By 10topmerchantservices June 11, 2025

By 10topmerchantservices March 21, 2025

By tentopmerchantservices January 9, 2025

With the rapid growth of online commerce and digital payment solutions, ensuring transaction security has become a top priority for businesses. Cybercriminals constantly seek opportunities to exploit vulnerabilities, putting businesses and customers at risk of fraud. This article explores essential best practices that can help safeguard financial transactions, ensuring trust and long-term success.

Understanding the Importance of Transaction Security

Transaction security refers to the measures implemented to protect sensitive information during financial exchanges. In today’s digital world, where electronic payments dominate, businesses handle large volumes of sensitive customer data, such as credit card numbers, personal identification, and bank account details.

Fraudulent transactions can lead to severe financial losses for businesses and customers alike. Beyond financial damage, security breaches can result in a loss of reputation and customer trust. Therefore, maintaining a secure transaction environment is not only a legal obligation but also a competitive advantage.

Cyberattacks, such as phishing, malware, and man-in-the-middle attacks, are prevalent in financial transactions. These threats highlight the need for businesses to stay updated with the latest security technologies and practices. By prioritizing transaction security, companies can build long-term relationships with their customers, enhance brand loyalty, and prevent costly legal issues.

Implementing Multi-Factor Authentication (MFA)

Multi-Factor Authentication (MFA) is one of the most effective ways to prevent unauthorized access to sensitive information. MFA requires users to verify their identity through multiple factors before completing a transaction. Typically, these factors include something the user knows (password), something the user has (a mobile device or security token), and something the user is (biometric verification).

By requiring multiple forms of verification, MFA significantly reduces the risk of fraud, even if one authentication method is compromised. For instance, if a hacker gains access to a user’s password, they would still need the second factor—such as a one-time password (OTP) sent to the user’s phone—to complete the transaction.

Businesses should adopt MFA not only for customer transactions but also for internal systems accessed by employees. Many data breaches occur due to compromised employee credentials. Implementing MFA across all access points helps mitigate this risk.

Additionally, businesses should educate customers about the importance of enabling MFA for their accounts. Providing simple instructions and support for setting up MFA can enhance its adoption and effectiveness.

Securing Payment Gateways and APIs

Payment gateways and APIs (Application Programming Interfaces) are critical components in online transactions. A payment gateway processes payments by transmitting sensitive information between the customer, the merchant, and the bank. APIs enable various software applications to communicate, facilitating seamless transactions.

Since payment gateways and APIs handle sensitive data, they are prime targets for cyberattacks. To secure these components, businesses should:

1.Use encryption: Encrypt sensitive data using strong encryption protocols, such as TLS (Transport Layer Security). This ensures that even if data is intercepted, it cannot be read by unauthorized parties.

2.Implement tokenization: Tokenization replaces sensitive data with unique tokens that cannot be reverse-engineered. This reduces the risk of data theft.

3.Conduct regular audits: Regular security audits and vulnerability assessments can help identify and fix potential weaknesses in payment gateways and APIs.

4.Adopt secure coding practices: Developers should follow secure coding guidelines to prevent common vulnerabilities, such as SQL injection and cross-site scripting (XSS).

Monitoring and Analyzing Transactions in Real-Time

Real-time transaction monitoring is a proactive approach to detect and prevent fraudulent activities. By analyzing transactions as they occur, businesses can identify unusual patterns and take immediate action.

Fraud detection systems use machine learning algorithms and behavioral analytics to spot anomalies. For example, if a customer suddenly makes a high-value purchase from an unusual location, the system can flag the transaction for further review.

Key steps to implement real-time monitoring include:

- Setting up rules and thresholds: Establish rules for normal transaction behavior and set thresholds for flagging suspicious activities.

- Utilizing machine learning models: Machine learning models can learn from past data to improve detection accuracy over time.

- Integrating with incident response systems: Ensure that flagged transactions trigger alerts and initiate an appropriate response, such as temporarily blocking the transaction or requesting additional verification.

Real-time monitoring helps businesses stay ahead of fraudsters and minimizes potential losses.

Encrypting Data During Storage and Transmission

Encryption is a fundamental practice for securing sensitive data. It ensures that even if data is intercepted or accessed by unauthorized parties, it remains unreadable without the decryption key.

There are two main types of encryption relevant to transaction security:

1.Data-in-transit encryption: Protects data while it is being transmitted over networks. Using protocols like HTTPS and TLS ensures that data remains encrypted during transmission.

2.Data-at-rest encryption: Secures data stored in databases and servers. Even if an attacker gains access to the storage system, encrypted data cannot be easily extracted.

Businesses should implement encryption at all levels of their infrastructure. Additionally, key management is crucial for ensuring encryption effectiveness. Companies should store encryption keys securely and regularly rotate them to reduce the risk of key compromise.

