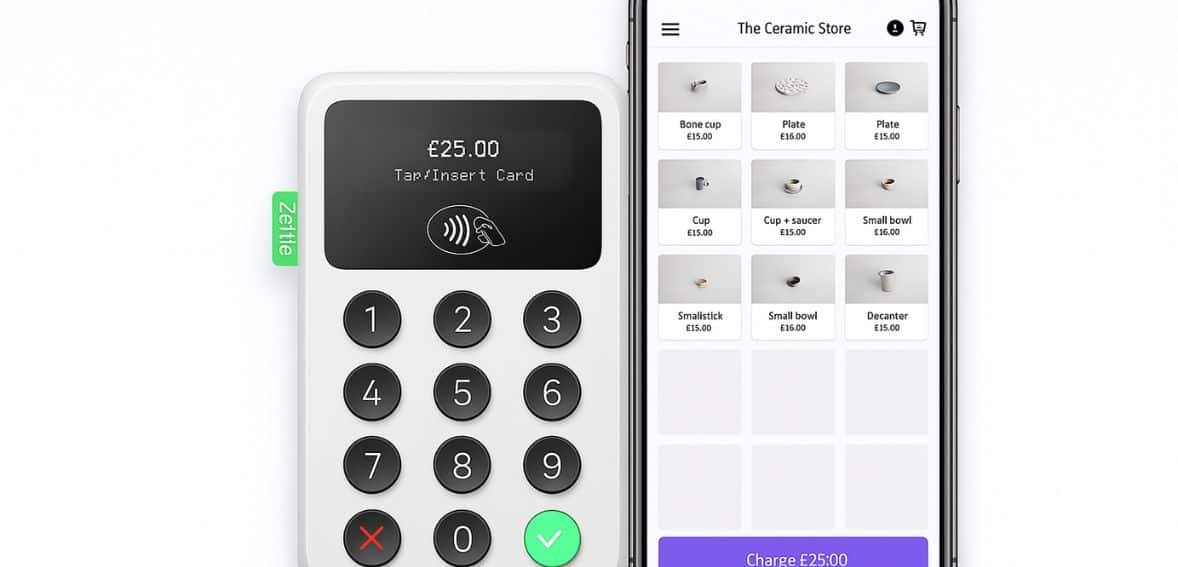

5.Zettle Card Reader 2

PayPal’s Zettle Card Reader 2 is an affordable and straightforward business tool for quick and affordable card payments. Ideal for small businesses, market stalls, and small-time sellers, it offers a straightforward way to accept card payments without monthly charges. The reader is rapidly connected to smartphones or tablets using Bluetooth, making it suitable for businesses that need flexibility on-site.

Key Features

- Low start-up hardware expense with no monthly subscription charges

- Major favorite and basic credit and debit cards, including American Express

- Beeps and e-mails receipts to tablets and smartphones using Bluetooth

- Instant transfers with PayPal Business Account

- Accepts contactless, chip, and PIN types of payments

- Easy-to-use interface with fast, simple setup for new users

Pros and Cons

Pros | Cons |

Affordable hardware cost (£29 + VAT) | Short battery life (8 hours) |

Simple and easy to set up | No built-in SIM card for cellular connectivity |

Instant fund settlement to PayPal Business Accounts | Compatibility issues with older Android devices |

Accepts all major card types, including American Express | No advanced inventory management features |

