By 10topmerchantservices July 3, 2025

Newtek Merchant Solutions is part of NewtekOne, a company that supports small and mid-sized businesses. While NewtekOne offers many services including lending, payroll and IT solutions, the merchant services division is focused on helping businesses accept, manage and process payments. Lets read more about Newtek Merchant Solutions Review.

This solution stands out by being flexible across different payment types, retail, online and mobile. For businesses already using Newtek’s other services, the merchant services feel like a natural extension, easy to integrate and a cohesive back office experience.

Newtek may not be a household name like some of the bigger payment processors, but its strength is in personalization. The service is designed for smaller businesses by bundling reliable payment processing with operational tools, a complete and approachable solution for growing businesses.

Core Payment Processing Features | Newtek Merchant Solutions Review

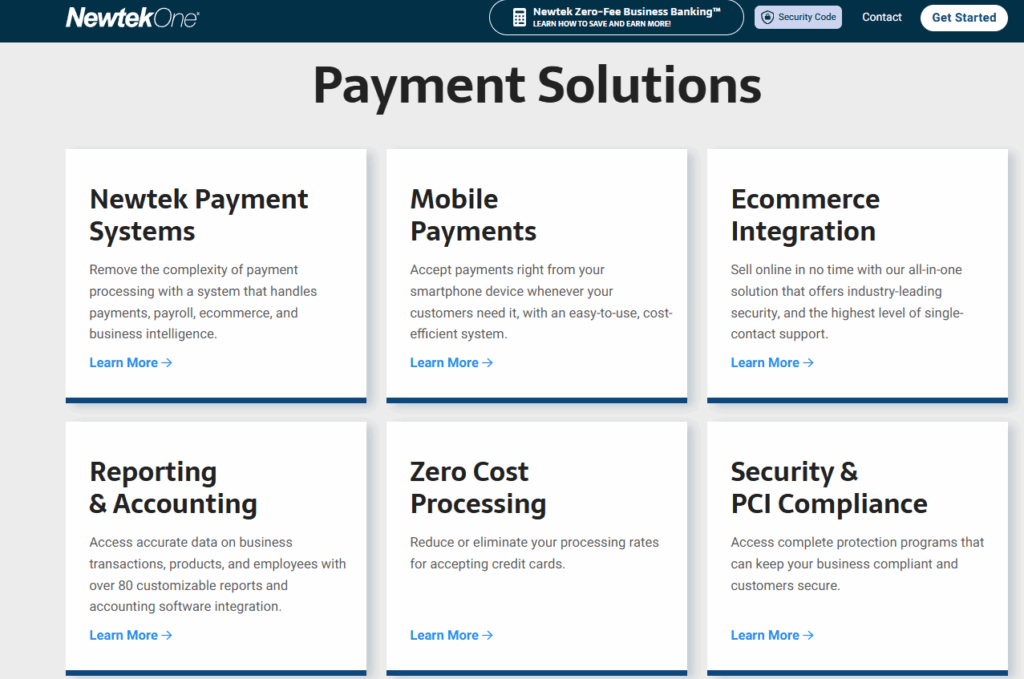

At its core, Newtek Merchant Solutions offers credit and debit card processing. The platform supports all major card networks Visa, Mastercard, Discover and American Express. Whether you have a physical storefront, a mobile setup or an online portal, Newtek has the tools to make secure transactions possible.

Features like authorization, batch processing and settlement are included. The system is scalable from a few transactions a day to high volume. Contactless payment methods like Apple Pay and Google Pay are also supported so you can offer your customers modern checkout experiences.

While the platform doesn’t push the boundaries of innovation, its commitment to industry standards is reliable. It’s focused on functionality over novelty, which can be a big plus for businesses that want consistency over experimental features.

POS Solutions

Newtek provides several POS hardware and software combinations suitable for in-store operations. These range from simple countertop terminals to more advanced systems that include employee and inventory management features. The solutions are particularly well-suited for restaurants, retail stores, and service-based businesses.

The hardware offered is sourced from reputable third-party vendors, ensuring compatibility with EMV chip cards and contactless payments. Businesses can choose between wired and wireless terminals depending on layout needs. On the software side, Newtek’s POS systems include tools for tracking sales, printing receipts, and managing basic customer data.

Integration with back-office functions like inventory or accounting is possible, though it may require some additional configuration. While it may not rival industry-specific POS suites, it does deliver the essentials needed for day-to-day retail operations.

