National Bankcard Review

National Bankcard is a well-established name in the U.S. payments industry, known for providing merchant services to small businesses, e-commerce sellers, and larger enterprises seeking secure payment processing. With so many providers competing for attention, merchants often find it difficult to distinguish one from another. National Bankcard has carved out a space for itself by offering a broad portfolio of services that aim to simplify transactions and give businesses the infrastructure needed to accept payments quickly and securely. Lets read more about National Bankcard Review.

This review takes a deeper look at what National Bankcard brings to the table. Instead of focusing on marketing claims, it examines the company’s history, services, pricing, hardware, integrations, and customer support. By weighing strengths and weaknesses, businesses can better understand how National Bankcard compares to other providers and whether its features justify the cost. Transparency, reliability, and flexibility often matter just as much as competitive rates, and this review explores where National Bankcard succeeds and where it leaves room for caution.

Company Overview and Background | National Bankcard Review

National Bankcard has been in the merchant services industry for many years, offering businesses an entry point into the complex world of payment acceptance. The company positions itself as a one-stop provider, helping merchants navigate banking networks and technology without relying on multiple vendors. Its client base includes traditional storefront retailers, restaurants, service-based businesses, and e-commerce companies, demonstrating flexibility across multiple industries.

The payments landscape has changed rapidly over the last decade. Consumers now expect digital wallets, mobile payments, and online checkout options alongside traditional cards. National Bankcard has adapted by expanding beyond countertop terminals into e-commerce gateways and mobile readers. This evolution allows businesses of varying sizes to find a suitable solution, whether they need a reliable terminal for in-store use, a shopping cart integration for online sales, or a mobile reader for payments on the go.

One of the company’s strengths lies in its attempt to bridge traditional reliability with modern demands. While some providers target either startups or large enterprises exclusively, National Bankcard markets itself to a broad spectrum. That wide positioning can be beneficial for businesses seeking flexibility, but it may also mean that highly specialized industries will not find the same level of tailored support as they might with niche providers. Understanding this broad market focus helps frame the evaluation of their specific offerings.

Core Services Offered

At the center of National Bankcard’s business is credit and debit card processing, covering Visa, Mastercard, American Express, and Discover. Alongside this core function, the company provides merchants with check processing, gift card programs, and loyalty solutions. These additional tools are designed to expand revenue streams and improve customer retention.

For physical retailers and restaurants, National Bankcard supplies POS systems and countertop terminals that support high-volume, fast-paced environments. E-commerce businesses gain access to an online gateway with fraud detection, recurring billing, and integrations with popular shopping cart platforms. Meanwhile, mobile service providers and event-based sellers can use portable readers connected to smartphones or tablets.

The company also emphasizes reporting and analytics, offering merchants the ability to track transactions, monitor chargebacks, and identify sales patterns. This breadth of service demonstrates an effort to cover multiple channels rather than specialize in one. While this flexibility is valuable, it can also mean that some tools are functional but not as advanced as those from specialized providers.

Payment Gateway and Online Solutions

E-commerce continues to dominate retail growth, and National Bankcard provides a gateway that connects online merchants to secure processing networks. Features include recurring billing, tokenization for securely storing customer data, and compatibility with major shopping carts. For businesses selling subscriptions, these functions reduce the need for manual invoicing and ensure consistent revenue collection.

Fraud detection measures are also bundled into the gateway. Suspicious transactions can be flagged before final approval, helping merchants minimize chargebacks and losses. Although these tools are standard across the industry, their inclusion ensures that National Bankcard meets basic merchant expectations.

Compatibility with popular platforms such as Shopify, WooCommerce, and Magento is another advantage. While integration may require technical setup or developer assistance in some cases, businesses without in-house IT support may find the process manageable with external help.

The gateway provides solid functionality but does not stand out as a groundbreaking innovation. For businesses with moderate e-commerce needs, it is sufficient. However, enterprises that rely heavily on advanced fraud prevention or specialized subscription tools may find greater value in dedicated e-commerce processors.

