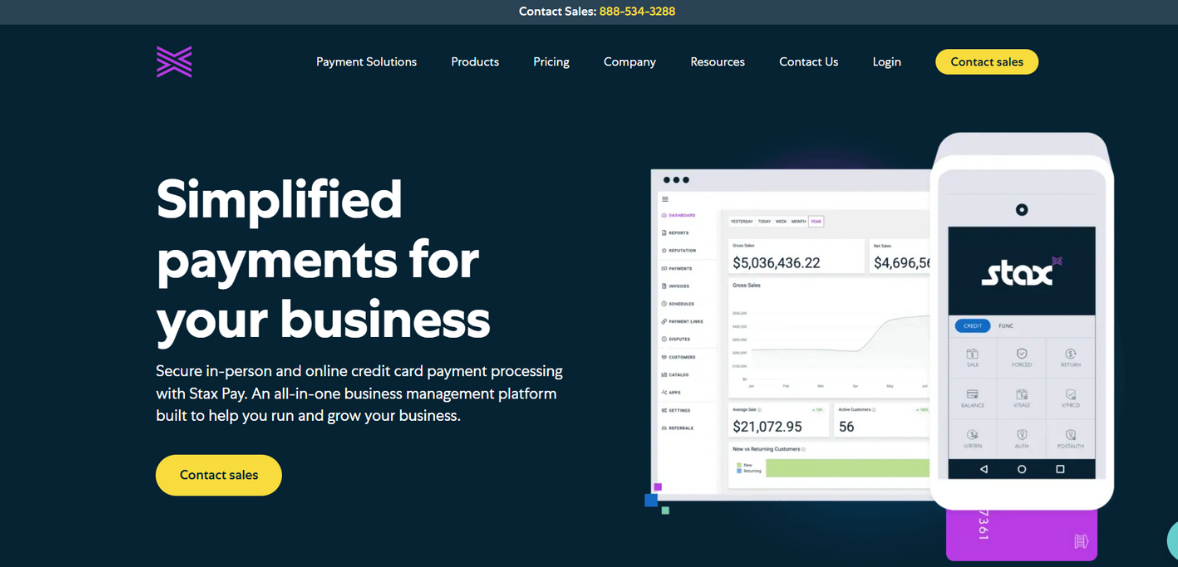

Stax Review

Stax is a subscription based payment processing platform that’s an alternative to the percentage fee model most merchant service providers use. Unlike traditional processors that charge a percentage of each transaction on top of interchange fees, Stax charges a flat monthly fee and passes interchange costs to the merchant without markup. This model is great for businesses with high transaction volume as it can save them a lot of money in the long run. Lets read more about Stax Review.

The platform can handle in-person, online and mobile payments so it’s a great solution for businesses that operate in multiple sales channels. It has a suite of tools for POS transactions, e-commerce integration, invoicing, recurring billing and advanced reporting. By combining payment acceptance with value added features like analytics Stax becomes more than just a transaction processor it becomes a central hub for payment management.

But while Stax has a more cost effective pricing model for some businesses it’s not for every type of merchant. Low volume businesses may find the subscription cost outweighs the benefits. And while the platform has a lot of integrations there may be a learning curve for users who are not familiar with advanced payment tools. Overall Stax has carved out a niche in the payment industry by offering an alternative pricing model and a full service solution.

Company Background and Market Position | Stax Review

Stax, originally launched as Fattmerchant in 2014, was founded with the goal of simplifying payment processing and making it more transparent for business owners. The company rebranded to Stax in 2021, aligning its image with a broader vision to serve a diverse range of industries and offer a complete payment ecosystem. Headquartered in Orlando, Florida, Stax has grown rapidly, gaining recognition for its innovative approach to merchant services and its flat-fee subscription model.

In the competitive payment processing market, Stax differentiates itself by targeting established businesses that process significant monthly volumes. While many payment processors focus on startups and smaller merchants with a pay-as-you-go model, Stax appeals to companies seeking predictable costs and more control over their processing fees. This focus allows Stax to compete not only with traditional merchant service providers but also with payment technology companies offering integrated solutions.

