First Hawaiian Bank Review

Having been established in 1858, First Hawaiian Bank (FHB) is the oldest and most reputable financial institution in Hawaii. With branches in Guam and the Northern Mariana Islands, FHB, which has its headquarters in Honolulu, has gradually expanded its presence throughout the Pacific. Its enduring presence is a testament to its dependability and strong ties to the communities it serves. Lets read more about First Hawaiian Bank Review.

FHB has developed into a full-service banking provider over the years. Services for individuals, families, small businesses, and corporate clients are all included in its portfolio. Despite being a regional bank, FHB has continued to invest in digital infrastructure to meet the demands of modern banking.

Customer relationships are a core strength. The bank regularly receives high satisfaction ratings in its operating regions, which speaks to its ability to blend traditional service values with contemporary banking. While its market reach is smaller compared to national institutions, FHB’s reputation for personal attention and stability remains a cornerstone of its appeal.

Personal Banking Products and Services | First Hawaiian Bank Review

FHB provides a well-rounded range of personal banking products suitable for varying customer needs and life stages. These include checking and savings accounts, money market options, and certificates of deposit. Checking accounts are tiered to serve different customer segments. Students, seniors, and basic users can access low-fee or no-fee options, while interest-bearing accounts are available for those maintaining higher balances. Most checking options include mobile and online banking, debit cards, and ATM access. However, some accounts carry monthly maintenance fees unless balance or activity criteria are met.

Savings products follow a standard tiered interest model. CDs are available with fixed returns over set periods but offer more modest rates compared to online-only competitors. Money market accounts provide better yields for higher balances but come with limited withdrawal flexibility. While the bank’s local ATM and branch access is strong within Hawaii and nearby territories, customers outside these regions may find accessibility limited. For Hawaii-based individuals who value community engagement and local service, FHB remains a practical and trustworthy banking choice.

Business Banking Solutions

FHB offers a diverse suite of business banking services tailored to Hawaii’s unique economic environment. Its offerings serve small businesses, mid-sized enterprises, and larger commercial operations.

Business checking and savings accounts are available in multiple formats to suit varying transaction volumes and cash management needs. These accounts come with digital banking tools like mobile check deposits, account alerts, and online bill payments. Fee structures are competitive, with waivers offered based on maintaining specific balance thresholds.

The bank offers term loans, equipment loans, business credit lines, and financing for commercial real estate. One clear benefit is that these products are run by teams that understand the island economy, which helps businesses deal with issues unique to the area.

Retail and service-based businesses can access merchant services like card processing and point-of-sale systems. FHB offers dependable payroll and treasury services, despite the fact that some digital tools might not be as advanced as fintech rivals. The bank’s relationship banking model is where it really shines. Working with experts who have firsthand knowledge of the local economy is often advantageous to local business owners. In an area where national providers might be lacking in context or adaptability, this individualised approach offers value.

Mortgage and Loan Offerings

FHB provides a comprehensive set of lending options, including home loans, personal loans, auto loans, and personal lines of credit. These products are structured to reflect Hawaii’s unique real estate dynamics and consumer needs. Mortgage offerings include fixed and adjustable-rate options, along with government-backed FHA and VA loans. Refinance and home equity lines of credit are also available. Rates are competitive locally, though they may not always align with those from online lenders operating at scale.

The mortgage application process is supported by both online tools and in-person guidance, which benefits first-time homebuyers or customers seeking clarity. Prequalification can be done digitally, but the bank continues to prioritize face-to-face service. Auto loans are available for both new and used vehicles, with flexible repayment terms and reasonable interest rates. While competitive in the local market, customers may want to compare national offers for the best possible deal.

Personal loans and lines of credit are designed for flexible use cases like debt consolidation or emergency expenses. These generally come with fixed or variable rates and do not always require collateral. Overall, FHB’s lending suite is practical, community-focused, and suited to those who prioritize service and support over chasing the absolute lowest rate.

