Ingenico Review

Ingenico has been a key player in the payment technology sector since its founding in France during the 1980s. Initially recognized for its hardware-focused offerings, the company has grown into a significant force in the broader payments ecosystem. With operations spanning more than 170 countries, Ingenico handles millions of transactions daily across industries such as retail, banking, hospitality, and transportation. Lets read more about Ingenico Review.

The brand has long enjoyed the trust of merchants thanks to its extensive use in physical payment systems. Formerly a part of Worldline until 2023, Ingenico is still growing while holding fast to its core competency: dependable card-present solutions. Working as a link between digital systems and physical terminals, Ingenico differs from many contemporary fintech companies that only concentrate on software. This puts the business in a position to serve as a key supplier for companies looking for scalable and safe payment infrastructure.

Though it faces competition from newer digital-first platforms, Ingenico remains a preferred choice for enterprise-scale businesses seeking robust, compliant, and globally accepted payment solutions.

A Broad Product Suite Covering Hardware and Software | Ingenico Review

Ingenico’s product lineup is engineered to meet a variety of merchant needs across different transaction settings. Its hardware range includes terminal families like Lane, Move, Desk, and the Android-based Axium series. These are tailored for everything from stationary retail counters to mobile and unattended environments.

Security and performance are central to Ingenico’s design. Most terminals feature EMV chip compatibility, NFC for contactless payments, and strong encryption. The Axium line, built on Android OS, reflects Ingenico’s shift toward enabling app-based commerce. These terminals support more than just transactions, they offer loyalty integrations, business applications, and analytics features.

Software tools complement the hardware, including estate management systems, configuration platforms, and APIs. These enable merchants to remotely monitor and manage devices at scale, which is particularly valuable for multi-location operations. While this integrated ecosystem provides convenience and consistency, it may limit flexibility for businesses that prefer open systems or more modular approaches. Overall, the product suite is dependable, secure, and well-suited for complex environments.

Security and Compliance as a Core Value

Security has been central to Ingenico’s offerings for decades. All devices comply with PCI PTS standards, ensuring they are tamper-resistant and capable of securely processing transactions. This is critical for merchants operating in sectors where compliance and trust are non-negotiable.

Ingenico supports both end-to-end encryption and point-to-point encryption. These technologies ensure that payment data is protected throughout its journey, from the terminal to the payment processor. P2PE, in particular, reduces PCI DSS compliance scope for merchants by encrypting card data immediately upon entry.

Another crucial feature is tokenisation, which substitutes secure tokens for private card information. In omnichannel settings, where a customer’s card may be used on several platforms, this is extremely helpful. Regular security patches and updates are also applied to Android-based devices. Merchants must, however, make sure that their operational procedures uphold these safeguards. Although Ingenico provides a solid technical basis, merchant diligence is also essential to the larger security ecosystem.

Omnichannel Commerce and Digital Enablement

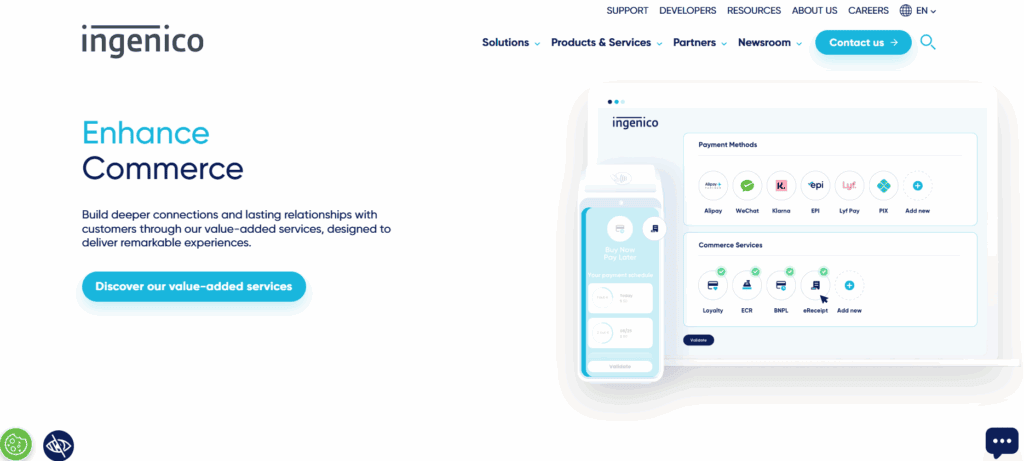

Ingenico has expanded beyond hardware to support unified payment experiences across in-store, mobile, and online channels. Its omnichannel capabilities are built around cloud-based services and APIs that connect various payment touchpoints into a single system. One of the standout tools is Ingenico’s estate management platform, which allows for remote monitoring and updating of terminals. This is especially beneficial for businesses with wide retail footprints, where consistency and uptime are vital.

Ingenico also offers developer kits and APIs that enable integration with loyalty programs, CRMs, and eCommerce platforms. The Axium series furthers this with the ability to run apps directly on the terminal, allowing tasks like inventory lookup or customer engagement alongside payment processing. Although Ingenico’s progress in digital integration is solid, it lags behind some newer platforms in areas like AI and personalization. Still, for businesses seeking operational continuity and unified commerce, Ingenico provides a dependable and structured framework.