The company has secured a position as a disruptor in the payments space, often highlighted in industry publications for its unique pricing structure. Its customer base spans retail, hospitality, healthcare, professional services, and e-commerce businesses. While Stax is still growing its brand recognition compared to larger processors like Square or PayPal, it has cultivated a strong reputation among users who value cost transparency and advanced reporting features.

The rebranding effort and ongoing feature expansions suggest that Stax is aiming for a stronger foothold in the mid-market segment while continuing to refine its service offerings for a broad range of industries.

Core Features Overview

Stax has more than payment acceptance. The platform supports multiple payment methods: credit cards, debit cards, ACH, mobile wallet (Apple Pay and Google Pay). So you can accommodate customer’s payment preferences no matter how they want to pay.

In addition to payment acceptance, Stax has POS for in person transactions, online checkout for e-commerce businesses and invoicing for service based businesses. Recurring billing for subscription based businesses. Reporting and analytics dashboard to consolidate transaction data so you can see sales trends, payment performance and customer behavior.

One of Stax’s strengths is its integrations. The platform can connect to accounting software, e-commerce platforms and CRM tools so you can have smoother workflows and less manual data entry. For businesses with custom needs Stax also has API access to build custom payment experiences.

Security is another focus. Tokenization, encryption and PCI DSS compliance. Stax is a payment management platform not just a processor. While the features are a plus, it may require more setup and training than simpler payment tools so it’s better for businesses that are willing to invest in using all the features.

Subscription-Based Pricing Model

Stax’s subscription-based pricing is one of its most notable differentiators. Instead of charging a percentage markup on top of interchange fees, the company offers a flat monthly fee, which varies depending on the plan and features selected. Interchange rates; the base fees set by card networks; are passed directly to the merchant without additional percentage charges from Stax.

This model can be highly advantageous for businesses processing large transaction volumes because it eliminates the compounding effect of percentage-based markups. For example, a company processing $100,000 per month in credit card sales might save significantly compared to a processor charging 2–3% on top of interchange.

However, the model may be less cost-effective for low-volume merchants. A business processing only a few thousand dollars in monthly transactions might find the subscription fee outweighs the savings from lower per-transaction costs. Stax’s pricing structure also requires business owners to understand their average processing volume and compare it against traditional percentage-based pricing to determine potential savings.

While the subscription model offers cost predictability, it does not remove all fees. Merchants still pay the interchange rates set by card issuers, as well as fees for certain optional services. Additionally, hardware costs for POS terminals or card readers may be separate. Overall, the pricing model is most beneficial for businesses confident in their transaction volume and looking for a transparent, predictable approach to payment processing costs.

POS Capabilities

The Stax POS is designed for in-person transactions across various industries: retail, hospitality, healthcare and professional services. It accepts EMV chip cards, contactless payments and magnetic stripe transactions so customers have options to pay. Hardware options include countertop terminals, mobile readers and tablet based systems so businesses can choose the setup that fits their business.

Beyond payment processing the POS software integrates with inventory management tools so you can track stock levels in real time and get automated alerts to reorder. For businesses with multiple locations the system can consolidate sales data into a single dashboard so management and reporting is streamlined.

Customizable receipt options, tipping features and integration with customer loyalty programs enhance the customer experience. The POS can also do partial payments, split bills and store credit so it’s good for restaurants, service providers and retail stores.

While the POS has a lot of functionality some users may find the hardware investment is high especially for advanced setups. And while Stax provides training resources there is a learning curve for staff not familiar with modern POS systems. Overall the POS is good for established businesses looking for a robust and scalable in-person payment solution that integrates with other Stax tools.

E-Commerce and Online Payment Tools

Stax includes a suite of e-commerce capabilities aimed at businesses selling products or services online. The platform integrates with popular online store builders such as Shopify, WooCommerce, and BigCommerce, allowing merchants to maintain their existing storefronts while using Stax as the payment processor. These integrations help streamline the checkout process and ensure secure transactions.

For businesses without a dedicated e-commerce site, Stax offers hosted payment pages that can be branded to match the company’s identity. This option allows merchants to start accepting online payments quickly without extensive web development. The system supports multiple payment types, including credit cards, debit cards, ACH transfers, and digital wallets, catering to a variety of customer preferences.