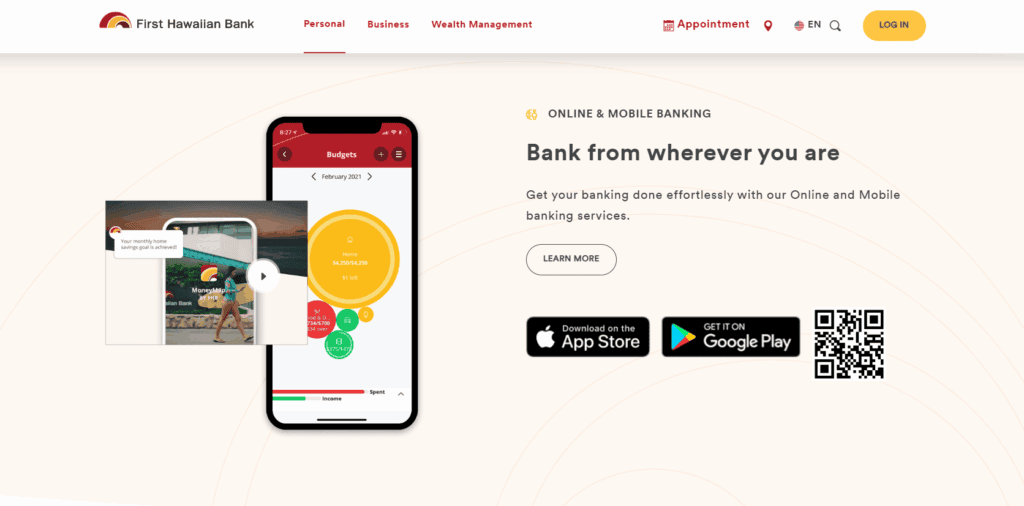

Digital Banking and Mobile App Experience

Significant progress has been made by First Hawaiian Bank in developing its digital capabilities. Although it doesn’t have as many features as major national banks and fintech startups, its mobile app and online banking platform do a good job of covering the essentials. Users of the FHB mobile app can pay bills, view balances, deposit checks, send peer-to-peer payments through Zelle, and transfer money. Additionally, customers can review statements and set up account alerts. Despite the interface’s ease of use, some users have complained about sluggish performance or trouble logging in during updates.

In addition to adding basic tools for managing accounts and tracking expenses, the online banking platform reflects the majority of app functionalities. The system lacks advanced budgeting tools and AI-driven financial insights, despite using encryption and contemporary security protocols. The app supports biometric login and two-factor authentication, contributing to overall account safety. Reviews on app stores are generally positive but indicate occasional reliability concerns.

For everyday banking needs, FHB’s digital tools are sufficient. However, users looking for robust financial management capabilities or tech innovation may find the experience a bit underwhelming.

Investment and Wealth Management Services

Through its subsidiary First Hawaiian Advisors, the bank offers investment and wealth management services tailored to individuals with varying financial goals. This includes options like mutual funds, IRAs, stocks, bonds, and annuities. Advisors at FHB provide personalized financial strategies, including retirement planning, estate services, and trust management. High-net-worth clients can access more comprehensive planning services, including multi- generational wealth transfer.

One of the firm’s key differentiators is its relationship-oriented model. Advisors tend to maintain long-term connections with clients and offer localized expertise in tax strategies and investment planning. This approach suits clients who value personalized attention over digital automation. However, the range of investment options is narrower compared to large national brokerage firms. Fees may also be higher for smaller accounts, and the platform lacks the cost-efficiency of self-managed online tools.

Still, for customers who prefer face-to-face interactions and customized advice rooted in local economic understanding, First Hawaiian Advisors offers a dependable and professional service experience.

