PayAnywhere Review

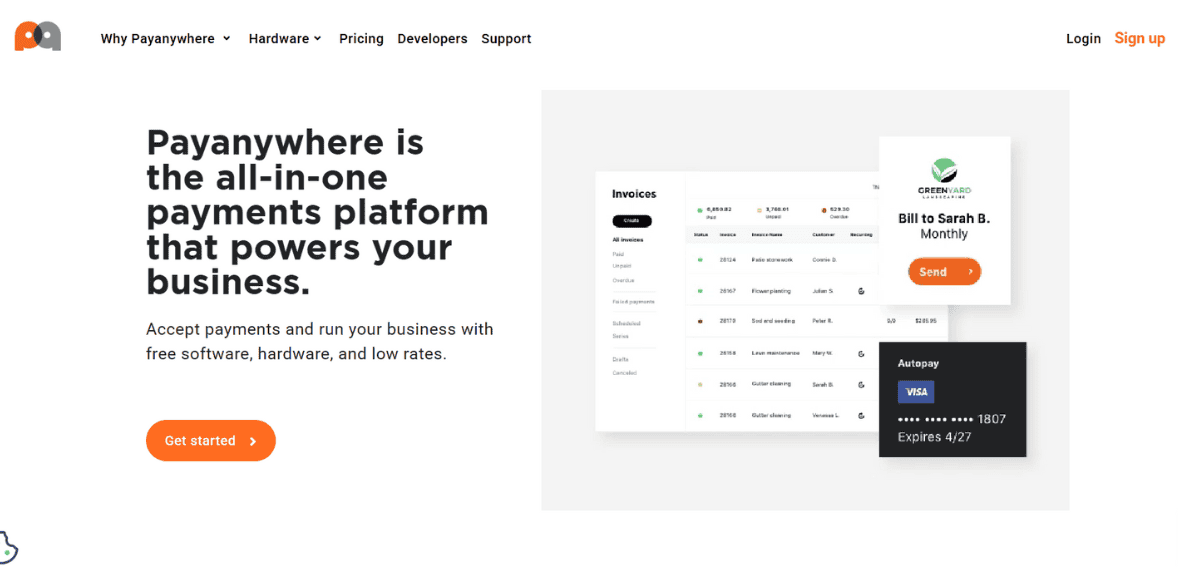

PayAnywhere is a payment processing solution that gives merchants flexibility when accepting payments in-store and on the go. Part of North American Bancard’s portfolio, it’s designed for small to medium-sized businesses that need affordability without sacrificing features. Unlike big name competitors that dominate the payment space, PayAnywhere bridges the gap between mobility and full-service point-of-sale. Lets read more about PayAnywhere Review.

The platform offers hardware like card readers and terminals, software to track sales, issue invoices and manage business operations. Its biggest selling point is simplicity; merchants can get started quickly with no technical background. This is why it’s attractive to independent vendors, mobile service providers and small retail stores.

But PayAnywhere isn’t a one-size-fits-all solution. While it has many features small businesses love, it also has limitations that larger more complex businesses will find restrictive. This review looks at the features, pricing, pros and cons to give you a balanced view of how it stacks up in the bigger payments picture.

Company Overview and Market Position | PayAnywhere Review

PayAnywhere was created by North American Bancard, a long time payment processor in the US. NAB has been serving merchants for years and PayAnywhere was designed to target businesses that needed a user friendly, mobile first payment solution. This was a smart move as mobile commerce and portable payment systems are a growing demand in today’s retail and service industries.

Market wise PayAnywhere competes with Square, Clover and Stripe. It positions itself as a versatile yet cost conscious option, especially for merchants who can’t justify higher equipment costs or complex system integrations. Its branding has always been around simplicity, giving business owners tools that don’t require heavy training or upfront investment.

But PayAnywhere’s market perception is mixed. Many users love the low barrier to entry and convenience while others have concerns about fee transparency and customer service. Unlike competitors that have built strong ecosystems of 3rd party apps and integrations, PayAnywhere is more modest in its offerings. This puts it in a unique position: attractive to merchants who want simple payment acceptance but less so for businesses that want customizations.

Onboarding and Setup Process

One of the best things about PayAnywhere is the simple onboarding process. Merchants can sign up online and fill out basic business info and then be guided through the account setup. Once approved, you can order hardware like mobile readers or POS terminals. No IT support required.