E-Commerce and Online Payment Tools

Newtek supports online payments through a suite of tools tailored to digital businesses. These include hosted checkout pages, virtual terminals, and integrations with e-commerce platforms. The virtual terminal enables manual card entry for remote payments, ideal for phone or email orders. The hosted checkout pages offer secure, branded experiences without the need for merchants to store sensitive data.

While Newtek offers compatibility with platforms like WooCommerce and Magento, integration may require extra setup or developer involvement. The tools are PCI-compliant and include encryption features to protect transaction data.

For businesses with straightforward online sales needs, Newtek’s offering is sufficient. Those requiring custom checkout flows, deep analytics, or complex subscription models may need to integrate additional third-party services.

Mobile Payment Support

Newtek’s mobile payment options are built for flexibility. Small business owners, mobile service providers, and event vendors can use portable card readers that connect to smartphones via Bluetooth or audio jack. These readers support swipe, chip, and contactless transactions, making them versatile for various situations.

The accompanying mobile app allows users to input amounts, view basic transaction logs, and send digital receipts. While the tools are easy to use and reliable, they do not offer extensive features like inventory tracking or CRM capabilities.

This solution is ideal for mobile-first operations that need a simple, lightweight tool to collect payments. Businesses with more robust mobile needs may need to supplement the system with additional platforms.

Invoicing and Recurring Billing

For businesses with subscription services or recurring billing models, Newtek has simple tools to create and send invoices and set up automated payments. Invoices can be customized and sent via email with embedded payment links that accept card payments.

Recurring billing allows businesses to set up schedules for automatic charges on a weekly, monthly or custom basis. The system stores payment data so you don’t have to re-enter info each cycle.

These are user friendly and will work for most small business needs. But they don’t have advanced features like tiered billing plans or usage based pricing. Businesses that need those will need to look into specialized billing platforms.

Integration with Business Tools

Newtek has basic integration with software like QuickBooks so you can sync transaction data for financial reporting. If you already use Newtek’s payroll or insurance services, the ecosystem integration will create operational efficiency.

While helpful, Newtek’s integration options aren’t as robust as platforms with open APIs or large app marketplaces. Customization options are limited and businesses with complex workflows will need to use third party middleware to connect all systems.

For small to mid-sized businesses using common tools, Newtek has enough connectivity to centralize data without being too complicated.

Security and Compliance Measures

Security is a cornerstone of Newtek’s merchant services. The platform adheres to PCI DSS requirements and employs encryption and tokenization to safeguard transaction data. This means that sensitive information is protected during both transmission and storage.

It also includes fraud prevention tools such as CVV and AVS checks and offers merchant guidance on maintaining PCI compliance. While the platform does not offer proprietary fraud detection algorithms, the existing tools are reliable and familiar to most users.

These features ensure a secure payment environment, which is especially important for small businesses without dedicated IT security resources.

Reporting and Analytics Dashboard

Newtek includes a reporting interface that tracks daily transactions, sales history, chargebacks, and other key performance indicators. The dashboard is simple and intuitive, designed for business owners who want quick access to financial data without learning complex analytics software.

Reports can be filtered by time frame, payment method, or location, making it easier to understand trends. Though the reporting features support basic financial analysis and accounting preparation, they are not meant for advanced forecasting or business intelligence.

This tool works well for routine oversight and performance reviews. Businesses needing predictive analytics or deeper customer insights may require additional software.

Customer Support and Service Structure

Customer service is one of Newtek’s strong suits. Support is offered by phone and email during business hours and you deal with a dedicated service rep, not a help desk.

Newtek also provides some basic documentation and onboarding help which is great for first time users. 24/7 support isn’t standard but the hands on approach is consistent.

For merchants who value direct communication and human help this service model is an advantage over larger platforms with long response times and impersonal interfaces.

Pricing Transparency and Fees

Newtek’s pricing is not published which can be frustrating for businesses that want instant quotes or price comparisons. Pricing is custom based on industry type, transaction volume and risk level.

Fees may include interchange costs, monthly service fees, statement fees and equipment rentals. Some merchants will be on a flat rate model, others will be on an interchange plus model. Early termination fees or long term contracts may apply depending on the agreement.

While negotiable terms are possible the lack of transparency can be a barrier for businesses that are not familiar with merchant account pricing. Prospective users should review contracts closely and ask direct questions about additional fees and pricing models.

Pros and Cons of Newtek Merchant Solutions

Newtek’s biggest strengths include its tailored approach to small businesses and its connection to the broader NewtekOne ecosystem. Bundled services like payroll and lending help simplify operations. The platform also offers stable payment tools and customer support with a human touch.

