CyberSource Review

CyberSource is a globally recognized payment management platform offering a wide range of services tailored to businesses of all sizes. Founded in 1994 and acquired by Visa Inc. in 2010, it now operates as a Visa solution, benefitting from the brand’s robust financial infrastructure and global trust. The platform enables secure payment acceptance across online, mobile, and in-store channels, making it a go-to solution for businesses navigating today’s omnichannel commerce environment. With a presence in over 190 countries and territories, CyberSource has expanded significantly over the years.

It supports business growth while managing complex areas like compliance, fraud prevention, and payment security. Unlike many competitors that focus primarily on startups and small businesses, CyberSource caters mainly to mid-sized and enterprise-level organizations. Its customer base spans diverse sectors such as retail, travel, hospitality, education, and financial services. Lets read more about CyberSource Review.

Its adaptable and modular architecture is a major differentiator, enabling companies to choose particular services like tokenization, risk management, and payment gateway. Scalable, customized integrations are supported by this design. CyberSource also helps businesses with international eCommerce by managing tax laws, multi-currency needs, and cross-border payments. Even though CyberSource is a part of Visa’s ecosystem, it still has enough operational autonomy to react swiftly to changing trends in digital commerce. It is a good choice for companies looking to expand internationally because of its scale, security, and adaptability.

Core Services and Capabilities | CyberSource Review

CyberSource provides a full range of payment services covering authorization, capture, settlement, and reconciliation, covering every stage of the transaction lifecycle. It accepts payments using digital wallets, credit and debit cards, and other services like Klarna and PayPal. Its ability to prevent fraud, which uses machine learning and predictive analytics to identify and stop suspicious transactions, is one of its main advantages.

This is particularly helpful for businesses that are big or risky. By substituting secure tokens for sensitive card data, tokenization services further improve security by lowering the risk of data breaches and streamlining compliance. Additionally, CyberSource facilitates multichannel payments and provides centralized reporting and processing for online, mobile, and in-store channels. This guarantees uniformity in customer experience and data management across all touchpoints.

Additionally, payment orchestration allows businesses to route transactions through preferred or most cost-effective acquiring banks. These advanced features are particularly beneficial for large organizations but can also be modularly adopted by growing businesses. Overall, CyberSource positions itself as a robust payment infrastructure provider, rather than a basic processor.

Global Reach and Multi-Currency Support

CyberSource is built for global commerce. The platform supports payments in over 190 countries and more than 50 currencies, enabling businesses to operate internationally with ease. It also supports popular localized payment methods such as iDEAL (Netherlands), SEPA (Europe), and Alipay (China), which can significantly improve conversion rates by accommodating regional preferences. Its infrastructure supports both local and global acquiring, allowing businesses to work with regional banks to enhance approval rates, reduce costs, and maintain compliance. The intelligent transaction routing feature automatically directs payments through optimal acquiring channels based on region or cost structure.

CyberSource also enables dynamic currency conversion, allowing international customers to pay in their local currencies while merchants receive settlements in their own. This enhances transparency at checkout and builds trust with global buyers. The platform further streamlines international operations by integrating fraud prevention tools and ensuring compliance with global standards like PSD2. While it simplifies many aspects of cross-border commerce, businesses must still stay informed about local regulatory nuances to ensure full compliance.

Payment Gateway and API Integration

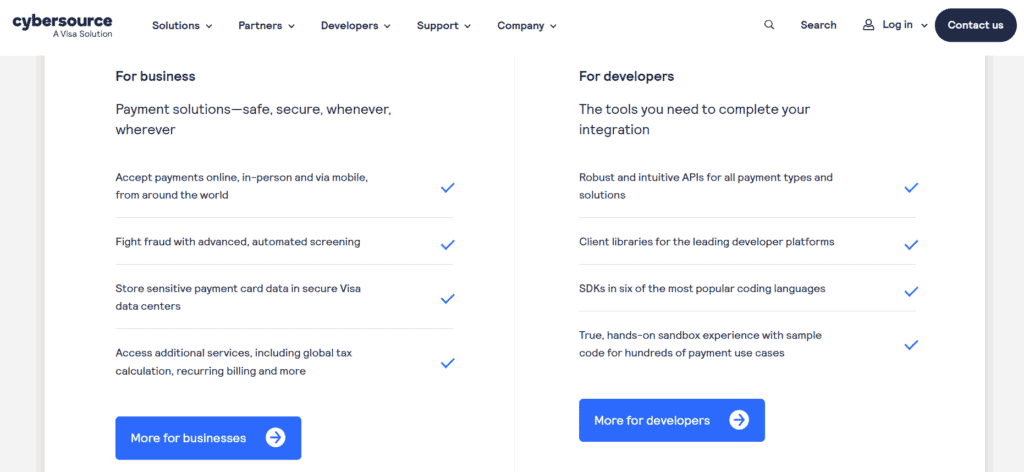

With extensive API support, CyberSource offers a reliable, developer-friendly payment gateway that integrates easily into enterprise systems, mobile apps, and websites. Its RESTful APIs include comprehensive documentation, multilingual SDKs (Java, PHP, and Python), and testing sandbox environments. This allows companies to create unique payment experiences without sacrificing security.

For merchants looking for a faster deployment, the platform also offers pre-built integrations with eCommerce platforms such as Magento, Shopify, WooCommerce, and BigCommerce. Digital wallets like Apple Pay and Google Pay, split payments, and subscription billing are just a few of the payment methods it supports.

