SumUp Review

SumUp has become a household name in the world of mobile payments, a bridge for small businesses and freelancers to modernise how they take payments. No complex banking relationships or long term contracts, just affordable hardware, transparent fees and a simple app. This is perfect for sole traders, local shops and service providers who want to go beyond cash but don’t have the volume to justify more expensive merchant accounts. Lets read more about SumUp Review.

The platform includes a range of hardware devices – compact card readers and POS terminals – and software tools for invoicing, analytics and online sales. With presence in Europe, the Americas and beyond, SumUp has become a global brand synonymous with flexibility and simplicity.

But SumUp is not a one size fits all solution. While it suits many smaller merchants, its limitations in customisation, integrations and advanced reporting may not be suitable for larger businesses or those in complex retail environments. Its focus on accessibility and affordability is clear but that same focus can mean trade-offs in depth of functionality.

Overall SumUp is a pragmatic choice for businesses that need simple tools to take payments in person and online. It’s not meant to replace enterprise grade systems but to give smaller operators a entry point into the digital payments ecosystem.

Company Background and Market Position | SumUp Review

SumUp was founded in 2012 in London, with the ambition of making card acceptance accessible to the smallest merchants; those often overlooked by traditional banks and payment processors. The company quickly grew across Europe, establishing itself as a disruptor in the financial technology sector. Today, it operates in more than 30 countries, including major markets such as the UK, Germany, Brazil, and the United States.

Its growth trajectory reflects the broader rise of mobile payments. By offering merchants low-cost devices that connect to smartphones, SumUp tapped into a market segment that had previously relied heavily on cash. This focus on inclusivity and affordability allowed it to build a large base of independent retailers, service professionals, and small business owners.

In terms of market positioning, SumUp competes with companies like Square (Block), Zettle by PayPal, and other regional players. Its competitive edge lies in simplicity: no monthly fees, straightforward onboarding, and transparent per-transaction charges. This clarity has helped it build trust among small operators who prefer predictable costs over complicated pricing structures.

Despite its success, SumUp faces challenges in appealing to larger businesses or those needing advanced enterprise solutions. Competitors like Square offer broader ecosystems with payroll, marketing, and e-commerce integrations, while PayPal brings global consumer recognition. Still, SumUp has carved out a valuable niche by prioritizing accessibility, and its ongoing expansion into banking and lending products shows a strategy aimed at deepening relationships with existing customers rather than competing head-to-head with enterprise platforms.

Products and Services Overview

SumUp’s products are designed to give you multiple ways to accept and manage payments. At the hardware level we have card readers that connect via Bluetooth to your smartphone, and standalone POS devices that don’t need any additional equipment. These can handle chip, swipe and contactless transactions, including mobile wallets like Apple Pay and Google Pay.

On the software side we have a mobile app that is the hub for payment processing, transaction history, sales tracking and digital receipts. The app is available for both iOS and Android and is so simple to use even a first time user can get started in minutes.

If you need more than in-person payments SumUp extends its services into online tools. This includes invoicing features, QR code payments and a lightweight online store that allows you to sell products without building a full e-commerce site. Payment links allow you to send secure checkout options via email or messaging apps, so you can accept payments beyond physical interactions.

Additional services such as business accounts, prepaid cards, and lending in certain regions show that SumUp is evolving into more than just a payment processor. It is building a broader financial ecosystem aimed at keeping small businesses within its platform for more of their day-to-day operations. While comprehensive in many ways, SumUp does not yet match the breadth of services offered by enterprise-focused competitors. Still, for small merchants, its mix of hardware and digital tools strikes a balance between affordability and functionality.

Hardware Solutions: Card Readers and POS Devices

One of SumUp’s biggest strengths is its hardware. The company offers several card readers and POS devices to suit businesses of all sizes and needs. The entry level is the SumUp Air, a compact reader that connects via Bluetooth to an app on your smartphone. It’s cheap, portable and perfect for freelancers or micro-merchants who process payments occasionally but want professional tools.

