Merchant One Review

Merchant One is a well-established credit card processing company that provides businesses with a range of tools to manage transactions efficiently. Over the years, it has positioned itself as a payment solutions provider catering primarily to small and medium-sized enterprises, though it also works with larger organizations. Its value proposition lies in making electronic payments more accessible, whether through point-of-sale systems, ecommerce gateways, or mobile readers. Lets read more about Merchant One Review.

The payments industry has undergone tremendous change in the last two decades, with consumer preferences shifting from cash to card, and more recently, toward digital wallets. Companies like Merchant One have grown alongside this shift, offering technology and service bundles that simplify complex aspects of accepting payments. Instead of focusing exclusively on hardware or software, Merchant One combines both, creating an ecosystem that supports modern businesses.

While the company highlights flexibility and customer service as its strengths, it also operates in a crowded market where transparency and reliability are key decision-making factors for merchants.

Company Background and History | Merchant One Review

Founded in 2002, Merchant One is headquartered in Miami, Florida, and has grown steadily to become a recognizable name in the payment processing industry. The company started with a goal to simplify how small businesses accept card payments at a time when setting up merchant accounts was often complicated and expensive. Over time, its client base expanded to include retailers, restaurants, service providers, and ecommerce businesses.

One of the reasons Merchant One has been able to maintain a presence in a highly competitive sector is its ability to adapt to new technologies and industry standards. From the introduction of EMV chip cards to the rise of mobile payments and contactless transactions, the company has consistently updated its offerings. By doing so, it has aligned itself with the expectations of both merchants and their customers.

Today, Merchant One claims to serve more than 350,000 businesses across different industries. This reach demonstrates not just longevity but also the ability to scale its operations. For many merchants, particularly those without large budgets, the appeal of a provider that understands the needs of smaller enterprises has been central to Merchant One’s growth. Its continued investment in partnerships and technology reinforces its role as a stable, mid-tier player in the U.S. payment ecosystem.

Partnership with Fiserv and Clover Systems

One of Merchant One’s biggest strengths is its partnership with Fiserv, a global leader in financial services technology. Fiserv provides the backbone infrastructure that enables secure and reliable transactions. For merchants, this partnership translates into confidence that their provider is backed by one of the most established names in the industry.

Through this relationship, Merchant One is able to offer Clover POS systems, which are among the most popular in the U.S. Clover hardware includes countertop terminals, mobile devices, and full POS stations that support everything from payment acceptance to inventory management. The availability of these systems gives Merchant One a competitive edge because it can provide tools that scale with a business’s growth.

Having access to Fiserv’s technology also ensures compliance with security regulations and the ability to handle large transaction volumes. This makes Merchant One suitable not just for small shops but also for mid-sized businesses with higher processing demands. While many independent sales organizations (ISOs) in the payment space struggle with credibility, Merchant One benefits from being tied to a trusted global processor. This affiliation reinforces reliability and helps mitigate concerns about operational risks.

Products and Services Overview

Merchant One’s portfolio covers a broad spectrum of payment solutions designed to serve different business models. At the core, it offers merchant accounts that allow businesses to accept credit and debit card payments. Beyond that, its services include:

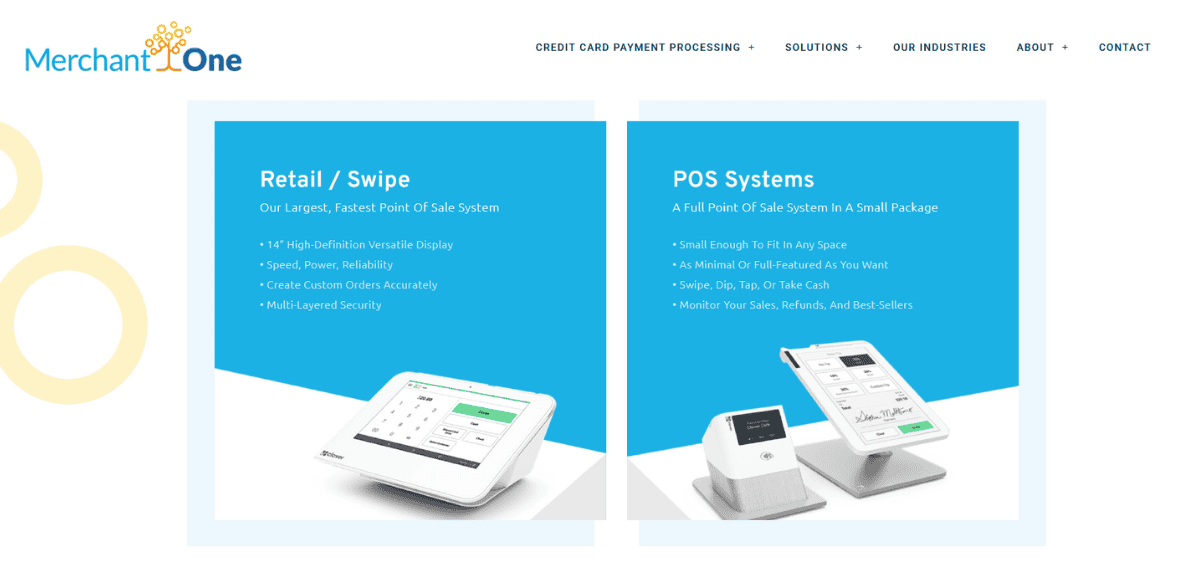

Point-of-Sale Systems: A range of Clover terminals and stations for in-store payments.

Mobile Payment Tools: Card readers and mobile apps for accepting payments on the go.

Ecommerce Solutions: Secure payment gateways and virtual terminals for online businesses.

Recurring Billing: Options for subscription-based businesses to automate payments.

Gift Cards and Loyalty Programs: Tools that help merchants engage and retain customers.

The diversity of services shows that Merchant One is not restricted to traditional brick-and-mortar retail. It has made efforts to ensure ecommerce merchants and mobile service providers have access to the same infrastructure as physical stores. This breadth of offerings is a selling point for businesses that may evolve over time — for instance, a retailer adding an online store can expand within Merchant One’s ecosystem instead of switching providers.

Merchant One Pricing Structure

Pricing in the payment processing industry is often one of the most challenging areas for businesses to evaluate, and Merchant One is no exception. The company advertises competitive rates, though exact fees depend on business type, volume, and risk profile. Typical charges include interchange fees, per-transaction fees, and monthly service costs.

Merchant One has been noted for offering customized quotes, which means pricing is not always transparent upfront. For some businesses, this flexibility can be an advantage, as rates may be tailored to their specific processing needs. For others, the lack of standard pricing may feel opaque compared to flat-rate processors. Additionally, there have been reports of early termination fees and equipment lease agreements, which are important to clarify before signing a contract.

While Merchant One positions itself as an affordable option for small and medium-sized businesses, it is essential for merchants to read contracts carefully. Understanding monthly minimums, PCI compliance fees, and potential cancellation penalties is crucial. Like many traditional merchant service providers, its pricing model is more complex than newer fintech competitors, but it can be cost-effective for businesses processing significant volumes.

Hardware and Technology Options

A significant component of Merchant One’s value comes from its hardware offerings. By reselling Clover devices, it provides merchants with access to one of the most widely used POS ecosystems. Clover devices are known for their sleek design, reliability, and ability to integrate business management tools beyond payment acceptance.

Options include handheld readers like Clover Flex, countertop solutions like Clover Station, and simple mobile readers for businesses on the move. These devices are designed to handle a variety of payment types, including chip cards, contactless payments, and mobile wallets like Apple Pay and Google Pay.