Ensuring PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect cardholder information. Compliance with PCI DSS is mandatory for businesses that accept credit card payments.

Key PCI DSS requirements include:

- Building a secure network: Use firewalls and routers to protect cardholder data.

- Protecting stored cardholder data: Encrypt sensitive information and avoid storing unnecessary data.

- Maintaining a vulnerability management program: Regularly update software and conduct vulnerability scans.

- Implementing strong access control measures: Limit access to cardholder data based on the need-to-know principle.

Achieving PCI DSS compliance requires ongoing effort and collaboration across different departments. Businesses should work with certified auditors to ensure compliance and address any identified gaps.

Training Employees on Security Awareness

Employees play a critical role in maintaining transaction security. Many cyberattacks target employees through social engineering tactics, such as phishing emails and fake calls. Therefore, businesses must invest in regular security awareness training.

Effective training programs should cover:

- Recognizing phishing attempts: Teach employees how to identify and report suspicious emails and messages.

- Handling sensitive information: Educate staff on proper handling and disposal of sensitive data.

- Using secure authentication methods: Encourage employees to use strong passwords and enable MFA.

- Responding to security incidents: Provide clear guidelines on how to respond to potential security breaches.

By fostering a culture of security awareness, businesses can reduce the risk of human error leading to fraud or data breaches.

Establishing Incident Response Plans

Despite the best preventive measures, no system is entirely immune to cyberattacks. Therefore, businesses must have an incident response plan (IRP) in place to handle security breaches effectively.

An effective IRP should include:

1.Preparation: Establish a dedicated incident response team and define roles and responsibilities.

2..Detection and analysis: Use monitoring tools to detect potential incidents and assess their impact.

3.Containment and eradication: Take immediate steps to contain the breach, prevent further damage, and eliminate the threat.

4.Recovery: Restore affected systems and data, and ensure normal operations resume.

5.Lessons learned: Conduct a post-incident review to identify areas for improvement and prevent future incidents.

Regularly testing the IRP through simulations and drills ensures that the team is prepared to respond effectively in a real crisis.

Conclusion

Ensuring transaction security is a continuous process that requires a combination of technology, policies, and human vigilance. By implementing best practices such as multi-factor authentication, real-time monitoring, encryption, and employee training, businesses can protect themselves and their customers from fraud.

In an increasingly digital world, prioritizing transaction security not only mitigates risks but also fosters trust and loyalty among customers. Businesses that proactively address security concerns will be better positioned to thrive in the competitive marketplace.

By tentopmerchantservices January 9, 2025

The payment processing landscape has undergone a significant transformation over the past few decades. From simple cash transactions to complex digital systems, technological advancements have revolutionized how businesses and consumers exchange money. The digital era has brought about an unprecedented level of convenience, speed, and security in financial transactions. This article explores the evolution of payment processing, key trends shaping the industry, and emerging technologies poised to redefine the future of payments.

The Early Days: From Bartering to Coin-Based Transactions

In ancient times, trade began with the barter system, where goods and services were exchanged directly. This system, though effective in primitive societies, had inherent inefficiencies. The lack of a standardized medium of exchange made it difficult to determine the value of goods and services. Consequently, the invention of coinage around 600 BCE in Lydia marked a turning point in commerce.

Coins offered a standardized and universally accepted medium of exchange, simplifying transactions and enabling long-distance trade. Metal-based currency, including gold and silver, became the foundation of economic systems for centuries. Despite its advantages, coin-based transactions posed challenges such as weight and security, which eventually led to the development of paper money and banking systems.

The Advent of Paper Money and Banking Systems

The introduction of paper money in China during the Tang Dynasty around the 7th century AD marked another milestone in payment processing. Paper currency reduced the burden of carrying heavy coins and facilitated larger transactions. By the 17th century, European nations adopted paper money, which helped expand trade and commerce.

Simultaneously, banking systems evolved to manage and facilitate financial transactions. Banks introduced checks, which allowed individuals to authorize payments without the need for physical currency. This system, although slower than today’s methods, added a new layer of security and convenience to transactions. Over time, checks became widely accepted, laying the groundwork for modern financial instruments.

The Emergence of Electronic Payment Systems

The mid-20th century witnessed a major shift with the emergence of electronic payment systems. In 1950, Diners Club introduced the first credit card, followed by American Express in 1958. These cards allowed users to make purchases without cash, with the issuing companies settling payments on behalf of customers.

The invention of Automated Teller Machines (ATMs) in the 1960s further revolutionized banking. ATMs provided 24/7 access to cash, enabling greater convenience for consumers. By the late 20th century, debit cards had become mainstream, allowing users to make payments directly from their bank accounts.

Electronic payment systems laid the foundation for digital payment methods, as they introduced the concept of cashless transactions. The combination of credit cards, debit cards, and ATMs marked the beginning of a cashless society.