Price Structure

Cost Component | Price |

Hardware cost | £29 + VAT (for new customers) |

Transaction fee | 2.29% + £0.09 per transaction |

Monthly fees | None |

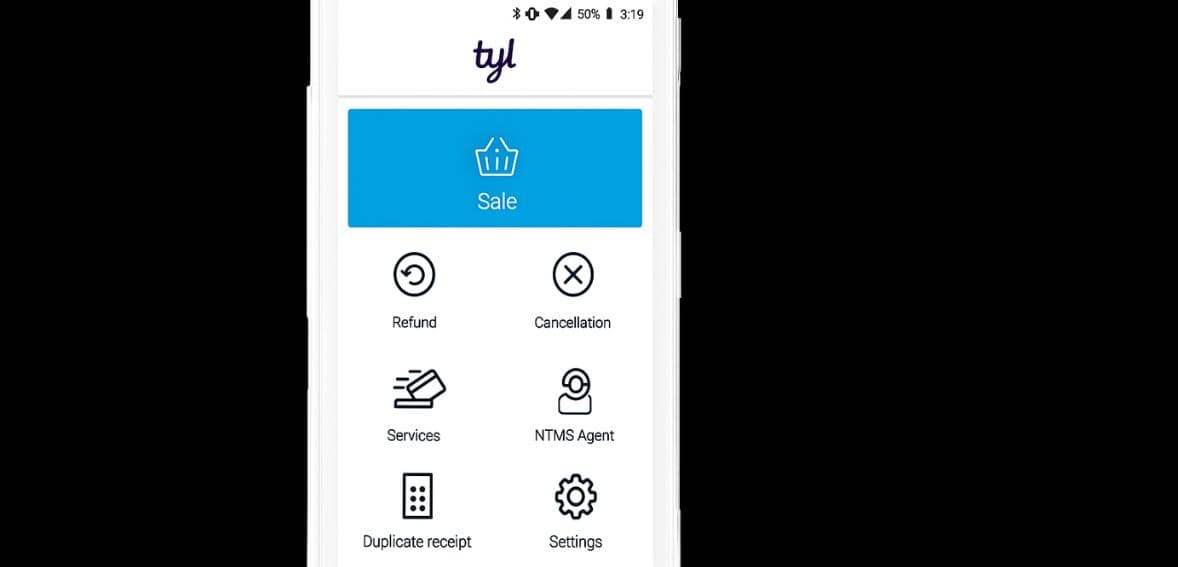

6.Tyl PAX A50

NatWest Tyl PAX A50 is light in your pocket and kind to the planet. Digital receipts are included as standard, reducing paper usage and making it a green choice for environmentally conscious businesses. It weighs only 163 grams and is palm-sized and lightweight—ideal for service businesses that are constantly on the go. Stay fully connected with silky-smooth 4G, Wi-Fi, and Bluetooth connectivity wherever your business takes you.

Key Features

- Light and thin build measuring 180g only

- Offers digital receipts to cut costs on paper

- Offers roaming connectivity options in 4G, Wi-Fi, and Bluetooth

- Secure payments via PCI DSS 4.0

- Potential aids on fees for high-expenditure companies

- Offers contactless, chip, and PIN card acceptance payment processing

Pros and Cons

Pros | Cons |

Digital receipts help reduce paper waste | No built-in printer for businesses that require paper receipts |

Supports multiple connectivity options (4G, Wi-Fi, Bluetooth) | Monthly lease model may not suit all types of businesses |

Lightweight and easy to carry (163g) | Battery life limited to around 8 hours |

Transaction fees may be waived for high-revenue businesses | Smaller businesses may face higher transaction fees |

Price Structure

Cost Component | Price |

Hardware lease | From £9.99 + VAT per month |

Transaction fee | 1.39% + £0.05 per transaction (UK & Europe only) |

Monthly fee | 12 months free gateway (normally £14.95 + VAT per month) |

Waived fees | First 6 months free for businesses processing £100k+ annually |

7.Dojo Go

Dojo Go is a great choice for businesses that need fast processing and trustworthy performance. Transaction speed averages a fastest 1.7 seconds, making it one of the fastest card machines available in 2025—offering fast checkouts and customer satisfaction. Native Wi-Fi, 4G, and Bluetooth connectivity ensure it stays stable and reliable, allowing you to accept payments nearly everywhere, without the need for extra internet connectivity.

Key Features

- Fast transaction processing of 1.7 seconds average

- Integrated 4G, Wi-Fi, and Bluetooth for strong, flexible connectivity

- Next-day payments 7 days a week

- PCI Level 1 high-level security

- Contactless, chip, and PIN card payments

- Real-time end-to-end visibility and actionable business intelligence through Dojo app

Pros and Cons

Pros | Cons |

Ultra-fast transaction processing | Requires a contract of 12 months or more |

Next-day payouts, including weekends | Monthly fees may be higher than some competitors |

Built-in 4G, Wi-Fi, and Bluetooth connectivity | No option for manual card entry |

Strong security with PCI compliance and fraud prevention | Early termination fees apply if the contract is ended early |