The integration of technology extends to reporting and analytics. Many Clover devices come with built-in apps that help track sales, manage employees, and oversee inventory. This means that for businesses looking for more than just payment acceptance, Merchant One offers solutions that contribute to operational efficiency. While the hardware is an attractive feature, merchants should evaluate costs carefully, as device leases can add to long-term expenses.

Security and Compliance Standards

Security is a non-negotiable factor in payment processing, and Merchant One emphasizes compliance with industry standards. The company ensures that all accounts meet PCI DSS (Payment Card Industry Data Security Standard) requirements, which are designed to protect cardholder data.

Fraud prevention tools are also part of its services, offering merchants safeguards against chargebacks and suspicious transactions. Through its partnership with Fiserv, Merchant One can rely on advanced encryption and tokenization technologies that minimize risks during payment transmission.

However, compliance does come with associated costs. Merchants should confirm whether PCI compliance fees are part of their monthly charges. Failure to maintain compliance can result in penalties, so it is important that businesses understand their responsibilities. Overall, Merchant One delivers the level of security expected from a reputable provider, but merchants must stay proactive in ensuring ongoing compliance to avoid unexpected fees.

Onboarding and Application Process

Merchant One’s onboarding process is designed to be straightforward, though as with most merchant service providers, approval depends on business type and risk level. The application requires basic information such as business details, estimated transaction volumes, and processing history.

One of the company’s selling points is fast approvals. In many cases, accounts can be set up within 24 hours, allowing businesses to begin accepting payments quickly. This is particularly beneficial for new merchants who need to start operations without delays.

That said, some merchants have reported that the contract terms can be confusing at the outset. Clarity around pricing, equipment leases, and cancellation fees is essential before finalizing the application. Businesses should also be prepared for underwriting checks, which may take longer if the business falls into a higher-risk category. Overall, the process is competitive compared to other traditional providers but requires attention to detail from applicants.

User Experience and Ease of Use

Day-to-day usability is where Merchant One delivers tangible value for merchants. The systems provided, especially Clover POS, are known for intuitive interfaces that simplify training for employees. Features such as touchscreen navigation, integrated reporting, and digital receipts contribute to a smoother checkout process for customers.

For ecommerce merchants, the virtual terminal and gateway solutions are also designed with ease of use in mind. Businesses can process transactions online securely and manage them through centralized dashboards. Having consolidated reporting tools helps businesses monitor sales trends and customer behaviors, aiding better decision-making.

That said, some of the more advanced features may require additional apps or software, which can add to costs. While the base experience is user-friendly, merchants should evaluate whether they need premium add-ons or integrations. Overall, Merchant One provides a balance between functionality and simplicity, making it suitable for businesses without extensive technical expertise.

Customer Support and Service Quality

Customer support is a critical factor when choosing a payment processor, and Merchant One emphasizes its 24/7 availability. Merchants can access support via phone, email, and live chat, ensuring that technical issues or service interruptions are addressed quickly.

Many customers appreciate the responsiveness of Merchant One’s support team, especially during onboarding. However, reviews are mixed, with some merchants reporting difficulties in resolving billing disputes or contract-related concerns. This suggests that while the company has invested in accessible support channels, the quality of resolutions may vary depending on the issue.

For businesses that rely on uninterrupted payment processing, the assurance of around-the-clock support is a positive. Still, prospective merchants should research user experiences to understand potential challenges in areas like contract cancellations or fee disputes.

Reputation and Market Presence

Merchant One has built a sizable presence, serving over 350,000 businesses nationwide. Its affiliation with Fiserv adds credibility, while its longevity in the market signals stability. On platforms such as the Better Business Bureau (BBB), Merchant One holds accreditation, though ratings reflect a mix of positive and critical feedback.

Satisfied customers often highlight the reliability of payment systems and responsive onboarding support. On the other hand, complaints commonly revolve around contract terms, unexpected fees, or challenges with cancellation. These are not uncommon in the payment industry but are important considerations for merchants making a choice.