The Rise of Online Payments and E-Commerce

The advent of the internet in the 1990s gave birth to online payments. Companies like PayPal, founded in 1998, played a pivotal role in facilitating digital transactions for e-commerce platforms. Consumers could now make purchases online without disclosing sensitive banking information.

Online payment gateways emerged to bridge the gap between buyers and sellers, ensuring secure transactions. These gateways encrypted sensitive data, reducing the risk of fraud. The rise of e-commerce giants such as Amazon and eBay further accelerated the adoption of online payments.

As digital infrastructure improved, online banking services also gained popularity. Customers could transfer funds, pay bills, and manage accounts from the comfort of their homes. The convenience offered by online payments and banking services became a key driver of digital transformation in the financial sector.

Mobile Payments: A New Era of Convenience

The introduction of smartphones ushered in a new era of payment processing. Mobile payments gained traction with the launch of services like Apple Pay, Google Wallet, and Samsung Pay. These platforms allowed users to store card information on their devices and make payments through Near Field Communication (NFC) technology.

In addition to NFC-based payments, QR code payments became popular in many parts of the world. Mobile payment apps such as Alipay, WeChat Pay, and Paytm revolutionized transactions in Asia, particularly in China and India. These apps enabled peer-to-peer (P2P) transfers, bill payments, and online shopping, all within a single platform.

Mobile payments offered unmatched convenience, as users no longer needed to carry physical wallets. The integration of biometric authentication, such as fingerprint and facial recognition, enhanced security, making mobile payments a preferred choice for many consumers.

Cryptocurrencies and Blockchain Technology

The introduction of Bitcoin in 2009 marked the beginning of a new chapter in payment processing. Based on blockchain technology, cryptocurrencies offered a decentralized and transparent way to transfer value. Unlike traditional payment systems, which rely on intermediaries like banks, blockchain-based transactions occur directly between parties.

As more cryptocurrencies entered the market, businesses began accepting them as a form of payment. Platforms like Coinbase and BitPay facilitated crypto payments, bridging the gap between traditional finance and digital currencies.

Blockchain technology also introduced the concept of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts have the potential to automate various aspects of payment processing, reducing costs and increasing efficiency.

Despite its potential, cryptocurrency adoption faces challenges such as regulatory uncertainty and price volatility. Nevertheless, the growing interest in digital currencies indicates that they will play a significant role in the future of payments.

The Growth of Contactless Payments

Contactless payment technology has become increasingly popular in recent years. This method allows users to make payments by simply tapping their card or smartphone on a compatible terminal. The COVID-19 pandemic further accelerated the adoption of contactless payments, as consumers sought safer and more hygienic payment methods.

Contactless cards, equipped with Radio Frequency Identification (RFID) technology, enable quick and secure transactions. In addition, digital wallets like Apple Pay and Google Pay support contactless payments, offering an added layer of security through tokenization.

Tokenization replaces sensitive card information with a unique identifier or token, which reduces the risk of data breaches. This technology, combined with encryption, ensures that contactless payments remain secure.

Emerging Trends in Payment Processing

Several emerging trends are shaping the future of payment processing. One notable trend is the adoption of Artificial Intelligence (AI) and Machine Learning (ML) in fraud detection. Payment processors are leveraging AI to analyze transaction patterns and identify fraudulent activities in real time.

Another trend is the use of biometric authentication in payment systems. Fingerprint, facial recognition, and even voice authentication are becoming common methods to enhance security. These technologies provide a seamless user experience while ensuring that transactions remain secure.

The rise of digital-only banks, also known as neobanks, is another trend transforming the payment landscape. These banks operate entirely online, offering a range of financial services through mobile apps. Neobanks provide users with innovative payment solutions, such as instant transfers and low-cost international payments.

Conclusion: The Future of Payment Processing

The evolution of payment processing reflects the ongoing quest for convenience, speed, and security. From bartering to blockchain, each innovation has brought humanity closer to a cashless society. As emerging technologies continue to reshape the industry, businesses and consumers must stay informed and adapt to new payment methods.

In the coming years, we can expect further advancements in areas such as AI-driven financial services, decentralized finance (DeFi), and biometric payments. These innovations will not only enhance the payment experience but also open new possibilities for financial inclusion and global commerce.

The digital age has undoubtedly transformed payment processing, and the journey is far from over. As we look to the future, one thing is certain: payment processing will continue to evolve, driven by technological progress and the ever-changing needs of society.

By tentopmerchantservices January 9, 2025

Merchant Cash Advances (MCAs) have gained popularity among small and growing enterprises as a quick and flexible financing solution. Unlike traditional loans, MCAs provide upfront capital in exchange for a portion of future sales. While they can be beneficial for businesses in need of immediate funds, they also come with significant risks and costs. This article explores what MCAs are, how they work, and the key advantages and disadvantages to help business owners make informed decisions.