For those who need more autonomy, the SumUp Solo is a standalone device with a touchscreen, Wi-Fi and SIM card support for mobile connectivity. This means you can take payments without needing a separate smartphone. Businesses with high footfall, like cafés and small shops, tend to prefer this option.

SumUp also offers POS kits with cash drawers, receipt printers and stands so they are more suitable for traditional retail environments. These solutions position the company not just as a provider of mobile card readers but as a competitor in the POS market for smaller retailers.

The hardware is generally well-regarded for its sleek design, ease of setup, and reliability. Battery life is strong, and the devices are compatible with most modern cards and wallets. However, compared to competitors, customization options are limited, and advanced features; like inventory management or loyalty programs, require additional software.

Overall, SumUp’s hardware is practical and effective for its target audience. It offers a clean, minimalist design and sufficient functionality for basic to moderate business needs, without overwhelming users with unnecessary complexity.

Software Solutions and Mobile App Experience

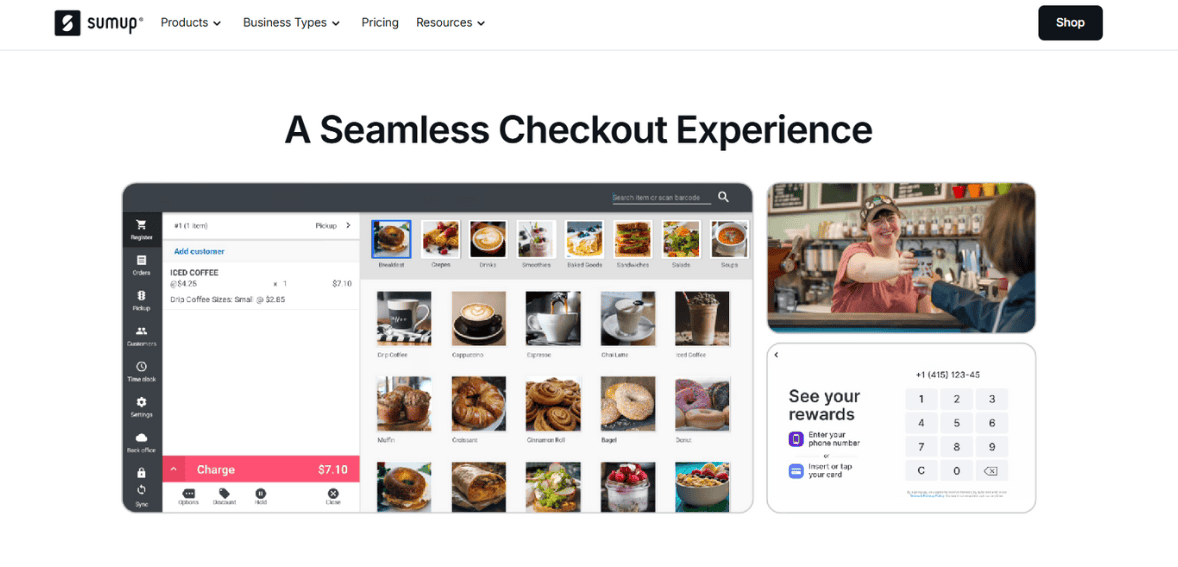

The SumUp mobile app is the core of the platform. Simple and easy to use, it allows you to process transactions, issue refunds, view sales reports and manage products. The interface is clean with big buttons and simple menus so even non techy users can use it.

One of the best features of the app is the ability to send digital receipts instantly via SMS or email, no more paper receipts and a modern experience for your customers. Inventory management is included but basic compared to specialized POS software. You can add products with descriptions and prices to make checkout faster and more consistent.

The reporting features give you insights into sales volume, transaction history and customer payment methods. Useful for day to day management but advanced analytics is not included which might be a limitation for data driven businesses. On both iOS and Android, the app receives positive reviews for stability and reliability. It connects seamlessly with SumUp hardware, reducing setup time and technical frustrations. Offline functionality, however, is limited, meaning businesses must maintain a reliable internet connection to avoid disruptions.

