GoCardless Review

GoCardless is a UK-based financial technology firm founded in 2011, focused on facilitating bank-to-bank payments via Direct Debit. Rather than using traditional card rails like Visa or Mastercard, the platform enables merchants to collect payments directly from customers’ bank accounts. This method proves especially effective for businesses with recurring payment models, such as subscriptions, memberships, or invoice-based services. Lets read more about GoCardless Review.

Operating in more than 30 nations and supporting a variety of currencies, GoCardless has established a solid reputation as a simplified, less expensive substitute for traditional payment processors. SaaS providers, accounting platforms, fitness facilities, and nonprofit organisations seeking to streamline and automate their payment collection procedures have all embraced it.

GoCardless’ focus on minimising manual reconciliation and lowering payment failures is one of its most notable benefits. The platform improves conversion rates and increases payment predictability with integrated automation and bank-level verification. It may not appeal to all demographics, though, and is more appropriate for client segments that are accustomed to Direct Debit systems.

Payment Capabilities and Core Features | GoCardless Review

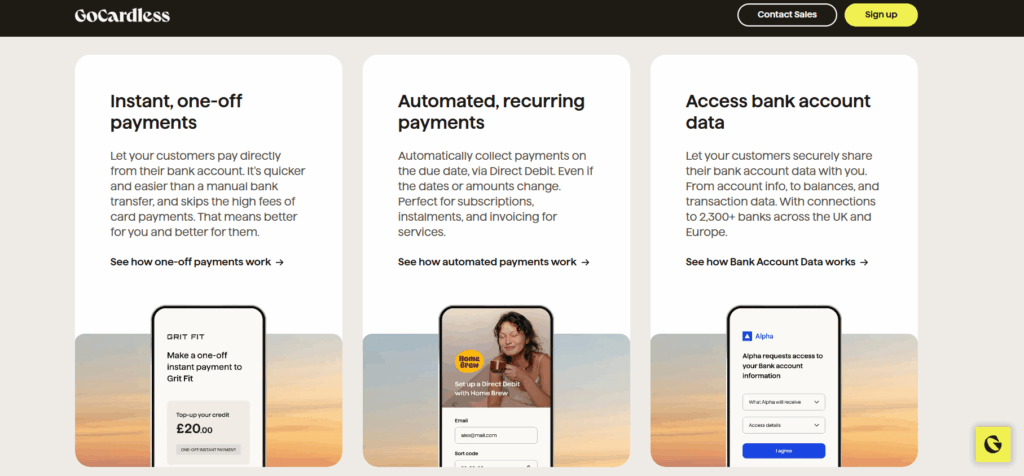

GoCardless’s core functionality revolves around Direct Debit, a mechanism that allows businesses to withdraw funds from customer accounts with pre-approved consent. This is ideal for use cases involving repeated billing, such as monthly services or installment plans. Although GoCardless is primarily geared toward recurring payments, it also offers one-off transaction capabilities. A key innovation is Instant Bank Pay, which utilizes open banking to enable immediate, one-time payments; addressing the common delay associated with traditional Direct Debit.

The platform includes features like automatic retries for failed payments, customizable checkout pages, and real-time notifications. Users can configure billing cycles, view payment statuses, and manage customer data from a unified interface. The system also supports mandate creation and monitoring without manual intervention.

Multi-currency support is robust, with compatibility across GBP, USD, EUR, AUD, and NZD. While the platform is ideal for recurring billing businesses, it may not suit industries that require instant payment authorizations or point-of-sale capabilities.

Integration and Developer Tools

GoCardless offers a powerful and well-documented API, making it attractive to tech-savvy businesses that want to embed payment capabilities directly into their software. Its RESTful API and webhook support allow for real-time synchronization and full automation of payment workflows. Developers benefit from comprehensive documentation, sandbox testing environments, and SDKs in multiple programming languages. This flexibility makes it possible to build highly customized payment infrastructures with minimal friction.