The equipment once received pairs with smartphones, tablets or operates as a standalone POS. For mobile readers, you just download the PayAnywhere app, connect the reader to your device and start processing payments. The software will walk you through the first few transactions. Account verification is usually quick but some merchants have reported delays in approval depending on underwriting requirements. PayAnywhere, like most processors, still applies standard risk assessment procedures so businesses in high risk industries may have a stricter review.

Overall the onboarding process is designed to be easy. No extensive training or system configuration required which is a big plus for small businesses that want to start accepting payments right away. But merchants should review the contract terms during setup as some have pointed out that the fine print on fees or equipment leases can be missed in the rush to get started.

Hardware and Mobile POS Solutions

PayAnywhere offers a range of hardware designed to accommodate both mobile and stationary businesses. The simplest option is a mobile card reader that connects to smartphones or tablets. These devices accept EMV chip cards, magnetic stripe cards, and contactless payments such as Apple Pay or Google Pay. This versatility ensures merchants don’t miss out on customers who prefer newer digital wallet technologies.

For more established setups, PayAnywhere provides POS terminals and smart solutions with touchscreens, receipt printers, and built-in software. These terminals are designed for retail counters, restaurants, and service providers who prefer a more traditional checkout experience. The company also offers portable terminals that combine mobility with full features, allowing merchants to carry them within a store or take them to pop-up events.

The hardware is generally easy to use, though its design and durability may not rival that of higher-priced systems. Merchants who require advanced inventory management, customer loyalty features, or extensive customizations may find the hardware somewhat limited. Still, for small businesses and mobile vendors, it strikes a good balance between affordability and functionality. Ultimately, PayAnywhere’s hardware strategy aligns with its target audience: businesses that want to accept multiple payment types without significant upfront investment in POS technology.

Software Features and Dashboard

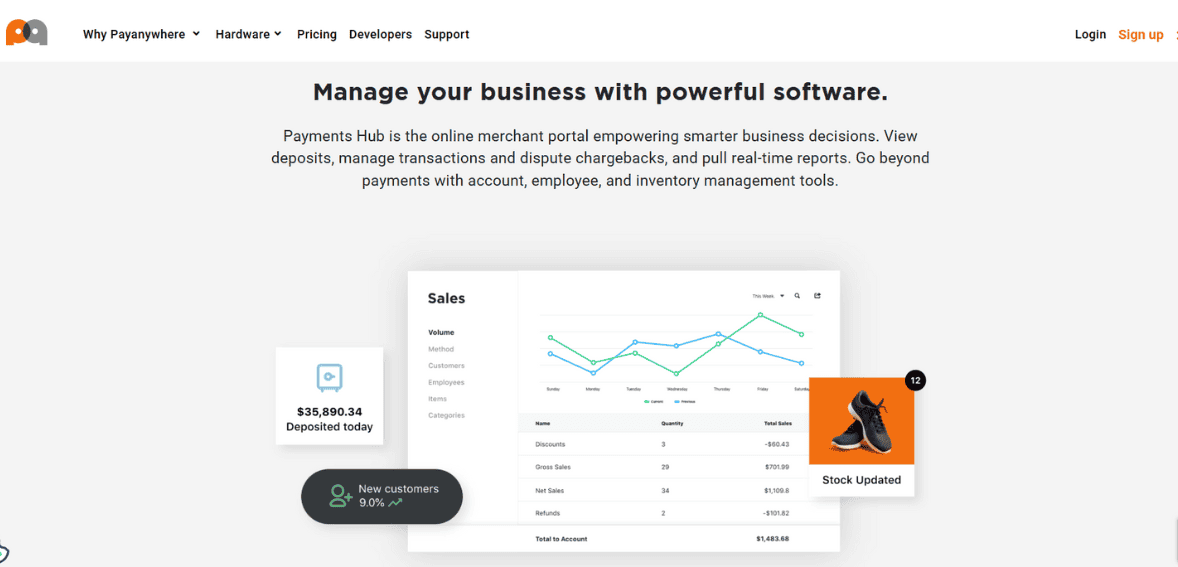

The PayAnywhere software is centered on its mobile app and web-based dashboard, providing business owners with tools to track transactions and manage operations. The app allows users to process payments, issue digital receipts, and view sales activity in real time. For merchants using terminals, the same features are integrated into the device interface.

The dashboard gives a broader view of business performance. Merchants can analyze sales trends, generate reports, and track activity across locations. Invoicing functionality is available, enabling merchants to send digital invoices directly to customers and accept payments online. Recurring billing options are also provided, making it useful for service-based businesses that rely on subscriptions or repeat clients.