However, the limited integration options and lack of cutting-edge features may not meet the needs of larger or tech-savvy businesses. Pricing opacity is another potential drawback, especially for those seeking straightforward cost structures.

Businesses prioritizing reliability and relationship-driven service will find value in Newtek. Those seeking advanced technology or deep customization may find the platform less suitable.

Ideal Business Types for Newtek

Newtek Merchant Solutions is designed for small and mid-sized businesses. Retail stores, professional service providers, and e-commerce shops with basic requirements are well-positioned to benefit. Its invoicing and recurring billing tools are useful for consultants, membership services, and healthcare providers.

Merchants already using Newtek’s other services will enjoy better integration and streamlined operations. On the other hand, businesses in highly technical industries or with complex payment workflows might need more specialized solutions.

Newtek fits best where usability and trust are more important than having the latest innovations.

Final Verdict

Newtek Merchant Solutions offers reliable, user-friendly payment services ideal for small businesses. Its strengths include solid customer support, essential tools, and integration with NewtekOne. While not the most flexible or tech-advanced, it meets core business needs. Improved pricing transparency and integration options could enhance its competitive appeal further.

FAQs

Q1: Does Newtek Merchant Solutions support high-risk businesses?

Newtek typically focuses on standard-risk industries. High-risk businesses should contact Newtek directly to assess eligibility and underwriting options.

Q2: Can Newtek integrate with my e-commerce platform?

Yes, it supports integration with several popular platforms. However, setup may require plugins or technical assistance to ensure compatibility.

Q3: Is a long-term contract required?

Contract terms can vary. Some merchants may get month-to-month agreements, while others may face longer commitments. Be sure to clarify all terms before signing.

By 10topmerchantservices July 1, 2025

Moneris is one of the most trusted payment processors in Canada. Founded in 2000 as a joint venture between the Royal Bank of Canada and the Bank of Montreal, Moneris has become the go-to solution for over 350,000 businesses. Its entire focus is on Canadian merchants, with solutions for industries like retail, hospitality, healthcare and professional services. Lets read more about Moneris Review.

Being a domestic company gives Moneris a deep understanding of Canadian financial regulations and customer expectations. Moneris integrates with the local banking infrastructure which can be a big advantage for merchants who want to be aligned with familiar institutions. This allows the company to serve businesses of all sizes, from single location shops to national brands.

Moneris offers in-store, online and mobile payments. With a strong emphasis on compliance, fraud prevention and customer support, it gives businesses the tools to manage payments securely and efficiently. But some small businesses may find its contract terms and pricing not as transparent as expected. For businesses that value institutional backing and local support, Moneris is a competitive option.

Payment Processing Services and Capabilities | Moneris Review

Moneris offers a full suite of payment services tailored for different business types. Whether you run a physical store, accept payments online, or operate on the move, Moneris has solutions to help streamline your operations.

The platform supports all major card networks, including Visa, Mastercard, American Express, and Discover. It also integrates with Interac for debit payments, which is a preferred method among many Canadian customers. In addition, it is compatible with Apple Pay and Google Pay, making it easy to accept mobile and tap payments.

What sets Moneris apart is its unified platform. Businesses can manage transactions across in-store, online, and mobile channels from one interface. This simplifies reporting and reduces the complexity that often comes with juggling multiple systems. Moneris also offers features like recurring billing, invoice-based payments, and support for digital gift cards.

While its capabilities are comprehensive, the cost structure varies depending on transaction type and volume. Larger businesses with consistent sales may benefit from competitive rates, but smaller operations might find better deals through providers with simpler, flat-rate models.