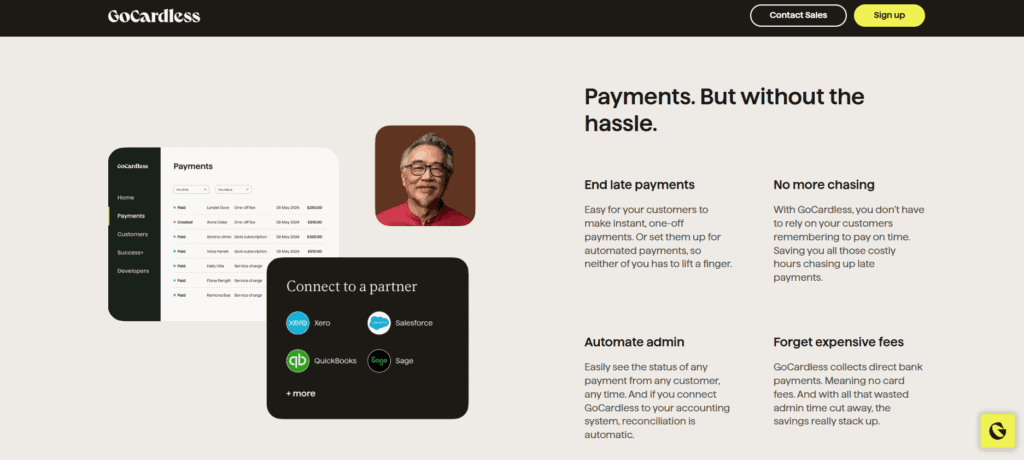

GoCardless easily integrates with well-known platforms like Xero, QuickBooks, Chargebee, Recurly, Salesforce, Zuora, and Magento for users who prefer ready-to-use solutions. The process of integrating Direct Debit functionality into current systems is made easier by these integrations. Furthermore, GoCardless is compatible with automation platforms such as Zapier, allowing non-technical users to link it to hundreds of third-party applications. The long-term benefits in terms of automation and flexibility outweigh the initial technical effort, particularly for growing businesses.

Dashboard and User Experience

The GoCardless web dashboard is intuitive and designed for ease of use across departments. Finance teams, administrators, and support staff can access vital information quickly thanks to a clean, uncluttered interface.

Users can track all payment activity in real time, including pending, completed, and failed transactions. Customer profiles are comprehensive, consolidating payment history, mandate statuses, and communication logs. Setting up new payers is also straightforward, typically requiring only basic information to initiate a mandate.

The dashboard supports reporting tools for analyzing payment performance and generating summaries for accounting purposes. Reports can be downloaded or integrated with external systems via the API. While mobile accessibility is limited compared to desktop functionality, the interface is still suitable for monitoring tasks and approvals on the go.

Overall, the platform strikes a balance between usability and depth, appealing to both novice users and experienced finance professionals.

Pricing Structure and Fee Clarity

The fee structure used by GoCardless is clear and flat. Typically, it charges 1% of the transaction amount for domestic transactions, with a cap of £2 in the UK. The platform is cost-effective for companies managing steady, recurring revenue streams because it has no setup fees, monthly fees, or hidden costs.

Additional fees apply for currency conversions and international transactions. A different pricing structure might apply to features like Instant Bank Pay, especially for one-time transactions.

The standard settlement window is one factor to take into account. Usually, it takes 3 to 5 business days for payments to clear, which is slower than card-based processors but normal for Direct Debit systems. This could be a disadvantage for businesses that rely on having fast access to capital.

Custom pricing plans are available for high-volume users or businesses requiring additional support. These plans may include volume discounts, premium onboarding, and dedicated account management. Overall, GoCardless offers competitive pricing that scales with usage, especially for businesses seeking to reduce card processing costs.

Security and Regulatory Compliance

Security and compliance are core pillars of GoCardless’s operations. The company is regulated by the UK’s Financial Conduct Authority and adheres to applicable financial laws in each of its operational regions. It also holds ISO 27001 certification, signaling its commitment to rigorous information security practices.

