Newtek Merchant Solutions Review

Newtek Merchant Solutions is part of NewtekOne, a company that supports small and mid-sized businesses. While NewtekOne offers many services including lending, payroll and IT solutions, the merchant services division is focused on helping businesses accept, manage and process payments. Lets read more about Newtek Merchant Solutions Review.

This solution stands out by being flexible across different payment types, retail, online and mobile. For businesses already using Newtek’s other services, the merchant services feel like a natural extension, easy to integrate and a cohesive back office experience.

Newtek may not be a household name like some of the bigger payment processors, but its strength is in personalization. The service is designed for smaller businesses by bundling reliable payment processing with operational tools, a complete and approachable solution for growing businesses.

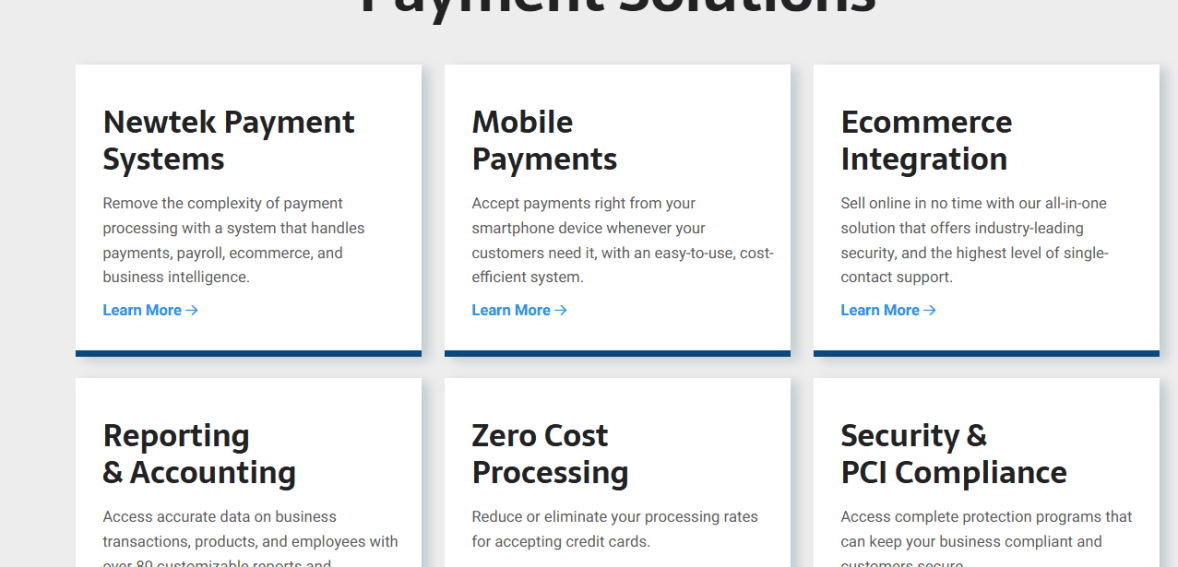

Core Payment Processing Features | Newtek Merchant Solutions Review

At its core, Newtek Merchant Solutions offers credit and debit card processing. The platform supports all major card networks Visa, Mastercard, Discover and American Express. Whether you have a physical storefront, a mobile setup or an online portal, Newtek has the tools to make secure transactions possible.

Features like authorization, batch processing and settlement are included. The system is scalable from a few transactions a day to high volume. Contactless payment methods like Apple Pay and Google Pay are also supported so you can offer your customers modern checkout experiences.

While the platform doesn’t push the boundaries of innovation, its commitment to industry standards is reliable. It’s focused on functionality over novelty, which can be a big plus for businesses that want consistency over experimental features.

POS Solutions

Newtek provides several POS hardware and software combinations suitable for in-store operations. These range from simple countertop terminals to more advanced systems that include employee and inventory management features. The solutions are particularly well-suited for restaurants, retail stores, and service-based businesses.

The hardware offered is sourced from reputable third-party vendors, ensuring compatibility with EMV chip cards and contactless payments. Businesses can choose between wired and wireless terminals depending on layout needs. On the software side, Newtek’s POS systems include tools for tracking sales, printing receipts, and managing basic customer data.

Integration with back-office functions like inventory or accounting is possible, though it may require some additional configuration. While it may not rival industry-specific POS suites, it does deliver the essentials needed for day-to-day retail operations.

E-Commerce and Online Payment Tools

Newtek supports online payments through a suite of tools tailored to digital businesses. These include hosted checkout pages, virtual terminals, and integrations with e-commerce platforms. The virtual terminal enables manual card entry for remote payments, ideal for phone or email orders. The hosted checkout pages offer secure, branded experiences without the need for merchants to store sensitive data.

While Newtek offers compatibility with platforms like WooCommerce and Magento, integration may require extra setup or developer involvement. The tools are PCI-compliant and include encryption features to protect transaction data.

For businesses with straightforward online sales needs, Newtek’s offering is sufficient. Those requiring custom checkout flows, deep analytics, or complex subscription models may need to integrate additional third-party services.

Mobile Payment Support

Newtek’s mobile payment options are built for flexibility. Small business owners, mobile service providers, and event vendors can use portable card readers that connect to smartphones via Bluetooth or audio jack. These readers support swipe, chip, and contactless transactions, making them versatile for various situations.