In essence, the SumUp app succeeds in delivering a clean, accessible experience that meets the needs of small businesses. While it lacks the depth and customization of more complex POS software, it strikes a balance between usability and functionality, aligning well with SumUp’s focus on simplicity.

Online Payment Features

Beyond in-person payments, SumUp has expanded into online transactions, recognizing the growing importance of digital commerce. Businesses can generate payment links that allow customers to pay securely through a webpage, making it convenient to collect money remotely. These links can be sent via email, text message, or social media, providing flexibility for both merchants and customers.

QR code payments are another feature that bridges the gap between physical and digital commerce. A merchant can generate a QR code for a transaction, and customers can complete the payment using their smartphone, reducing friction at checkout.

For businesses looking to establish a digital storefront, SumUp offers a lightweight online store builder. This tool allows merchants to create product listings and accept payments without building a complex website or integrating with external e-commerce platforms. While simple, it can be effective for businesses just starting out with online sales.

Invoicing tools also support small businesses that need to bill clients for services. Invoices can be sent electronically, and payments are tracked within the SumUp ecosystem. This reduces the need for third-party invoicing software.

The main drawback of SumUp’s online payment features is their simplicity. They are excellent for basic use cases but may fall short for merchants needing extensive e-commerce integrations, advanced inventory management, or complex shipping options. Competitors like Shopify or Square often provide deeper capabilities. Nonetheless, SumUp’s online tools are valuable additions that extend its usefulness beyond face-to-face payments, making it a versatile option for small business owners adapting to digital commerce.

Pricing and Transaction Fees

Pricing is one of SumUp’s biggest strengths, especially for small businesses that cannot afford high monthly fees. The company operates primarily on a pay-as-you-go model, with no fixed subscription costs for most services. Instead, it charges a flat fee per transaction, typically around 1.69%–2.75% depending on the country and card type. This transparent structure allows businesses to predict costs easily.

Hardware costs are also relatively low. Entry-level devices are priced affordably, with occasional promotions making them even more accessible. The one-time cost model ensures businesses are not locked into expensive equipment leases.

For businesses with fluctuating sales volumes, this fee structure can be ideal. They pay only when they process payments, avoiding the burden of monthly minimums. However, high-volume businesses may find SumUp less cost-effective compared to providers that offer lower transaction rates in exchange for monthly fees or custom contracts.

Other costs include fees for certain advanced services, such as chargebacks or optional add-ons. While still competitive, these extras can add up for businesses with specific needs. Additionally, bank deposit times can vary, with instant payouts sometimes incurring additional charges. Overall, SumUp’s pricing strategy aligns with its mission to support small merchants. It favors transparency and predictability over complex tiered systems, which is appealing for businesses that value simplicity. While not always the cheapest option for high-volume merchants, it remains one of the most accessible solutions for those just starting with card acceptance.

Security and Compliance

Security is a critical factor in payment processing, and SumUp takes steps to ensure both merchants and customers are protected. The company complies with PCI DSS, which governs the secure handling of cardholder information. Its devices are certified for EMV transactions, ensuring chip cards are processed securely, and they support end-to-end encryption.

Fraud protection measures are integrated into the system, with monitoring in place to detect suspicious activity. SumUp also provides chargeback management tools, though merchants still bear responsibility for disputed transactions, as is common in the industry.

In addition to technical safeguards, SumUp adheres to regulatory requirements in the markets where it operates. For example, it is authorized by the Financial Conduct Authority in the UK and equivalent bodies in other regions. This oversight provides reassurance to merchants that they are working with a legitimate, regulated entity.

From a customer perspective, SumUp transactions are as secure as those processed by larger payment networks. Contactless payments and mobile wallets add additional layers of security, including biometric authentication. While SumUp covers the essentials, its security features are not significantly more advanced than competitors. For businesses requiring highly customizable fraud detection or integration with enterprise security systems, the offering may feel limited.

Nonetheless, for small to medium-sized businesses, SumUp’s security and compliance measures are robust, reliable, and aligned with industry standards, offering peace of mind without complicating the user experience.