While the software covers core needs, it is not as advanced as larger POS ecosystems that integrate deep accounting or inventory features. Some businesses may find themselves needing additional software for specialized operations. However, for its target market, the platform remains functional, straightforward, and practical. In short, PayAnywhere’s software provides enough for small to medium merchants to run day-to-day payment activities, though it doesn’t aspire to be a full-scale enterprise resource system.

Payment Processing Capabilities

PayAnywhere supports a wide range of payment types, which is essential for modern merchants. It accepts all major credit and debit cards, EMV chip transactions, and contactless payments via NFC-enabled wallets. This flexibility ensures customers can pay the way they prefer, enhancing convenience and customer satisfaction.

The system also accommodates keyed-in transactions, useful when merchants need to process payments without a physical card present. Online payments are possible through invoicing and virtual terminals, giving businesses a way to expand beyond face-to-face interactions. Recurring billing options further add to its versatility, particularly for subscription-based businesses. Processing speeds are competitive, with funds typically deposited within one to two business days. Same-day funding is sometimes available, though it may incur additional costs. This quick access to funds can be a lifeline for small businesses managing tight cash flow.

The main limitation lies in customization. While PayAnywhere handles the basics well, it doesn’t provide as many specialized features as enterprise-level processors. For example, integrations with advanced e-commerce systems are limited compared to competitors like Stripe or Square. Nonetheless, for small businesses prioritizing straightforward payment acceptance, the capabilities are more than adequate.

Security and Compliance

Security is a critical concern in payment processing, and PayAnywhere follows industry standards to protect merchants and customers alike. The platform is PCI-compliant, ensuring transactions meet the Payment Card Industry’s data security requirements. It also uses encryption and tokenization to safeguard sensitive card data during processing, reducing exposure to fraud and data breaches.

Fraud prevention features include monitoring tools that flag suspicious transactions, giving merchants the ability to review or decline high-risk sales. These measures are especially important for businesses that deal with card-not-present transactions, which are more vulnerable to fraud.

While PayAnywhere provides the core compliance features expected of a processor, it does not stand out as an innovator in this area. Competitors often advertise more advanced fraud management systems or broader compliance certifications. Still, for most small and medium businesses, the protections offered are sufficient to maintain security and build customer trust. Merchants should remain proactive, however, by regularly reviewing PayAnywhere’s policies and ensuring their own business practices align with compliance requirements.

Integrations and Compatibility

One of PayAnywhere’s limitations is its relatively modest range of integrations. While it provides essential features within its own ecosystem, it doesn’t offer the same extensive compatibility with third-party software as some competitors.

For example, accounting integrations with platforms like QuickBooks may not be as seamless as those offered by Square or Stripe. E-commerce support also exists but is not as expansive, making PayAnywhere better suited for physical or mobile-based businesses than for online-first retailers. That said, the platform is compatible with common operating systems and mobile devices, allowing merchants to use their existing smartphones or tablets without issue. This makes it versatile in terms of device support, but less so in terms of advanced business software connectivity.

Merchants seeking a lightweight, standalone solution may not find this limiting. However, those planning to scale operations and integrate across multiple platforms may eventually outgrow PayAnywhere’s capabilities.

Pricing and Fees

Pricing is one of the most scrutinized aspects of PayAnywhere. The company advertises competitive transaction rates, often using flat-rate pricing as a simple entry point. However, fees can vary depending on the type of business and transaction volume. In some cases, interchange-plus pricing may be applied.

The most common charges include transaction fees per swipe, tap, or keyed-in payment. While advertised rates seem straightforward, some merchants have reported hidden or unexpected charges. Equipment leasing, in particular, has drawn criticism, as the long-term costs of leasing can outweigh the benefits compared to purchasing hardware outright.

Monthly fees are not always required, but certain plans may include service charges depending on the features selected. Early termination fees have also been noted in some contracts, despite marketing that emphasizes flexibility. Overall, PayAnywhere can be cost-effective for small businesses with moderate transaction volumes. However, merchants should carefully review contract terms and ask detailed questions about potential charges before committing. Transparency in pricing has been a common area of feedback among users.

Customer Support and Service Quality

Customer service is an area where PayAnywhere receives mixed reviews. The company offers phone, email, and online support, along with documentation and FAQs on its website. For basic inquiries and setup assistance, these resources are generally adequate.