Price Structure

Cost Component | Price |

Hardware lease | From £20 + VAT per month |

Transaction fee | Custom pricing (varies based on business type) |

Early termination fee | Applies if contract is canceled before term ends |

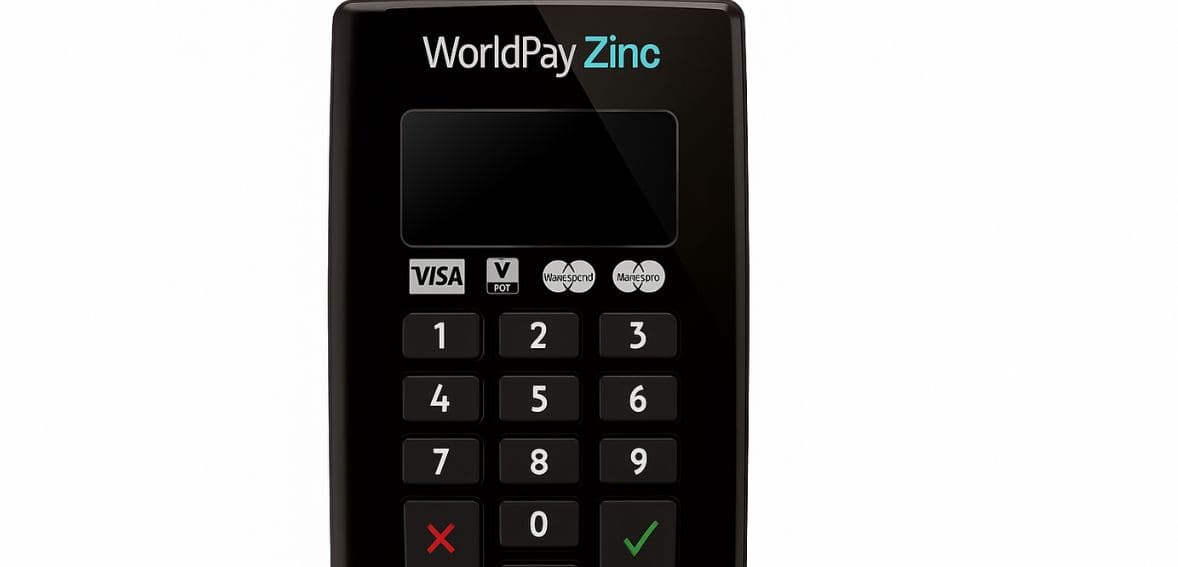

8.Worldpay Zinc

Worldpay Zinc is a straightforward, mobile card reader for sole traders, mobile employees, and small traders. It offers an easy way to accept card payments on the move without a sign-up contract and transparent pricing—offering an effortless solution for those who have to travel and pay for reliability without installation inconvenience.

Key Features

- Single flat pay-as-you-go fee of 1.9% per transaction

- Accepts contactless, chip and PIN, and mobile wallet transactions

- No additional merchant account is required to be established

- Perfect for small establishments such as coffee shops and food vendors

- Utilize the portable card reader that is perfect for low volume, on-the-go business

Pros and Cons

Pros | Cons |

No long-term contracts | Higher transaction fees than some competitors |

Quick setup | No phone line support |

Good for small businesses |

Price Structure

Cost Component | Details |

Pay-as-you-go plan | No contract or monthly fee |

Transaction fee (PayG) | 2.75% per card payment |

Refund fee (PayG) | £0.75 per refund |

Monthly plan | £5.99 per month |

Transaction fee (Monthly) | 1.95% per card payment |

Refund fee (Monthly) | £0.75 per refund |

Transaction limit | £5,000 per card transaction |

Hardware cost | £39.99 for chip and PIN keypad (includes 12-month warranty) |

Early termination fee | None (no contract required) |

9.Barclays Smartpay

Barclays Smartpay is a flexible payment solution that is well suited for small and start-up businesses that need to accept in-store or mobile payments. With flat rate pricing, no monthly minimum charges, and all major card acceptance—contactless and mobile wallets—the solution is ideal for merchants seeking a low-cost, safe way of receiving payments.

Key Features

- Starts with seamless integration with Barclays business accounts

- Provides competitive transaction rates at 1.3%

- 24/7 online fraud protection for secure transactions

- Provides different card machines for small businesses

- Facilitates cashless payment loved by new customers

- Empress cost and vital payment ability

Pros and Cons

Pros | Cons |

Instant access to funds | Only available to Barclays business customers |

Low transaction fees | Monthly fees may apply |

Price Structure

Cost Component | Price / Details |

Hardware cost (excluding VAT) | £29 |

Minimum monthly fee | None |

Debit card transaction fee | 1.60% |

Credit card transaction fee | 1.60% |

American Express (Amex) fee | 1.60% |

Card-not-present transaction fee | 1.60% |

10.PaymentSense

PaymentSense is a UK card card payment processor that provides easy and fast payment solutions ideal for small and medium-sized businesses. Loved for easy setup, 24/7 customer support, and affordable costs, it is the merchant favorite for secure card payments in-store and online.

Key Features

- Pricing tailored to the size and type of business

- Both countertop and portable card machines

- Robust printers that are simple to install and use on-the-go

- Connectivity in multiple formats to avoid disruption at time of payment

- Pre-configured to be easy and convenient for small businesses to make payments

Pros and Cons

Pros | Cons |

Flexible pricing plans | Potential for hidden fees |

Responsive customer support | Support hours may not cover late nights |

Pricing Structure

Package | Monthly Fee | 12-Month Contract | Transaction Volume |

Starter | £9.95 | £8.30 | £50,000 per year |

Basic | £14.95 | £12.45 | £250,000 per year |

Pro | £19.95 | £16.60 | £1.2 million per year |

Conclusion

In 2025, the leading credit card terminals are not only payment devices— they provide you with speed, security, mobility, and smart business capabilities to assist evolving customer needs. With a retail shop or mobile enterprise, choosing the right terminal can boost your checkout and drive business expansion. Rank critical features according to your business, and you are not merely purchasing an instrument rather than a payment machine—you are investing in a strong business asset.

FAQs

1. Which card machine is ideal for small businesses?

Products such as SumUp and Square are ideal since they have a low cost of acquisition and installation.

2. Do I need internet to use a card machine?

Most of them need Wi-Fi or mobile reception, but a few with internal SIM are able to work on their own.

3. Are credit card machines charged with a monthly fee?

Others are charged monthly fees, yet others are charged pay-as-you-go and there is no charge for the repeated use.

4. What happens to payments using credit cards?

All new terminals settle within a duration of less than 3 seconds, and payment is easy and quick.

5. Can I accept foreign wallets and cards?

Most of the new machines accept big international wallets and cards like Apple Pay and Google Pay.