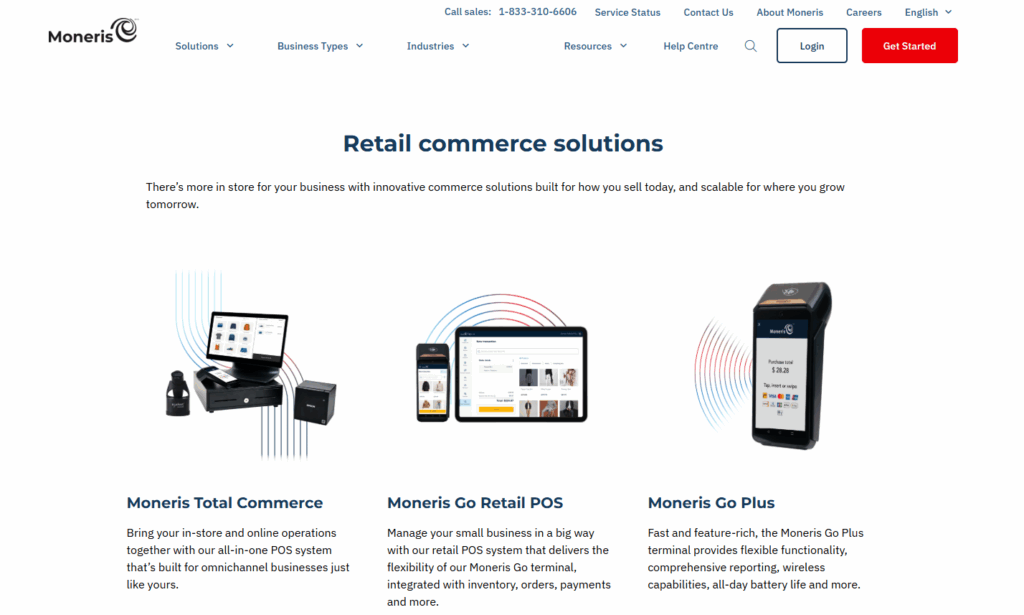

POS Solutions

Moneris delivers a range of POS solutions that cater to both small and large businesses. From basic countertop terminals to advanced smart devices, its POS offerings are designed to handle day-to-day transactions with ease and speed.

Traditional countertop terminals work well in fixed-location stores. These devices process chip, tap, and swipe transactions and are known for reliability. Wireless terminals, on the other hand, offer mobility for businesses like restaurants and mobile service providers. They enable payments from anywhere within a location, which enhances convenience for both staff and customers.

Moneris Go, the company’s smart terminal, is a standout product. It combines payment processing, inventory tracking, and sales data into one compact device. Running on Android, it includes a built-in receipt printer and supports Wi-Fi and cellular connections, making it ideal for modern retail environments.

Many of Moneris’ POS solutions integrate with business tools such as accounting software and inventory systems. This reduces manual work and ensures real-time data access. However, the initial investment in hardware and the potential for long-term contracts may be a drawback for businesses seeking more budget-friendly or short-term options.

E-Commerce and Online Payment Gateway

For businesses with an online presence, Moneris has e-commerce capabilities. Whether you have a fully integrated e-commerce site or just need to accept online payments, Moneris has multiple tools to support digital transactions. One of the options is the hosted checkout page which allows merchants to accept payments without coding knowledge. For developers and tech-savvy businesses, Moneris has APIs and SDKs to support custom checkout experiences and deep back-end integration.

Moneris works with popular e-commerce platforms like Shopify, WooCommerce, BigCommerce and Magento. This makes it easy for merchants to connect their existing stores to Moneris’ payment gateway. The gateway accepts all major credit cards and digital wallets so customers can pay with their preferred method.

Security features like tokenization, 3D Secure authentication and fraud prevention tools are built into the gateway. Merchants can also offer recurring billing for subscription based services. While these features are great, smaller businesses without technical support may find the setup more complex than all-in-one platforms designed for ease of use.

Mobile Payments and On-the-Go Solutions

Moneris offers flexible mobile payment options for businesses that need to process transactions beyond traditional storefronts. These solutions are well-suited for mobile vendors, tradespeople, delivery services, and pop-up retail setups. It Go functions as both a stationary and mobile terminal. It is a standalone device with a touchscreen, built-in printer, and support for chip, tap, and swipe payments. It also works with Apple Pay and Google Pay, allowing contactless payments.

The Moneris mobile app lets merchants turn smartphones or tablets into payment terminals when paired with a card reader. This is a practical and cost-effective option for businesses with limited hardware needs or those requiring a backup solution.

Transactions made through mobile devices are encrypted and automatically synced with the merchant’s Moneris account. This ensures secure processing and centralized reporting. However, the cost of mobile hardware and processing fees may not be as low as some app-based fintech alternatives. For businesses operating in Canada that prioritize security and bank-backed reliability, Moneris’ mobile tools are a solid option.

Payment Security and Fraud Prevention Tools

Moneris places strong emphasis on keeping payment data safe. As a Canadian company backed by major banks, it ensures full compliance with PCI DSS standards and includes security features designed to protect both merchants and customers.

A core component of Moneris’ security approach is tokenization, which substitutes sensitive card data with unique identifiers during transactions. This protects payment information from being exposed during the process. The platform also uses end-to-end encryption to safeguard data from the point of entry through to authorization.