Recurring billing functionality is also available for subscription-based services or membership programs. Invoicing tools enable businesses to send digital bills that customers can pay online, reducing reliance on paper invoices and manual processing.

Security is a key consideration in e-commerce, and Stax addresses this with encryption, tokenization, and PCI-compliant processes. While the platform provides strong features for online selling, it is worth noting that it does not attempt to replace full-scale e-commerce platforms; rather, it complements them by acting as the underlying payment engine. Businesses seeking an all-in-one site builder may need to integrate Stax with third-party solutions. Overall, the e-commerce tools are well-suited for companies that value secure, flexible, and integration-friendly payment processing.

Invoicing and Recurring Billing Features

Stax’s invoicing and recurring billing is designed for service based businesses, subscription providers and organizations with membership models to manage payments better. The invoicing tool allows merchants to create professional branded invoices and send to customers via email or shareable links. Customers can then pay directly from the invoice using their preferred payment method.

Recurring billing supports automated payment schedules so you don’t have to follow up manually and minimize late payments. You can set billing intervals – weekly, monthly or annually and customize payment reminders. For customers this provides a convenient and predictable payment experience especially for services like fitness memberships, software subscriptions or professional retainers.

The invoicing system integrates with the Stax dashboard so you can track payment status, view overdue accounts and generate reports on receivables. This gives you better cash flow visibility and follow up on outstanding balances. ACH payment options can also reduce processing costs for recurring transactions compared to credit cards.

While the invoicing and recurring billing is robust, it may not have all the advanced automation of specialized billing platforms. Businesses with complex subscription models or multi tiered pricing may need more customization. But for most small to medium sized businesses, Stax’s tools provide a way to manage client billing without using separate invoicing software and consolidate payment operations in one platform.

Integrations and API Flexibility

One of Stax’s strengths is its integration ecosystem, which connects with various third-party applications to extend functionality. Businesses can link Stax to accounting software such as QuickBooks or Xero, ensuring payment data flows seamlessly into financial records. This reduces manual entry, minimizes errors, and improves bookkeeping efficiency.

E-commerce integrations with platforms like Shopify, WooCommerce, and Magento allow for streamlined online sales processing. For customer relationship management, Stax can connect with tools like Salesforce and HubSpot, enabling businesses to link payment data with customer profiles for more informed marketing and service strategies.

For companies with specific needs, Stax offers API access that allows developers to create custom payment experiences, embed checkout forms, or build tailored reporting dashboards. This flexibility makes Stax appealing to tech-savvy businesses or those with unique operational workflows. The availability of integrations means that Stax can fit into existing software stacks rather than requiring a complete overhaul of business systems. However, setting up and optimizing these integrations may require technical expertise, especially for API-based customizations.

Overall, the integration and API capabilities position Stax as a scalable solution that can adapt to different industries and workflows. Businesses that value interconnected systems and process automation will likely find these features to be a significant advantage over more closed payment platforms.

Analytics and Reporting Tools

Stax offers built-in analytics and reporting tools that go beyond simple transaction logs. The platform’s dashboard consolidates sales data across all payment channels, giving businesses a complete picture of their financial performance. Merchants can view real-time transaction activity, identify top-selling products or services, and monitor revenue trends over specific timeframes.

Customizable reports allow users to filter data by location, payment method, or customer type. These insights can support strategic decisions, such as identifying peak sales periods or optimizing staffing levels based on transaction volume. Additionally, payment performance metrics; like authorization rates and chargeback trends; help merchants monitor operational health and take corrective actions when needed.

For accounting and compliance purposes, the reporting system enables easy export of transaction data in formats compatible with financial software. This streamlines reconciliation processes and ensures accurate financial records.

While Stax’s analytics tools are strong for general business management, they may not replace dedicated business intelligence platforms for organizations requiring deep data modeling or predictive analytics. Still, for most small and mid-sized businesses, the built-in reporting strikes a balance between usability and actionable insights.

By combining payment processing data with key performance indicators, Stax helps businesses move beyond transactional records and into informed decision-making. The result is greater visibility into the factors driving revenue, enabling more effective operational and marketing strategies.

Security and Compliance Standards

Security is a central focus for Stax, given the sensitive nature of payment data. The platform is fully compliant with the PCI DSS, which sets requirements for the secure handling of cardholder information. Stax uses encryption and tokenization to protect data during transmission and storage, reducing the risk of breaches.