Customer Support and Service Quality

Customer support is often a decisive factor for small businesses, and SumUp’s performance in this area is mixed. The company provides multiple support channels, including email, phone, and an online help center with FAQs and guides. For many common issues, the self-service resources are sufficient, covering setup, troubleshooting, and account management.

Phone support is available in several markets, though hours of operation may be limited compared to competitors with 24/7 coverage. Response times are generally acceptable, but user reviews suggest variability; some report quick resolutions, while others express frustration with delays. The company has also invested in online resources, including community forums and tutorials, which can reduce reliance on direct support. However, the quality of assistance depends heavily on the complexity of the issue. More advanced technical or account-specific concerns sometimes require persistence to resolve.

Compared to larger competitors, SumUp’s customer support lacks the depth of dedicated account managers or premium service tiers. This is understandable, given its focus on affordability, but it may leave some businesses wanting more personalized guidance.

Overall, SumUp’s support is functional and accessible for standard inquiries, but may not always meet the expectations of businesses with complex needs. For its target audience; smaller merchants looking for straightforward tools; the support offering is generally adequate, though there remains room for improvement in consistency and responsiveness.

Ease of Use and Setup

Ease of use is one of SumUp’s strongest qualities. The onboarding process is designed to be as frictionless as possible. Merchants can sign up online, receive their device quickly, and begin accepting payments within minutes of setup. The devices pair easily with smartphones or work independently, depending on the model chosen.

The installation steps are straightforward, often involving little more than downloading the mobile app, connecting the card reader, and completing a test transaction. For business owners who may not be technologically inclined, this simplicity is a significant advantage. The interface of both the devices and the app reinforces this approach. Clean menus, large icons, and guided prompts reduce confusion, ensuring that transactions are processed smoothly. Unlike more complex POS systems that require training, SumUp can be learned by most users almost instantly.

Another aspect that contributes to ease of use is portability. The hardware is lightweight and wireless, making it suitable for mobile businesses such as food trucks, market stalls, or delivery services. The only notable limitation is in customization. Businesses that want to tailor workflows, integrate with complex systems, or build custom reports may find the simplicity restrictive. However, for the core goal; accepting payments quickly and efficiently; SumUp’s ease of use is difficult to rival.

Integrations and Compatibility

SumUp offers limited but useful integrations with third-party platforms. It can connect to popular e-commerce platforms, accounting tools, and some business management systems, enabling smoother workflows. For example, merchants can sync transactions with accounting software to simplify bookkeeping.

However, compared to competitors like Square or Shopify, SumUp’s integration ecosystem is narrower. Advanced features such as automated marketing, loyalty programs, or deep CRM connectivity are not as fully developed. This reflects the company’s target audience; smaller merchants who prioritize core payment functionality over complex integrations.

Hardware compatibility is strong. The devices support all major credit and debit cards, as well as digital wallets like Apple Pay and Google Pay. The app works reliably on both iOS and Android devices, ensuring flexibility regardless of a merchant’s preferred mobile platform. SumUp has also taken steps to expand compatibility with online payment systems, including links, QR codes, and lightweight online stores. These provide versatility for businesses that operate across physical and digital channels.

That said, businesses looking for seamless integration with enterprise systems may need to look elsewhere. SumUp’s focus is not on advanced customization but rather on providing reliable, essential tools that work well out of the box. For its intended audience, this approach is usually sufficient, but it limits scalability for larger operations.

Pros of Using SumUp

The main advantages of SumUp lie in its accessibility, simplicity, and affordability. For small businesses and freelancers, the absence of monthly fees makes it a low-risk way to start accepting card payments. Merchants only pay when they process transactions, aligning costs with revenue. The hardware is another strong point. Compact, stylish devices with reliable performance give businesses professional tools without requiring large investments. Combined with the user-friendly app, the system is easy to set up and operate.

Flexibility is also a key benefit. SumUp supports in-person, online, and mobile payments, offering multiple ways to serve customers. Features like payment links, QR codes, and a lightweight online store extend its utility beyond physical card acceptance. Security and compliance standards are met, providing peace of mind for both merchants and customers. Meanwhile, transparent pricing builds trust, reducing the risk of hidden costs or confusing contracts.