What is a Merchant Cash Advance?

A Merchant Cash Advance (MCA) is a form of business financing where a provider offers a lump sum payment to a business in exchange for a percentage of its future daily credit card sales. MCAs are not traditional loans but are instead structured as sales agreements. The repayment process is automatic, with a predetermined percentage of daily or weekly sales being withheld until the advance, plus fees, is fully paid.

MCAs are appealing because they do not require collateral, and approval is relatively quick and straightforward. Businesses with fluctuating revenue streams, such as restaurants and retail stores, often turn to MCAs for quick capital. However, the ease of obtaining an MCA comes at a price, often in the form of high factor rates and limited regulatory oversight.

The approval process for MCAs typically focuses on the business’s cash flow and credit card sales history rather than the owner’s credit score. This makes MCAs accessible to businesses that may not qualify for traditional bank loans. Providers often approve MCAs within a few days, making it a viable option for urgent financial needs.

How Merchant Cash Advances Work

Merchant Cash Advances operate differently from traditional loans. Instead of paying back a fixed monthly amount with interest, businesses repay MCAs through a percentage of their daily sales. This percentage, known as the holdback rate, typically ranges from 10% to 20% of daily sales.

The total repayment amount is determined by a factor rate, which is usually between 1.2 and 1.5. For example, if a business receives an advance of $50,000 with a factor rate of 1.4, the total repayment will be $70,000 ($50,000 × 1.4). The repayment period depends on the volume of daily sales, meaning businesses with higher sales can repay the advance faster.

Unlike traditional loans, MCAs do not have a set repayment term. The repayment period can vary based on the business’s sales performance. This flexible repayment structure can be beneficial for businesses during slow periods, but it can also extend the repayment period, increasing the overall cost.

Advantages of Merchant Cash Advances

Quick Access to Capital

One of the primary reasons businesses opt for MCAs is the speed of funding. Traditional bank loans often require extensive documentation and weeks or even months for approval. In contrast, MCAs typically have a streamlined application process and can be approved within 24 to 72 hours.

This quick access to capital is particularly valuable for businesses facing urgent financial needs, such as equipment repairs, inventory purchases, or unexpected expenses. The ability to secure funds quickly can help businesses avoid operational disruptions and take advantage of time-sensitive opportunities.

Flexible Repayment Structure

MCAs offer a flexible repayment structure that adjusts with the business’s sales volume. Since repayments are made as a percentage of daily sales, businesses pay more when sales are high and less when sales are low. This can be especially beneficial for businesses with seasonal or fluctuating revenues.

Unlike traditional loans with fixed monthly payments, MCAs provide breathing room during slow periods, reducing the risk of default. However, while the flexibility is attractive, it also means that businesses may end up paying more over time compared to a fixed-term loan.

Lenient Approval Criteria

MCAs have less stringent approval criteria compared to traditional loans. Providers focus primarily on the business’s cash flow and daily sales rather than the owner’s personal credit score. This makes MCAs accessible to businesses with poor credit or limited credit history.

Additionally, MCAs do not require collateral, which reduces the risk for business owners. Unlike secured loans that may require pledging assets such as real estate or equipment, MCAs are unsecured, meaning there is no risk of losing valuable assets if the business struggles to repay the advance.

No Fixed Repayment Term

Since MCAs are repaid based on a percentage of daily sales, there is no fixed repayment term. This can be beneficial for businesses experiencing varying revenue streams. During slow months, businesses can take comfort in knowing that their repayment obligations will decrease in proportion to their sales.

This feature is particularly useful for businesses with seasonal sales fluctuations. For example, a retail store that experiences high sales during the holiday season and lower sales during other months can benefit from the variable repayment schedule.

Disadvantages of Merchant Cash Advances

High Cost of Capital

One of the most significant downsides of MCAs is their high cost. Unlike traditional loans with annual percentage rates (APRs), MCAs use factor rates, which can make it challenging to compare costs directly. However, when converted to an APR, the cost of an MCA can range from 40% to over 350%, making it one of the most expensive financing options available.

For example, if a business receives a $50,000 advance with a factor rate of 1.4, the total repayment is $70,000. Even though the daily repayment amount may seem manageable, the overall cost can significantly impact the business’s profitability. High costs can lead to a cycle of dependency on MCAs, where businesses continuously take out new advances to cover previous obligations.

Cash Flow Strain

While the flexible repayment structure is touted as an advantage, it can also create cash flow strain. Since a percentage of daily sales is automatically deducted, businesses may struggle to cover other essential expenses, such as payroll, rent, and utilities, especially during slow periods.

The automatic deductions can also make it difficult for businesses to plan and manage their finances effectively. Unlike traditional loans with predictable monthly payments, the variable repayment amounts can complicate cash flow forecasting and budgeting.