Integration options range from hosted checkout pages for easier PCI compliance to full API implementations for complete UI control. While its flexibility is a significant advantage, businesses with limited technical capabilities may find the platform’s complexity a barrier, especially compared to simpler options like Stripe or Square. However, for organizations with advanced requirements or international operations, CyberSource offers an integration framework that is both robust and scalable.

Security and Compliance Standards

CyberSource’s security framework is a standout feature, underpinned by Visa’s global systems. It is fully PCI-DSS compliant, ensuring secure handling of cardholder data. Its tokenization technology replaces sensitive card details with secure tokens, reducing risks associated with data breaches; especially useful for businesses handling recurring payments. The platform also supports 3-D Secure (including 3DS2), which strengthens online transaction security and helps businesses comply with European SCA requirements. Additional fraud prevention tools include address verification, device fingerprinting, and transaction risk analysis, all of which can be tailored to the business’s specific needs and risk thresholds.

From a compliance perspective, CyberSource helps businesses navigate evolving data regulations such as GDPR, CCPA, and other anti-fraud laws. However, merchants remain ultimately responsible for their internal compliance processes. For businesses focused on security and regulatory alignment, CyberSource offers a trustworthy and scalable solution.

Fraud Management with Decision Manager

One of the most advanced fraud prevention solutions available is CyberSource’s Decision Manager. It evaluates and reduces fraud in real time by utilizing AI, machine learning, and insights from more than 68 billion transactions yearly. To determine a risk score, the system considers more than 300 data points per transaction, such as device information, IP address, and purchasing patterns. To better handle borderline transactions, merchants can modify fraud rules, model possible effects, and even control manual review queues. Reviewing chargebacks and disputes is made easier by the case management feature. Decision Manager maintains transaction integrity while lowering false positives by utilizing Visa’s fraud intelligence network.

Though powerful, the system may be more than what a small business needs. However, for medium and large enterprises, especially those dealing with high fraud risk, it offers a robust layer of protection that goes beyond standard gateway filters.

Reporting, Analytics, and Dashboard Usability

CyberSource offers a feature-rich dashboard tailored for enterprise users. It includes performance metrics, transaction histories, and real-time alerts. Merchants can generate detailed reports, monitor fraud trends, and export data in formats like CSV and XML. Reports cover everything from settlement batches and chargebacks to region-wise performance and payment method preferences. While the interface prioritizes functionality over visual appeal, it provides high visibility into operations across all channels and regions. Alerts for failed transactions, chargebacks, or high-risk behavior help businesses stay responsive and informed.

That said, new users; especially from smaller teams; may face a learning curve due to the platform’s complexity. For data-driven organizations, however, CyberSource offers a powerful analytics suite that supports smarter decision-making and strategic optimization.

Pricing Structure and Fee Transparency

CyberSource does not publish a standard pricing plan, as fees are customized based on transaction volume, risk, and geographic scope. Common costs include setup charges, monthly gateway fees, and per-transaction charges, with additional fees for services like fraud management or tokenization. This lack of transparency can make it difficult for smaller businesses to estimate total costs. While enterprise users benefit from tailored pricing models that offer long-term value, startups may find flat-rate alternatives more appealing.

Before onboarding, businesses should request a detailed quote that includes all applicable charges; such as cross-border fees, chargeback costs, and monthly minimums. Overall, while not the cheapest option, CyberSource can be cost-effective for high-volume merchants who require advanced capabilities.

Customer Support and Onboarding Experience

CyberSource provides assistance via phone, email, live chat (in some areas), and a comprehensive Developer Center. Technical liaisons and dedicated account managers are often provided to enterprise clients. Depending on complexity, full API integrations can take anywhere from one to three weeks, whereas plugin-based setups are quick. While the Help Center handles more general user support, the Developer Center offers extensive resources such as SDKs, code samples, and integration guides. Some documentation, though, might be too much for non-technical users to handle. Depending on the time zone and location, some users also complain about slower response times.

That said, for businesses with internal tech teams, CyberSource provides a reliable onboarding and support structure. Smaller merchants may require external development support to fully implement the system.

Pros and Cons of Using CyberSource

Pros:

Backed by Visa’s enterprise-grade infrastructure

Excellent international support and multi-currency features

Advanced fraud prevention through Decision Manager

Flexible API and plugin integration options

Modular services for complex, scalable setups

Cons:

No transparent pricing for new users

Complexity may deter small businesses

Requires technical expertise for full integration

Dashboard can be overwhelming for beginners

CyberSource is not a platform that works for everyone. Despite its immense power, it works best for companies with complex requirements or plans for international growth. CyberSource continues to be a leading option for individuals in need of a flexible, safe, and expandable payment system.

FAQs

Q1. Is CyberSource suitable for small businesses or startups?

Not ideally. The platform’s complexity and cost structure are better suited for mid-sized and enterprise businesses.

Q2. How long does integration take?

Plugin integrations can be completed in a day or two. Full API integration may take 1–3 weeks, depending on system complexity.

Q3. How does CyberSource compare with Stripe or Authorize.Net?

CyberSource offers superior global support and advanced fraud tools. While Stripe is better for ease of use, CyberSource suits businesses with higher risk exposure or international operations.