The accompanying mobile app allows users to input amounts, view basic transaction logs, and send digital receipts. While the tools are easy to use and reliable, they do not offer extensive features like inventory tracking or CRM capabilities.

This solution is ideal for mobile-first operations that need a simple, lightweight tool to collect payments. Businesses with more robust mobile needs may need to supplement the system with additional platforms.

Invoicing and Recurring Billing

For businesses with subscription services or recurring billing models, Newtek has simple tools to create and send invoices and set up automated payments. Invoices can be customized and sent via email with embedded payment links that accept card payments.

Recurring billing allows businesses to set up schedules for automatic charges on a weekly, monthly or custom basis. The system stores payment data so you don’t have to re-enter info each cycle.

These are user friendly and will work for most small business needs. But they don’t have advanced features like tiered billing plans or usage based pricing. Businesses that need those will need to look into specialized billing platforms.

Integration with Business Tools

Newtek has basic integration with software like QuickBooks so you can sync transaction data for financial reporting. If you already use Newtek’s payroll or insurance services, the ecosystem integration will create operational efficiency.

While helpful, Newtek’s integration options aren’t as robust as platforms with open APIs or large app marketplaces. Customization options are limited and businesses with complex workflows will need to use third party middleware to connect all systems.

For small to mid-sized businesses using common tools, Newtek has enough connectivity to centralize data without being too complicated.

Security and Compliance Measures

Security is a cornerstone of Newtek’s merchant services. The platform adheres to PCI DSS requirements and employs encryption and tokenization to safeguard transaction data. This means that sensitive information is protected during both transmission and storage.

It also includes fraud prevention tools such as CVV and AVS checks and offers merchant guidance on maintaining PCI compliance. While the platform does not offer proprietary fraud detection algorithms, the existing tools are reliable and familiar to most users.

These features ensure a secure payment environment, which is especially important for small businesses without dedicated IT security resources.

Reporting and Analytics Dashboard

Newtek includes a reporting interface that tracks daily transactions, sales history, chargebacks, and other key performance indicators. The dashboard is simple and intuitive, designed for business owners who want quick access to financial data without learning complex analytics software.

Reports can be filtered by time frame, payment method, or location, making it easier to understand trends. Though the reporting features support basic financial analysis and accounting preparation, they are not meant for advanced forecasting or business intelligence.

This tool works well for routine oversight and performance reviews. Businesses needing predictive analytics or deeper customer insights may require additional software.

Customer Support and Service Structure

Customer service is one of Newtek’s strong suits. Support is offered by phone and email during business hours and you deal with a dedicated service rep, not a help desk.

Newtek also provides some basic documentation and onboarding help which is great for first time users. 24/7 support isn’t standard but the hands on approach is consistent.

For merchants who value direct communication and human help this service model is an advantage over larger platforms with long response times and impersonal interfaces.

Pricing Transparency and Fees

Newtek’s pricing is not published which can be frustrating for businesses that want instant quotes or price comparisons. Pricing is custom based on industry type, transaction volume and risk level.

Fees may include interchange costs, monthly service fees, statement fees and equipment rentals. Some merchants will be on a flat rate model, others will be on an interchange plus model. Early termination fees or long term contracts may apply depending on the agreement.

While negotiable terms are possible the lack of transparency can be a barrier for businesses that are not familiar with merchant account pricing. Prospective users should review contracts closely and ask direct questions about additional fees and pricing models.

Pros and Cons of Newtek Merchant Solutions

Newtek’s biggest strengths include its tailored approach to small businesses and its connection to the broader NewtekOne ecosystem. Bundled services like payroll and lending help simplify operations. The platform also offers stable payment tools and customer support with a human touch.

However, the limited integration options and lack of cutting-edge features may not meet the needs of larger or tech-savvy businesses. Pricing opacity is another potential drawback, especially for those seeking straightforward cost structures.

Businesses prioritizing reliability and relationship-driven service will find value in Newtek. Those seeking advanced technology or deep customization may find the platform less suitable.

Ideal Business Types for Newtek

Newtek Merchant Solutions is designed for small and mid-sized businesses. Retail stores, professional service providers, and e-commerce shops with basic requirements are well-positioned to benefit. Its invoicing and recurring billing tools are useful for consultants, membership services, and healthcare providers.

Merchants already using Newtek’s other services will enjoy better integration and streamlined operations. On the other hand, businesses in highly technical industries or with complex payment workflows might need more specialized solutions.

Newtek fits best where usability and trust are more important than having the latest innovations.

Final Verdict

Newtek Merchant Solutions offers reliable, user-friendly payment services ideal for small businesses. Its strengths include solid customer support, essential tools, and integration with NewtekOne. While not the most flexible or tech-advanced, it meets core business needs. Improved pricing transparency and integration options could enhance its competitive appeal further.

FAQs

Q1: Does Newtek Merchant Solutions support high-risk businesses?

Newtek typically focuses on standard-risk industries. High-risk businesses should contact Newtek directly to assess eligibility and underwriting options.

Q2: Can Newtek integrate with my e-commerce platform?

Yes, it supports integration with several popular platforms. However, setup may require plugins or technical assistance to ensure compatibility.

Q3: Is a long-term contract required?

Contract terms can vary. Some merchants may get month-to-month agreements, while others may face longer commitments. Be sure to clarify all terms before signing.