The platform employs end-to-end encryption and stores data in secure, GDPR-compliant environments. Payment data is handled responsibly and is not shared without consent. GoCardless also ensures high system uptime and fault tolerance through a redundant infrastructure. As a payment method, Direct Debit is generally less prone to chargebacks, and the platform includes protections for both businesses and customers in case of disputes. Validation protocols reduce the chance of errors or fraudulent attempts.

Still, businesses must account for potential drawbacks such as delayed settlements or fund reversals if a customer disputes a charge. GoCardless provides tools and alerts to help merchants stay ahead of such risks.

International Reach and Currency Options

With coverage across more than 30 countries, GoCardless supports businesses serving global customers. Countries include major markets like the UK, US, Canada, Australia, New Zealand, and much of Europe.

The platform’s FX features enable cross-border payments. Companies can receive money in their home currency and receive payments in a local currency; currency conversion is done automatically. This feature makes things more convenient for both payers and merchants, even though there are foreign exchange fees involved.

Users can centrally handle international transactions with a single dashboard and API. Since GoCardless manages the regional complexities in-house, there is no need to open local bank accounts in every nation. However, depending on the regional Direct Debit scheme (such as SEPA in Europe or ACH in the US), the functionality may vary slightly between regions. Refund policies, mandate procedures, and processing times can change.

Despite these nuances, GoCardless offers a compelling international solution for businesses with recurring revenue models.

Onboarding and Customer Support

Getting started with GoCardless is a streamlined process. Businesses can sign up online and access a range of resources including setup tutorials, video guides, and documentation. Most users can begin collecting payments within a few days. Customer support is available via chat, email, and help center articles. Phone support is generally limited to users on enterprise or premium plans. The help center is detailed and covers a wide array of topics, including API troubleshooting and integration with third-party platforms.

While support quality is generally praised, some users on lower-tier plans report slower response times during peak periods. Also, support is not 24/7, which may present challenges for companies operating across global time zones. For enterprise clients, GoCardless offers dedicated account managers and personalized onboarding assistance, particularly beneficial during complex integrations or large-scale transitions.

Business Fit and Ideal Use Cases

GoCardless is designed for businesses that prioritize recurring payments or invoice-based billing. It is especially effective in sectors like SaaS, fitness, insurance, accounting, and education; where collections are routine and predictable. It’s an optimal choice for companies looking to lower processing fees and streamline back-office operations. B2B businesses with clients who prefer bank transfers over card payments also stand to benefit.

GoCardless is less suitable, though, for situations requiring real-time authorisations, like retail or e-commerce. Additionally, it does not directly accept card payments, which might be a drawback for companies that require a variety of payment methods. Businesses in high-risk industries or those that deal with a lot of chargebacks might also want to look into other processors. Additionally, card or wire options might be more suitable for companies that handle one-time, high-value payments.

Pros and Cons

Advantages : GoCardless delivers a clean, low-cost solution for recurring payments. Key strengths include:

Low fees for domestic payments

Strong automation and retry logic

Developer-friendly API

Wide integration ecosystem

Multi-currency and international support

Drawbacks: However, it does come with a few trade-offs:

Slower settlement times

No native card support

Limited utility for one-time or real-time transactions

No 24/7 support for basic users

The platform succeeds best when deployed in the right context, providing simplicity and efficiency for recurring billing needs.

FAQs

Can GoCardless handle one-time payments?

Yes, GoCardless supports one-time payments via Instant Bank Pay. However, the platform is primarily optimized for recurring billing.

Is GoCardless better than Stripe or PayPal for small businesses?

For recurring bank payments, GoCardless can be more cost-effective than Stripe or PayPal. However, it lacks card processing and may not suit businesses requiring a broader payment method mix.

Does GoCardless offer fast payouts?

No, standard settlement takes 3–5 working days, depending on the country and payment scheme. This is a common characteristic of Direct Debit systems.