Lack of Regulation and Transparency

The MCA industry is less regulated than traditional lending, which can lead to predatory practices. Unlike banks, MCA providers are not subject to the same regulatory scrutiny, allowing some providers to engage in unfair or deceptive practices.

Business owners may encounter hidden fees, unclear terms, and aggressive collection tactics. Additionally, the lack of standardized disclosure requirements makes it difficult for businesses to compare offers from different providers. Without clear and transparent information, business owners may unknowingly agree to unfavorable terms.

No Benefit to Early Repayment

Unlike traditional loans, MCAs do not offer any benefit for early repayment. Since the total repayment amount is predetermined by the factor rate, paying off the advance early does not reduce the cost. This can be frustrating for businesses that experience a surge in sales and want to repay the advance quickly to save on interest.

In contrast, traditional loans often allow for early repayment with interest savings. The lack of incentive for early repayment can make MCAs less appealing for businesses that anticipate improved cash flow in the near future.

When to Consider a Merchant Cash Advance

MCAs can be a suitable financing option for businesses that:

1.Need immediate access to capital and cannot afford to wait for traditional loan approval.

2.Have a high volume of credit card sales, ensuring consistent cash flow for repayments.

3.Are unable to qualify for traditional loans due to poor credit or lack of collateral.

4.Experience seasonal or fluctuating revenue patterns and need a flexible repayment structure.

However, businesses should carefully evaluate the cost and impact on cash flow before committing to an MCA. Consulting with a financial advisor or accountant can help business owners assess whether an MCA is the right choice for their specific situation.

Alternatives to Merchant Cash Advances

Businesses considering MCAs should also explore alternative financing options, such as:

1.Traditional Bank Loans: While they require more documentation and have a longer approval process, bank loans typically offer lower interest rates and longer repayment terms.

2.Business Lines of Credit: A line of credit provides flexible access to funds with lower costs than MCAs. Businesses can draw funds as needed and only pay interest on the amount borrowed.

3.SBA Loans: Small Business Administration (SBA) loans are government-backed loans with favorable terms, including low interest rates and long repayment periods.

4.Invoice Financing: For businesses with outstanding invoices, invoice financing can provide quick access to cash by advancing a portion of the invoice value.

Conclusion

Merchant Cash Advances can provide quick and flexible financing for businesses in need of immediate funds. However, they come with high costs and potential risks that business owners must carefully consider. By understanding how MCAs work and weighing the pros and cons, businesses can make informed decisions about whether this financing option aligns with their goals.

Before committing to an MCA, it’s advisable to explore alternative financing options and seek professional advice to ensure the best outcome for the business’s financial health.

By tentopmerchantservices January 9, 2025

Introduction

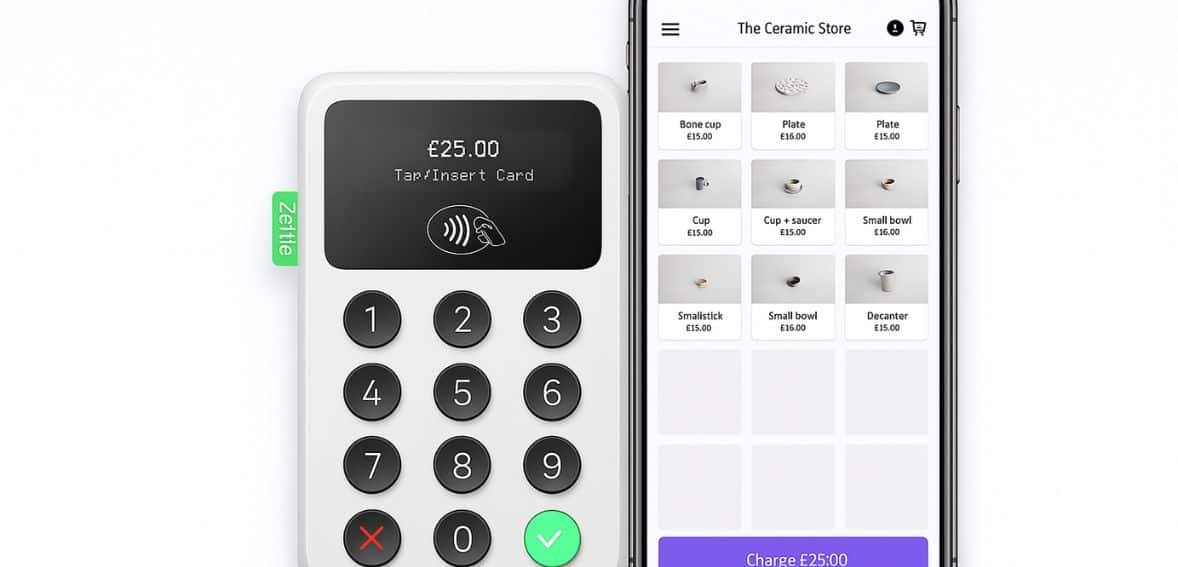

In an increasingly competitive market, businesses must seek every opportunity to improve customer experience and boost sales. Point-of-Sale (POS) systems, traditionally viewed as mere transaction processing tools, have evolved into dynamic platforms that play a crucial role in business growth. By leveraging the advanced features of modern POS systems, businesses can streamline operations, gather valuable customer insights, and create personalized shopping experiences that foster customer loyalty.