Tokenization replaces sensitive card details with secure, non-reversible tokens, meaning actual card data is never stored on merchant systems. This reduces liability in the event of a security incident. Additionally, Stax’s systems are regularly audited to ensure adherence to compliance protocols. For merchants, PCI compliance can be a complex process, but Stax provides tools and guidance to help meet these requirements. This includes self-assessment questionnaires, security scans, and best-practice recommendations.

The platform also supports features like fraud detection and chargeback management, which help identify suspicious transactions and mitigate disputes. While no system can completely eliminate the risk of fraud, these measures add multiple layers of protection for both merchants and customers.

Businesses that prioritize security will find that Stax meets industry standards while also offering practical tools to maintain compliance. However, merchants must still ensure that their internal practices; such as employee training and device security; align with PCI guidelines, as the platform cannot control every aspect of the payment environment.

Customer Support and Service Quality

Stax offers multiple support channels, including phone, email, and live chat. The company also provides an online knowledge base with articles, guides, and FAQs covering common setup and troubleshooting topics. For more complex issues, merchants can reach out to support representatives during extended business hours, with some plans offering priority assistance.

User feedback on customer service is mixed. Some customers praise Stax for quick response times and knowledgeable staff, particularly during onboarding. Others report delays in resolving technical issues or inconsistent follow-up, which can be a concern for businesses that rely on timely payment processing. In addition to reactive support, Stax offers onboarding assistance to help new customers set up accounts, integrate software, and configure payment hardware. This proactive approach can reduce the initial learning curve and minimize disruptions during transition from a previous provider.

The quality of customer support can vary depending on plan level, with higher-tier subscriptions often receiving faster or more personalized service. Businesses considering Stax should evaluate their support expectations and ensure their chosen plan meets those needs. Overall, while Stax’s support infrastructure is robust in terms of available channels and resources, consistency in response quality could be an area for further improvement to match the expectations of enterprise-level clients.

Pros of Using Stax

Flat monthly subscription pricing can reduce costs for high-volume merchants.

Interchange-plus structure with no percentage markup adds transparency.

Versatile payment acceptance across in-person, online, and mobile channels.

Strong integration capabilities with accounting, e-commerce, and CRM tools.

Robust reporting and analytics for data-driven decision-making.

PCI-compliant security with tokenization and encryption.

Invoicing and recurring billing features included in the platform.

Cons and Potential Limitations

Monthly subscription fees may be costly for low-volume businesses.

Requires accurate volume assessment to determine cost-effectiveness.

Learning curve for businesses new to advanced payment platforms.

Mixed customer support experiences reported by users.

Limited native e-commerce site-building capabilities.

Some advanced subscription billing models may require third-party tools.

Ideal Business Types for Stax

Stax is particularly well-suited for established businesses that process significant monthly transaction volumes and seek predictable payment processing costs. Retail stores, restaurants, healthcare practices, professional service firms, and membership-based organizations can all benefit from its flat-fee model, especially if they operate across multiple sales channels.

E-commerce businesses that already use platforms like Shopify or WooCommerce will appreciate Stax’s integration capabilities, while service providers will find value in the invoicing and recurring billing features. However, small businesses with low transaction volumes may find that the subscription fees outweigh potential savings. Similarly, companies seeking an all-in-one website builder or highly specialized industry tools may need to supplement Stax with other software.

In short, Stax works best for businesses that prioritize cost transparency, have consistent or growing transaction volumes, and are willing to leverage its integrations and reporting tools for operational improvement.

FAQs

Q1. Is Stax suitable for small businesses or only larger enterprises?

Stax can work for both, but its subscription model is generally most cost-effective for medium to large businesses with higher monthly processing volumes. Smaller merchants should carefully compare projected savings against the subscription cost.

Q2. How does Stax differ from traditional payment processors?

Unlike traditional processors that add a percentage markup to interchange rates, Stax charges a flat monthly subscription fee and passes interchange costs directly to the merchant without extra markup.

Q3. What types of support channels are available for Stax users?

Stax provides phone, email, and live chat support, along with a self-service knowledge base. Some subscription tiers offer priority or extended support hours.