Market presence alone indicates that Merchant One is a trusted provider for many businesses. However, prospective clients should balance this reputation with a clear understanding of contractual obligations. Transparency remains a recurring theme when assessing the company’s overall image.

Advantages of Using Merchant One

Merchant One offers several benefits that appeal to a wide range of merchants. Its partnership with Fiserv provides access to secure, scalable infrastructure, while Clover POS systems offer modern hardware and business management tools. The ability to serve both in-store and online merchants makes it versatile.

Another advantage is the speed of account setup, which can be completed in as little as 24 hours. This is attractive for businesses needing to launch quickly. The company also provides 24/7 support, which is reassuring for merchants who cannot afford downtime.

Flexibility in services, such as recurring billing and loyalty programs, further enhances its appeal. For businesses that want more than basic payment acceptance, these add-ons provide opportunities to improve customer engagement. Ultimately, Merchant One’s strengths lie in its adaptability, industry credibility, and ability to provide a comprehensive package of solutions.

Limitations and Criticisms

Like many traditional payment processors, Merchant One has its drawbacks. One of the most common criticisms is the lack of transparent pricing. Customized quotes can make it difficult for businesses to compare rates upfront, and unexpected fees have been reported by some merchants.

Contract terms are another area of concern. Early termination fees and equipment lease agreements can lock businesses into longer commitments than anticipated. This may be challenging for newer businesses that need flexibility.

Customer service, while accessible, has received mixed reviews. Some merchants report excellent experiences, while others note difficulties in resolving disputes. The inconsistency highlights the need for businesses to carefully evaluate support quality.

Overall, Merchant One provides strong services but requires merchants to exercise diligence. Reading contracts thoroughly and asking detailed questions before signing can help mitigate many of the common complaints.

Who Should Consider Merchant One?

Merchant One is best suited for small to medium-sized businesses that need flexible payment options and reliable hardware. Retailers, restaurants, and service providers that value Clover POS systems may find Merchant One an attractive choice. Ecommerce businesses can also benefit from its secure gateways and virtual terminals.

However, businesses that prioritize flat-rate pricing and complete transparency may find newer fintech providers more appealing. Merchant One’s model is more traditional, which works well for merchants processing higher volumes but may feel restrictive for startups or businesses with uncertain cash flow.

In summary, Merchant One is a strong option for businesses seeking a balance between established infrastructure and versatile services. Those willing to navigate its contracts and pricing structures may find it to be a long-term partner in payment processing.

Conclusion and Final Thoughts

Merchant One has established itself as a reputable provider in the competitive payment processing market. Its partnership with Fiserv and use of Clover POS systems ensure that merchants receive reliable, modern tools. The breadth of services, from in-store payments to ecommerce and mobile processing, highlights its versatility.

At the same time, the company’s limitations in transparency and contract flexibility are important considerations. Businesses must weigh the benefits of secure, scalable infrastructure against the potential challenges of fees and long-term agreements.

For many merchants, Merchant One provides a dependable way to accept payments and manage business operations. With careful evaluation of terms, it can serve as a valuable partner in navigating today’s complex payment landscape.

FAQs

Q1. Does Merchant One require a long-term contract?

Yes, Merchant One typically requires a contract that may include early termination fees. While some merchants report flexibility, it is essential to review terms carefully to understand the commitment involved.

Q2. What types of businesses benefit most from Merchant One?

Merchant One is well suited for retailers, restaurants, service providers, and ecommerce businesses. It is particularly useful for small to medium-sized companies that need a mix of in-store and online payment tools.

Q3. How does Merchant One compare with newer fintech providers?

Compared to fintech companies offering flat-rate pricing, Merchant One provides more traditional, customized pricing. This can be cost-effective for higher-volume businesses but may lack transparency for smaller merchants. Its advantage lies in its established infrastructure and partnership with Fiserv.