POS Systems and Hardware Options

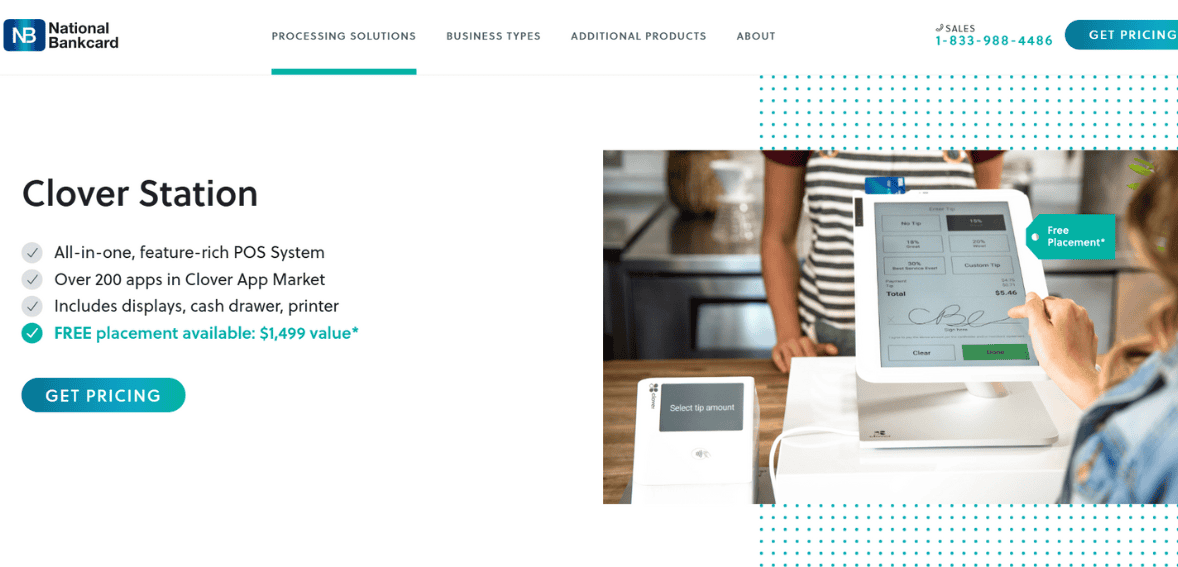

Point-of-sale systems remain critical for brick-and-mortar businesses, and National Bankcard offers a range of hardware options. Countertop terminals that support magnetic swipe, chip, and contactless payments provide familiar reliability. For more advanced needs, integrated POS systems include inventory management, employee tracking, and sales reporting.

Restaurants can access POS systems designed for order management, table tracking, and tip adjustment. Retailers may prefer systems with barcode scanning and receipt printing. For mobile businesses, wireless terminals and portable readers allow payments to be processed outside of fixed locations.

Hardware reliability is crucial since downtime directly affects revenue. National Bankcard partners with well-known manufacturers, reducing the risk of equipment failure. Still, merchants should clarify warranty policies, replacement terms, and any fees tied to leasing or renting equipment.

While the equipment catalog is comprehensive, competitors increasingly highlight touchscreen smart terminals with advanced features. National Bankcard leans toward proven reliability over innovation, appealing to businesses that prioritize stability over experimentation.

Mobile and Contactless Payments

The rise of mobile wallets and touch-free transactions has changed consumer behavior. National Bankcard provides card readers compatible with smartphones and tablets that accept EMV chips and NFC-based payments such as Apple Pay and Google Pay. These tools are particularly useful for delivery services, repair providers, and vendors at temporary locations.

Merchants also gain access to an app that connects mobile devices to the processing network. Through the app, users can process payments, view basic reports, and issue refunds. While the functionality does not rival advanced mobile POS systems, it covers the essentials for small businesses.

The emphasis on contactless payments reflects shifting consumer expectations. Many customers prefer touch-free checkout for speed and safety, and businesses without NFC capability risk falling behind. National Bankcard’s support in this area ensures merchants can remain competitive, even if the mobile ecosystem does not yet rival the advanced offerings of fintech-driven platforms.

Pricing and Fees Structure

Pricing remains one of the most important and contentious aspects of any payment processor. National Bankcard, like many traditional providers, does not list standardized rates publicly. Instead, fees often depend on business type, volume, and perceived risk. Merchants may encounter tiered pricing or, in some cases, interchange-plus models depending on negotiations.

Common charges include transaction fees, monthly account fees, PCI compliance costs, and gateway fees for online processing. Some merchants have reported contracts with early termination penalties, a factor that can complicate switching providers if dissatisfaction arises. This lack of transparency can frustrate smaller merchants who prefer predictable costs.

On the positive side, larger businesses that process higher volumes may be able to negotiate significantly lower transaction rates. Equipment placement programs sometimes reduce upfront hardware costs, though they may involve recurring leasing expenses.

The main takeaway is that pricing is highly variable. Merchants should request detailed contract terms, confirm whether interchange-plus pricing is available, and clarify early termination policies before signing. Evaluating total costs over the length of a contract is essential to avoid unexpected expenses.

Security and Compliance

Protecting customer data is a non-negotiable requirement in payment processing. National Bankcard aligns with PCI DSS standards, ensuring merchants follow the rules established by the Payment Card Industry Security Standards Council. Encryption and tokenization tools secure sensitive data and reduce risks of breaches.

Fraud prevention measures include filters, alerts, and chargeback management tools that allow businesses to dispute transactions effectively. For online sellers, support for AVS (address verification) and CVV checks adds another safeguard against unauthorized card use.

While these features meet industry expectations, they do not necessarily distinguish National Bankcard from competitors. Still, the company provides the baseline protections merchants should expect, ensuring compliance and risk reduction. Businesses with higher risk profiles may still need specialized fraud solutions layered on top of what National Bankcard offers.

Integrations and API Support

Smooth integrations are crucial for businesses that rely on multiple software systems. National Bankcard provides APIs for connecting payment processing to third-party platforms such as shopping carts, accounting software, and CRM systems. Automating these data flows reduces manual bookkeeping, improves accuracy, and enhances customer management.