However, some merchants report difficulty reaching knowledgeable representatives, particularly during high-volume times. Resolution speed has also been noted as a concern, with some issues taking longer to address than expected. This can be especially frustrating for businesses that depend on reliable processing to maintain daily operations.

On the positive side, many users have found the support team helpful during onboarding and hardware setup. The challenge seems to lie more in resolving complex account or funding issues, which sometimes require persistence from the merchant. As with many payment processors, customer support experiences can vary widely. For some, the service is satisfactory; for others, it falls short. Prospective merchants should weigh this factor carefully, especially if they place a high priority on responsive support.

User Experience and Usability

PayAnywhere’s design emphasizes simplicity and accessibility. The mobile app has a straightforward interface, allowing merchants to process payments with minimal clicks. Receipts can be emailed or printed, and reports are easy to generate through the dashboard. The hardware, while functional, is designed more for practicality than aesthetics. It gets the job done, but users who value premium design or advanced customizability may find it basic. That said, many small businesses appreciate that it “just works” without requiring lengthy tutorials.

Usability is a strong point, particularly for merchants who are new to payment processing. The learning curve is minimal, making it suitable for staff training and day-to-day use. Some limitations exist for businesses that want to go beyond the basics, but within its intended scope, PayAnywhere delivers a solid user experience.

Pros of Using PayAnywhere

PayAnywhere has several advantages that make it appealing to small and medium businesses. The first is its accessibility; merchants can start processing payments quickly with minimal setup. The availability of mobile readers and affordable hardware options adds to this appeal. Another benefit is its support for multiple payment types, including EMV and contactless options, which ensures compatibility with modern consumer preferences. The software also provides useful tools like invoicing and recurring billing, covering core needs for many service providers.

Cost can be competitive for businesses with moderate transaction volumes. The straightforward app design and usability further strengthen its case for merchants who don’t want to spend excessive time managing technology. In short, PayAnywhere’s strengths lie in simplicity, affordability, and flexibility for small businesses.

Cons and Limitations of PayAnywhere

Despite its benefits, PayAnywhere is not without drawbacks. A frequent concern is transparency in pricing and fees. Some merchants report unexpected charges or find that equipment leasing terms are less favorable than advertised. Customer service is another area of criticism, with inconsistent experiences reported by users. This can be problematic for businesses that rely on fast support during payment disruptions.

Additionally, PayAnywhere lacks the depth of integrations found in competitors’ ecosystems. Businesses that need advanced inventory systems, loyalty programs, or seamless accounting integrations may find it limiting. Finally, while the hardware works well for basic needs, it doesn’t offer the advanced features or polish of higher-end POS solutions. These factors make PayAnywhere better suited for smaller operations rather than large, complex enterprises.

Best Suited Business Types

PayAnywhere is particularly beneficial for small businesses that prioritize mobility, affordability, and ease of use. Examples include mobile vendors, service professionals, food trucks, pop-up retailers, and small storefronts. The platform provides just enough functionality to support their daily operations without requiring major investment.

For businesses that need advanced customization, large-scale integrations, or enterprise-grade systems, PayAnywhere may not be the best fit. In such cases, competitors like Square or Clover may offer more robust ecosystems. Still, within its target segment, PayAnywhere delivers solid value. It is well-suited for entrepreneurs who want to focus on their business rather than spend excessive time learning complex software.

Conclusion: Is PayAnywhere Worth It?

PayAnywhere offers an attractive mix of affordability, simplicity, and essential features for small to medium-sized businesses. Its mobile-first approach makes it appealing for merchants who operate outside of traditional retail environments, while its POS terminals provide enough flexibility for storefronts. The platform’s strengths include straightforward setup, broad payment acceptance, and competitive pricing for certain users. However, limitations in transparency, customer service consistency, and integration options cannot be ignored. Ultimately, PayAnywhere is a solid option for smaller businesses seeking a reliable payment solution without the overhead of more complex systems. For those who require advanced customization or long-term scalability, exploring alternative providers may be worthwhile.

FAQs

Q1. Does PayAnywhere work for both online and in-person payments?

Yes, PayAnywhere supports in-person transactions through mobile readers and terminals, as well as online payments via invoices and virtual terminals.

Q2. Are there long-term contracts with PayAnywhere?

PayAnywhere often promotes flexible terms, but merchants should review agreements carefully. Equipment leasing and certain pricing plans may involve longer commitments.

Q3. What types of businesses benefit most from PayAnywhere?

Small retailers, mobile vendors, service professionals, and businesses that prioritize affordability and ease of use benefit most from PayAnywhere.