In short, SumUp is ideal for those who value straightforward solutions. Its pros align well with the needs of small operators, making it a reliable partner for businesses that want to modernize payment acceptance without complexity or significant financial commitment.

Cons and Limitations

While SumUp has many strengths, it also has clear limitations. One of the most notable is its lack of advanced features. Businesses seeking comprehensive reporting, deep integrations, or complex inventory management may find the platform restrictive. Customer support, while generally functional, is not always consistent. Limited service hours and variability in response times can frustrate merchants who rely heavily on timely assistance.

Another drawback is cost scalability. For high-volume merchants, transaction fees may become less competitive compared to providers offering volume discounts or custom pricing. The absence of advanced subscription tiers means SumUp may not be cost-effective for larger businesses over the long term.

Offline functionality is also limited, which can be a concern for businesses operating in areas with unreliable internet connectivity. Additionally, while the online store and invoicing tools are helpful, they lack the depth and customization of dedicated e-commerce or accounting platforms. In essence, SumUp’s limitations stem from its design philosophy. By focusing on simplicity and affordability, it inevitably sacrifices advanced capabilities. This is not necessarily a flaw, but businesses must be aware of whether their current and future needs align with what SumUp can deliver.

Ideal Business Types for SumUp

SumUp’s target audience is clear: small businesses, freelancers, and entrepreneurs who need simple and affordable payment solutions. Street vendors, cafés, beauty salons, personal trainers, and delivery services are all examples of businesses that can benefit from SumUp’s model. For these operators, the advantages of portability, no monthly fees, and straightforward setup outweigh the lack of advanced features. SumUp gives them the ability to accept cards and digital wallets professionally, which can improve customer satisfaction and broaden their sales potential.

Freelancers and micro-merchants who process payments sporadically also find SumUp appealing, as they avoid ongoing costs during slower periods. Meanwhile, small retailers can use SumUp’s POS kits to set up a modest checkout system without investing heavily in larger infrastructures. However, medium to large businesses, or those with complex operations, may find SumUp insufficient. They may require deeper integrations with inventory, accounting, or CRM systems, as well as more advanced reporting capabilities. In these cases, competitors like Square, Shopify, or

Final Verdict

SumUp is a reliable payment solution tailored for small businesses, freelancers, and independent merchants. Its main strengths are affordability, simplicity, and versatility, offering sleek card readers, an intuitive mobile app, and flexible online tools that make it easy to adopt digital payments without heavy costs. For small operators, it provides a practical and trustworthy entry point into cashless transactions. However, the same simplicity limits its appeal to larger businesses with complex needs.

Advanced features like in-depth reporting, extensive integrations, and customization options are lacking. Transaction fees, while transparent, may be less competitive for high-volume merchants, and customer support could be more responsive, especially outside regular hours. Offline functionality and e-commerce tools also trail behind some competitors. Despite these limitations, SumUp delivers on its core promise: accessible, cost-effective payment acceptance for small merchants. It may not be ideal for everyone, but for its target audience, it’s a strong and dependable choice.

FAQs

Q1. Is SumUp a good choice for small businesses?

Yes, SumUp is generally well-suited for small businesses, freelancers, and startups. Its transparent, pay-as-you-go pricing ensures that businesses only incur costs when processing sales, which is helpful for those with unpredictable volumes. However, businesses with larger operations or more advanced needs may prefer platforms with deeper features.

Q2. Does SumUp require a monthly fee?

No, SumUp does not require a monthly subscription for most of its services. Merchants only pay a per-transaction fee and the one-time cost of purchasing hardware. This makes it accessible for micro-merchants and businesses that want flexibility without ongoing commitments.

Q3. Can SumUp handle both online and in-person payments?

Yes, SumUp supports a wide range of payment methods. Merchants can accept chip, swipe, and contactless cards in person, as well as digital wallets like Apple Pay and Google Pay. Additionally, they can use payment links, QR codes, invoicing, and an online store feature for remote or online transactions.