For example, linking sales data directly into accounting software eliminates time-consuming reconciliations. Integration with CRM systems allows customer loyalty and purchase history to be tracked seamlessly. National Bankcard’s plug-and-play compatibility with Shopify and WooCommerce is useful for e-commerce merchants who want straightforward setups.

However, businesses with highly technical needs or custom workflows may find the available integrations limited. While the documentation supports flexibility, developer assistance may be required for advanced implementations. For most small-to-medium-sized merchants, the integration support is adequate, but it may not satisfy enterprise-level requirements.

Customer Support and Reliability

Customer support quality often determines whether a payment processor becomes a long-term partner or a short-term experiment. National Bankcard provides phone, email, and in some cases live chat support. Availability is marketed as round-the-clock, though merchant experiences vary. Some report quick, helpful responses, while others describe delays in issue resolution, particularly around billing disputes.

Larger clients often benefit from dedicated account representatives, giving them faster access to assistance. Smaller businesses may rely on general support lines, which can create inconsistent experiences depending on account size.

Reliability of the processing network itself is generally solid, with minimal downtime reported. Since the company leverages established banking infrastructure, most merchants experience steady service. However, as with any provider, occasional outages are possible, and businesses should evaluate whether backup plans are in place.

Pros of Using National Bankcard

National Bankcard’s advantages stem from its breadth of service. Businesses can manage in-store, online, and mobile transactions under one provider. The availability of POS systems, mobile readers, and online gateways provides flexibility for diverse models. Security compliance is strong, ensuring basic protections for sensitive data.

Merchants processing high volumes can negotiate competitive rates, making the service cost-effective in certain scenarios. Integration with common platforms also reduces administrative burdens. Finally, the company’s longevity in the industry gives it credibility, offering reassurance to merchants who prefer working with established providers.

Cons and Limitations

The biggest drawback reported by many merchants is pricing transparency. Without standardized interchange-plus offerings advertised upfront, contracts may involve tiered pricing and hidden fees. Long-term contracts with early termination penalties can also lock businesses into arrangements that are difficult to exit.

Customer support quality is inconsistent, particularly for smaller businesses. While larger accounts may receive dedicated attention, smaller merchants may struggle to get quick resolution. Equipment leasing programs may reduce upfront costs but can accumulate into long-term expenses that outweigh ownership.

Innovation is another area where the company lags. While it provides the basics across mobile and online payments, competitors in the fintech sector often deliver more advanced tools with clearer pricing models. Businesses seeking cutting-edge solutions may find National Bankcard more conservative than expected.

Ideal Business Types for National Bankcard

National Bankcard is versatile, serving retailers, restaurants, service providers, and e-commerce merchants. Restaurants benefit from tipping and order management functions, while retailers value inventory tracking and barcode support. Mobile businesses gain from portable readers that allow payments at client sites or events.

E-commerce sellers find recurring billing and fraud detection useful, particularly for subscription models. Professional service providers may appreciate reporting features that simplify billing and chargeback management.

The company is best suited for small to mid-sized businesses that need a balance of in-store and online acceptance without deep customization. Larger enterprises with complex technical needs may require more specialized providers.

Competitor Comparison

Against competitors, National Bankcard’s strengths lie in its longevity and service breadth. Unlike newer fintech entrants that focus heavily on one channel, National Bankcard provides a multi-channel solution. However, transparency and innovation are areas where rivals often hold an edge.

Flat-rate processors like Square or Stripe appeal to merchants who prefer simplicity, while other traditional providers may offer more advanced POS ecosystems. Businesses must decide whether stability and experience outweigh the appeal of transparent rates and modernized platforms.

Final Verdict

National Bankcard delivers a comprehensive suite of merchant services covering card processing, POS systems, mobile acceptance, and online gateways. It performs reliably, meets compliance requirements, and integrates with common platforms. Larger merchants can benefit from negotiated rates, while smaller merchants gain flexible hardware and multi-channel options.

However, the company’s lack of pricing transparency, potential for restrictive contracts, and mixed support quality are significant considerations. It may not be the most innovative provider, but it remains a credible choice for businesses seeking established reliability. Merchants considering National Bankcard should review contracts closely, clarify fees, and evaluate support responsiveness before committing.

FAQs

Q1. Is National Bankcard suitable for small businesses just starting out?

Yes, National Bankcard offers entry-level tools that help small businesses accept payments. However, new merchants should carefully review contracts and confirm pricing terms to avoid hidden fees.

Q2. Does National Bankcard support e-commerce integrations with popular platforms?

Yes, National Bankcard’s gateway integrates with Shopify, WooCommerce, Magento, and other platforms. These integrations make it easier for online sellers to process transactions.

Q3. Are there cancellation fees with National Bankcard?

Yes, depending on the contract, early termination fees may apply. Merchants are advised to confirm cancellation policies in writing before signing an agreement.