Customer Service and Support

First Hawaiian Bank excels at providing excellent customer service, particularly in Hawaii. The bank’s branch-level service and community involvement reflect its strong emphasis on interpersonal relationships. Staff members who take the time to explain banking products, help with complicated problems, and establish a rapport with loyal customers are generally praised for their in-branch service. Customers who are older or less accustomed to using digital tools will particularly benefit from this.

For basic questions, live chat is available, and phone support is available during extended business hours. Even though representatives are usually polite and helpful, more complicated problems might need to be escalated or followed up on. The bank also provides secure messaging through its online platform and a helpful FAQ section. While functional, these digital support tools lack the immediacy of 24/7 assistance offered by some national players.

One standout feature is FHB’s multilingual support and accessible services for customers with disabilities, including large-print materials and accessible branches. Overall, FHB delivers solid customer support rooted in local understanding and cultural sensitivity, even if it doesn’t offer the speed or scale of larger competitors.

Fees, Charges, and Transparency

Like many regional banks, First Hawaiian Bank charges fees on certain account types and services, though there are ways to minimize them through balance thresholds or account activity. Personal checking and savings accounts may incur monthly maintenance fees ranging from $3 to $15. These fees can typically be waived by maintaining a minimum balance or setting up direct deposits. While this is standard among traditional banks, it may feel outdated compared to the no-fee structures of many digital banks.

Other common charges include out-of-network ATM fees, overdraft fees, and wire transfer charges. The bank provides overdraft protection, but it requires customer enrollment and understanding of the terms. FHB publishes its fee schedules online, and the disclosures are clear, though not always easy to find. Transparency could be improved by making pricing information more accessible upfront.

Business accounts also come with activity-based fees that can vary depending on transaction volume. In some cases, customers have noted the need to actively request fee waivers. In summary, FHB’s fees are on par with regional bank standards. Customers should review terms carefully to avoid unexpected charges, especially when comparing options with online or national banks.

Security, Fraud Protection, and Compliance

In its banking operations, FHB places a strong emphasis on compliance and safety. Depositors are protected up to $250,000 per eligible account category by this FDIC-insured institution. For digital security, the bank uses a variety of industry-standard techniques. These consist of session timeouts, fraud monitoring systems, encrypted sessions, and two-factor authentication. Mobile devices can support biometric logins, and users can use the app to immediately freeze their cards.

FHB has a spotless compliance history and hasn’t had any significant regulatory problems recently. Its cautious approach helps to build a reputation for reliability and caution. Its website also offers educational materials on cybersecurity, identity theft, and phishing. Clients who are unfamiliar with online banking or who require reassurance regarding digital threats may find this advice especially helpful.

While not known for leading-edge security innovations, FHB offers a robust, traditional model that prioritizes safety and compliance, particularly suited to customers seeking stability over experimentation.

Pros, Cons, and Final Verdict

First Hawaiian Bank delivers a strong regional banking experience, characterized by deep community engagement, solid financial products, and reliable customer service. Its key strengths include:

A wide range of personal and business services

Strong in-person support

Deep understanding of the local economy

Personalized wealth management and advisory

However, the bank also faces a few challenges:

Limited geographic footprint

Modest digital capabilities

Standard fees that may be higher than online-only banks

FHB is an excellent choice for residents of Hawaii, Guam, or CNMI who prioritize trust, community connection, and personalized service. It may be less ideal for digital-first users or those seeking the lowest-cost options nationwide. For what it is; a regionally focused institution with a long-standing presence; FHB stands out as a dependable and community-oriented bank.

FAQs

Q1: Does First Hawaiian Bank offer nationwide banking services?

No, FHB operates branches in Hawaii, Guam, and the Northern Mariana Islands. However, digital banking access is available nationwide.

Q2: Is First Hawaiian Bank FDIC insured?

Yes, FHB is FDIC insured. Eligible deposits are protected up to $250,000 per depositor, per account type.

Q3: How does FHB compare to larger national banks?

FHB provides stronger regional service and customer relationships but may not match national banks in technology or geographic coverage.