Industry-Specific Solutions for High-Volume Use

Ingenico’s value grows significantly when viewed through the lens of industry-specific solutions. Its technology is tailored to meet the needs of different sectors, including retail, hospitality, healthcare, transportation, and financial services. In retail, Ingenico supports high-speed processing and integrates with major POS platforms. For quick-service restaurants or small-format retail, mobile terminals allow for efficient order-taking and payment collection. In the hospitality sector, features like tipping and dynamic currency conversion are integrated for seamless guest transactions.

Rugged devices that are made for high-use or outdoor environments are advantageous for transportation and unattended systems. Secure patient billing and privacy are the main concerns of healthcare deployments. In the financial industry, Ingenico terminals are often found in ATMs, bank branches, and kiosk settings. These customised solutions offer a great deal of functionality, but they also have a platform structure that might not be as flexible for smaller or non-traditional business models. Ingenico is a good fit for the enterprise market, but it might not be as suitable for micro-merchants.

Global Operations and Local Adaptability

Ingenico’s reach is undeniably global. With solutions operating in more than 170 countries, the company is positioned to support multinational corporations and local merchants alike. Its ability to accommodate regional payment methods and certifications gives it an edge in global commerce. Devices support both international card schemes and local payment networks, making them suitable for cross-border commerce and in-country use. Ingenico’s infrastructure is supported by a network of partners including ISVs, banks, and system integrators.

This partner model extends support for installation, maintenance, and compliance. Localized support materials and updates help businesses remain aligned with country-specific regulations. However, the level of service may vary depending on the region and the partner’s capabilities. While the global footprint and adaptability are strong advantages, some inconsistencies in support and deployment can emerge. Businesses operating in regions with limited partner infrastructure may face slower service or integration timelines.

A Measured but Consistent Approach to Innovation

While many newer payment providers focus on rapid feature rollouts, Ingenico adopts a more measured approach to innovation. The company focuses on long-term reliability, compliance, and interoperability rather than frequent experimental updates.

The adoption of Android OS in the Axium product line is a noteworthy evolution. These terminals support business apps and smart features, enabling retailers to do more with their POS systems. App-based features like surveys, inventory management, and CRM integration are now possible directly from the payment device.

In keeping with the trend towards software-defined experiences, Ingenico is also making investments in cloud services and terminal-as-a-service models. However, Ingenico’s innovations put stability ahead of trend adoption, in contrast to agile fintech startups. Because of this, large businesses would benefit more from it than startups seeking rapid iteration.

Usability and Merchant Experience

From a usability perspective, Ingenico has consistently delivered devices that balance function and form. Terminals are ergonomically designed, with clear interfaces and responsive keypads or touchscreens. This improves transaction speed and reduces friction at checkout. The Axium series introduces enhanced displays and app compatibility, offering a more dynamic interaction point for merchants and customers. Pre-loaded configurations simplify setup, and remote management tools ease the process of updates and maintenance.

From the customer’s point of view, Ingenico devices support fast tap-and-go experiences, mobile wallet compatibility, and multilingual interfaces. However, older models still in circulation may not deliver the same responsive feel as newer devices. While usability is generally high, some merchants may encounter limitations in customizing workflows or branding due to proprietary software layers. Overall, it strikes a solid balance between ease of use and durability.

Pricing Structures and Integration Models

The business offers leasing as well as outright purchases. Enterprise clients looking for predictability favour its terminal-as-a-service model, which bundles hardware, updates, and support into one package. Generally, SDKs and APIs are used to integrate with POS systems and other platforms. Despite their strength, these integrations are usually partner-dependent, and smaller merchants may find onboarding more difficult. Partnerships play a major role in Ingenico’s market approach. This enables scale but also adds a layer between the end user and the technology provider, which can complicate support and customization.

Market Relevance and Competitive Outlook

Ingenico continues to hold a strong position in the global payments market. It is trusted by enterprises and financial institutions that prioritize scale, security, and long-term dependability. Its diverse terminal portfolio, global compatibility, and compliance leadership ensure it remains a serious contender in the space.

However, its limited agility, opaque pricing, and conservative innovation approach may not appeal to newer businesses or those seeking rapid customisation. Fintech disruptors with open platforms and flexible APIs might appeal more to this market. However, this has no impact on Ingenico’s reputation as a dependable, enterprise-level solution. It is particularly well-suited for high-volume merchants, regulated industries, and multinational corporations that need a dependable, secure platform.

FAQs

Is Ingenico compatible with third-party payment gateways?

Yes. Ingenico terminals can be integrated with third-party platforms through SDKs and APIs. However, compatibility depends on the specific terminal and integration provider.

Does Ingenico support mobile wallet and contactless payments?

Yes. Most Ingenico terminals include NFC capabilities for accepting Apple Pay, Google Pay, Samsung Pay, and contactless cards.

Can Ingenico terminals be used for self-service or unattended environments?

Yes. Ingenico offers ruggedized terminals designed for kiosks, parking systems, and vending machines, with features suitable for 24/7 operation.