This article will explore how businesses can go beyond transactions and use POS systems to improve customer satisfaction and increase revenue.

The Evolution of Point-of-Sale Systems

The earliest POS systems were simple cash registers designed solely to record sales and hold cash. Over time, technological advancements have transformed these basic tools into sophisticated platforms capable of much more. Today’s POS systems integrate hardware and software to perform multiple functions, including inventory management, sales analytics, and customer relationship management (CRM).

Modern POS systems operate in real-time, allowing businesses to track sales data instantly. Cloud-based POS systems, for example, offer seamless synchronization across multiple devices and locations, making them ideal for businesses with multiple outlets. By upgrading to a modern POS system, businesses can leverage features that go beyond simple transactions.

Key advancements include:

1.Inventory Automation: POS systems can now track inventory levels automatically, sending alerts when stock is low.

2.Customer Data Collection: POS systems collect detailed data on customer behavior, purchase history, and preferences.

3.Omnichannel Integration: Modern POS systems support sales across various channels—physical stores, e-commerce websites, and even social media.

The evolution of POS systems has turned them into indispensable tools for enhancing customer experience.

Enhancing Customer Experience with POS Systems

Customer experience is a critical factor that influences purchasing decisions. Businesses that prioritize customer satisfaction are more likely to retain existing customers and attract new ones. Modern POS systems offer several features designed to improve the overall shopping experience.

Personalized Recommendations

By analyzing purchase history and customer data, POS systems can provide personalized product recommendations. For instance, a customer who frequently buys skincare products may be offered discounts or promotions on related items. This not only increases sales but also enhances the customer’s perception of the brand.

Faster Checkout Process

Long checkout lines are a common frustration for customers. A modern POS system equipped with mobile payment options and contactless technology can significantly reduce wait times. Faster checkouts improve customer satisfaction and increase the likelihood of repeat business.

Loyalty Programs

POS systems can be integrated with loyalty programs that reward customers for their purchases. Offering points, discounts, or exclusive deals encourages repeat visits and helps build long-term relationships. Furthermore, digital loyalty programs eliminate the need for physical cards, making them more convenient for customers.

By leveraging these features, businesses can create a seamless and enjoyable shopping experience.

Boosting Sales with Advanced POS Features

A POS system can be a powerful sales tool when used strategically. Beyond processing payments, it provides businesses with insights and capabilities that can directly influence sales performance.

Real-Time Sales Analytics

Modern POS systems provide real-time sales data, enabling businesses to monitor performance and make data-driven decisions. For example, a restaurant can use sales data to determine which dishes are most popular and adjust its menu accordingly. Retailers can identify best-selling products and ensure they are always in stock.

Upselling and Cross-Selling Opportunities

POS systems can suggest complementary products during the checkout process, encouraging customers to make additional purchases. For instance, when a customer buys a smartphone, the system might suggest accessories such as a case or screen protector.

Promotions and Discounts

Running promotions and discounts is a proven way to boost sales. POS systems enable businesses to create, manage, and track the success of various promotional campaigns. Whether it’s a seasonal sale or a flash discount, businesses can quickly implement offers that drive traffic and increase revenue.

By utilizing these advanced POS features, businesses can effectively increase their sales volume.

Streamlining Operations with POS Systems

Efficiency is a key driver of profitability. A well-integrated POS system can streamline various operational aspects of a business, leading to cost savings and improved service delivery.

Inventory Management

Manually tracking inventory can be time-consuming and prone to errors. POS systems automate this process by updating inventory levels in real-time whenever a sale is made. Some systems also offer predictive analytics, helping businesses anticipate demand and avoid stockouts or overstocking.

Employee Management

POS systems can help manage employee schedules, track working hours, and monitor individual performance. This ensures that staffing levels are optimal, improving both employee productivity and customer service.

Reporting and Insights

Detailed reports generated by POS systems provide valuable insights into business performance. These reports can cover various metrics, such as total sales, peak hours, and customer demographics. By analyzing these insights, businesses can identify areas for improvement and implement strategies to enhance efficiency.

Streamlining operations with a modern POS system allows businesses to focus on delivering better products and services to their customers.

Building Customer Relationships through POS Systems

Strong customer relationships are essential for long-term success. Modern POS systems offer tools that help businesses engage with customers and build lasting connections.

Customer Profiles

POS systems can create detailed profiles for each customer, including their contact information, purchase history, and preferences. This data allows businesses to personalize their marketing efforts and offer tailored promotions.

Feedback Collection

Collecting customer feedback is crucial for understanding their needs and expectations. Some POS systems include features that allow businesses to gather feedback directly at the point of sale. This real-time feedback helps businesses address issues promptly and improve customer satisfaction.

Communication Channels

POS systems can be integrated with email and SMS marketing platforms, enabling businesses to stay in touch with their customers. Sending personalized messages, updates on new products, and exclusive offers keeps customers engaged and fosters loyalty.

By using POS systems to build and maintain strong customer relationships, businesses can create a loyal customer base that contributes to sustained growth.

Ensuring Security and Compliance

With the rise of digital payments, ensuring the security of customer data is more important than ever. Modern POS systems are designed with robust security features to protect sensitive information.

Data Encryption

POS systems use encryption to secure payment information during transactions. This ensures that customer data cannot be intercepted or stolen by unauthorized parties.

PCI Compliance

The Payment Card Industry Data Security Standard (PCI DSS) sets guidelines for businesses that handle credit card information. Modern POS systems are typically PCI-compliant, helping businesses meet these regulatory requirements and avoid penalties.

Fraud Detection

Some POS systems include fraud detection features that can identify suspicious transactions and prevent unauthorized access. This protects both the business and its customers from potential losses.

Ensuring security and compliance is essential for maintaining customer trust and avoiding financial liabilities.

Choosing the Right POS System for Your Business

Not all POS systems are created equal. When selecting a POS system, businesses must consider their specific needs and objectives.

Key Factors to Consider

- Scalability: Choose a system that can grow with your business.

- Ease of Use: A user-friendly interface ensures that staff can quickly learn and operate the system.

- Integration Capabilities: Ensure the POS system can integrate with existing tools and software.

- Cost: Consider both upfront costs and ongoing expenses, such as subscription fees.

Popular POS Systems

Several POS systems are well-regarded for their features and reliability. Some of the most popular options include Square, Shopify POS, and Toast for restaurants. Researching and comparing different providers will help businesses find the best fit for their needs.

Selecting the right POS system is a crucial step in leveraging technology to enhance customer experience and boost sales.

Conclusion

Point-of-Sale systems have come a long way from being simple cash registers to becoming powerful business tools. By leveraging the advanced features of modern POS systems, businesses can enhance customer experiences, streamline operations, and boost sales. Whether it’s through personalized recommendations, real-time analytics, or efficient inventory management, a well-implemented POS system offers numerous benefits.

As technology continues to evolve, businesses that embrace innovative POS solutions will be better positioned to thrive in a competitive market. Going beyond transactions and using POS systems strategically is the key to long-term success.

By tentopmerchantservices January 9, 2025

In an increasingly digital world, small businesses must stay ahead of technological trends to remain competitive. One key area where businesses can gain an edge is in offering seamless and secure payment solutions. This article serves as a comprehensive guide for small business owners who want to navigate the often complex world of payment gateways.

Understanding Payment Gateways

What Is a Payment Gateway?

A payment gateway is a technology that facilitates the transfer of payment data from customers to merchants and ultimately to banks or credit card networks. It acts as a middleman that ensures sensitive financial information is transmitted securely during online and in-person transactions. Without payment gateways, e-commerce as we know it would not exist.

When a customer makes a purchase, the payment gateway encrypts their payment details and sends them to the acquiring bank. The bank then forwards the request to the issuing bank or card network for authorization. Once approved, the gateway sends the confirmation back to the merchant, completing the transaction.

Why Are Payment Gateways Important?

Payment gateways are crucial because they provide the infrastructure that allows merchants to accept a variety of payment methods, including credit cards, debit cards, and digital wallets. They also ensure that sensitive payment information is handled in a secure manner, protecting both businesses and customers from fraud.

Additionally, gateways enhance customer convenience by providing quick and reliable payment processing. In a world where user experience is paramount, having a smooth checkout process can make or break a sale.

Types of Payment Gateways

Hosted Payment Gateways

Hosted payment gateways redirect customers to a third-party payment page to complete their transactions. PayPal and Stripe are popular examples of hosted gateways. One advantage of this type is that the provider handles all security and compliance issues, reducing the burden on the merchant.

However, redirecting customers to another site can disrupt the user experience and may lead to higher cart abandonment rates. Therefore, businesses need to weigh the pros and cons before choosing a hosted gateway.

Integrated Payment Gateways

Integrated payment gateways allow customers to complete transactions directly on the merchant’s website without redirection. These gateways offer a seamless user experience and are ideal for businesses that want to maintain full control over their checkout process.

While integrated gateways provide a better customer experience, they require more technical expertise to set up and maintain. Merchants are also responsible for ensuring PCI compliance, which can add complexity to their operations.

API-Based Payment Gateways

API-based gateways are highly customizable solutions that allow businesses to create tailored payment experiences. Developers can use the gateway’s API to build a payment system that integrates with other business systems, such as inventory management and customer relationship management (CRM) tools.

These gateways are best suited for businesses with unique payment needs or those that want to offer advanced features like subscription billing or multi-currency support. However, they require significant development resources and ongoing maintenance.

Key Features to Look for in a Payment Gateway

Security and Fraud Prevention

Security should be a top priority when selecting a payment gateway. Look for providers that comply with Payment Card Industry Data Security Standard (PCI DSS) requirements and offer features like tokenization, encryption, and fraud detection.

Fraud prevention tools, such as address verification systems (AVS) and 3D Secure, can help reduce the risk of chargebacks and fraudulent transactions. Choosing a gateway with robust security measures will not only protect your business but also build customer trust.

Multi-Currency Support

For businesses that operate internationally or plan to expand globally, multi-currency support is essential. A payment gateway that can process payments in multiple currencies allows customers to pay in their preferred currency, improving the overall shopping experience.

Additionally, gateways that support dynamic currency conversion (DCC) can automatically display prices in the customer’s local currency, reducing confusion and increasing conversion rates.

Compatibility with Your Business Model

Different businesses have different needs, so it’s important to choose a gateway that aligns with your business model. For example, if you run a subscription-based service, look for a gateway that supports recurring billing. If you have a high transaction volume, prioritize gateways with low transaction fees.

Ensure that the gateway can integrate with your existing e-commerce platform, point-of-sale system, and accounting software. Compatibility will streamline your operations and reduce manual work.

Transparent Pricing Structure

Understanding the pricing structure of a payment gateway is crucial for budgeting and profitability. Gateways typically charge a combination of setup fees, monthly fees, and transaction fees. Some may also have hidden costs, such as chargeback fees or currency conversion fees.

Before committing to a provider, request a detailed breakdown of all costs and compare multiple options. Choosing a gateway with transparent pricing will help you avoid unpleasant surprises down the road.

Steps to Set Up a Payment Gateway

Step 1: Identify Your Business Needs

Before selecting a payment gateway, take the time to understand your business requirements. Consider factors such as the volume of transactions, types of payment methods you want to accept, and whether you need support for international payments.

Step 2: Research Providers

Once you have a clear understanding of your needs, start researching payment gateway providers. Read reviews, compare features, and request demos to see how each gateway works. Look for providers with a strong reputation for reliability, security, and customer support.

Step 3: Register and Set Up an Account

After selecting a provider, you’ll need to register and create an account. This typically involves providing business details, such as your company name, address, and bank account information. Some providers may also require verification documents.

Step 4: Integrate the Gateway

Integration can be done using plugins, APIs, or third-party services, depending on your platform and technical expertise. Ensure that the integration process is well-documented and that support is available if you encounter any issues.

Step 5: Test the System

Before going live, conduct thorough testing to ensure that the payment gateway works correctly. Test different payment methods, currencies, and scenarios to identify and resolve any issues. Once you’re satisfied with the performance, you can start accepting real transactions.

Common Challenges and How to Overcome Them

Technical Issues

One of the most common challenges businesses face when using payment gateways is technical issues. These can range from integration problems to system outages. To mitigate these risks, choose a gateway with a proven track record of reliability and responsive customer support.

Having a backup payment gateway in place can also help minimize downtime and ensure that you can continue accepting payments even if your primary gateway experiences issues.

Chargebacks and Fraud

Chargebacks and fraudulent transactions can be costly for businesses. To reduce the risk of chargebacks, ensure that your product descriptions are accurate, your return policy is clear, and your customer service team is responsive.

Investing in fraud detection tools and regularly monitoring transactions for suspicious activity can help prevent fraud. Additionally, working with a payment gateway that offers chargeback protection can provide an added layer of security.

Hidden Fees

Many businesses are caught off guard by hidden fees associated with payment gateways. To avoid this, carefully review the provider’s pricing structure and ask for clarification on any fees you don’t understand.

It’s also a good idea to periodically review your statements to ensure that you’re not being charged unexpected fees. If you notice any discrepancies, contact your provider immediately.

Conclusion

Navigating the complex world of payment gateways can be challenging, but it’s a crucial aspect of running a successful small business. By understanding how payment gateways work, identifying your business needs, and carefully selecting a provider, you can create a seamless and secure payment experience for your customers.

Investing time in choosing the right payment gateway will not only improve your operational efficiency but also enhance customer satisfaction and boost your bottom line. Whether you’re just starting out or looking to upgrade your existing system, this guide provides a solid foundation to help you make informed decisions.