Fraud prevention tools are built into both in-store and online systems. Merchants have access to features like CVV verification, address verification, and 3D Secure for online transactions. The Moneris iGuard system monitors for suspicious activity and allows merchants to apply automated rules that flag high-risk payments.

While the security tools are robust, some advanced options may require extra setup or are reserved for larger merchants. Smaller businesses may need guidance to make the most of these features. Overall, it provides a strong security framework that helps protect against fraud and ensures compliance with Canadian data protection laws.

Reporting, Analytics, and Business Tools

Moneris supports business decision-making with a suite of reporting and analytics features. These tools are accessible through the MyMoneris portal, which allows merchants to view transactions, generate reports, and track sales metrics in real time. The portal provides insights into revenue trends, customer behavior, and product performance. Businesses can analyze data such as hourly sales, best-selling items, and average transaction values. This visibility can help optimize operations, staffing, and marketing strategies.

Merchants can export reports for use with external tools or accounting software. Scheduled reporting options are also available, reducing the time spent manually compiling sales data. While the analytics are useful for most users, they may not offer the depth of segmentation and forecasting that more advanced analytics platforms provide.

Moneris also supports customer loyalty features and gift card campaigns. Businesses can create repeat business opportunities by tracking spending history and offering rewards. While these tools are helpful, they are more basic compared to dedicated CRM systems. Still, for small to mid-sized businesses, they add value without additional software costs.

Customer Support and Service Experience

Moneris offers support through phone, email and live chat. Support is available 7 days a week and Moneris also has a self-serve knowledge base with user guides, FAQs and troubleshooting articles. Canadian businesses get support from people who understand local needs and banking systems. It also offers onboarding assistance for businesses setting up POS systems or integrating with e-commerce platforms.

Larger businesses may get assigned dedicated account managers who can offer more personalized advice. For smaller merchants support response times are generally good but some users mention inconsistent experiences depending on the issue or time of day.

The MyMoneris portal allows merchants to track support tickets and follow up on service requests. While Moneris is generally reliable, issues around billing or hardware replacement sometimes get negative feedback. But its local support model is a big plus over some of the global support centers offered by other competitors.

Pricing, Fees, and Contract Terms

Moneris uses a combination of fixed fees, transaction charges, and hardware rental costs. Pricing details are not always available publicly, so it’s important for prospective customers to request a custom quote and review contract terms closely. Typical pricing includes a setup fee and a monthly charge that covers access to the platform and terminal rental. Transaction fees vary by card type. Debit transactions tend to be cheaper than credit cards, which incur a percentage-based charge plus a small per-use fee.

Other fees may include early termination penalties, PCI non-compliance charges, and costs for chargebacks. Contracts often run for three years, and breaking the agreement early can result in significant fees.

For larger businesses, Moneris may offer negotiated pricing that bundles services for better value. However, startups and smaller merchants might find more predictable pricing with flat-rate providers. Transparency remains an area where Moneris could improve, especially for businesses comparing multiple payment processors.

Pros and Cons of Choosing Moneris

Moneris is a strong Canada focused payment solution backed by two of Canada’s biggest banks. Their integrated services cover in-store, online and mobile transactions with robust security and local customer service. For businesses looking for institutional reliability and long term support Moneris is a good option. They are especially good for merchants who value compliance, advanced fraud tools and broad integration.

But the downsides are limited transparency on pricing, long term contracts and setup costs that may not be suitable for smaller or newer businesses. Some of their tools may not have the same level of user experience as newer software driven competitors. It is good for established Canadian businesses looking for a bank backed all in one payment processor. Those with low transaction volumes or flexible needs may prefer providers that offer simpler terms or lower costs.

FAQs

Q1. Is Moneris only available in Canada?

Yes, it operates exclusively within Canada and focuses on serving Canadian merchants with localized solutions.

Q2. Does Moneris offer month-to-month contracts?

Moneris typically provides multi-year contracts. While promotional offers may include more flexible terms, it’s important to verify before signing.

Q3. Can Moneris be integrated with my existing e-commerce platform?

Yes, it integrates with popular platforms like Shopify, WooCommerce, and Magento, and also offers APIs for custom integrations.

By 10topmerchantservices June 26, 2025

JetPay started as an independent payment processor with a focus on simplifying complex financial stuff for businesses. They offered a mix of services including payment processing, payroll and HR solutions for businesses of all sizes. JetPay positioned themselves as more than just a processor, as a one stop shop for merchants looking for integrated financial tools. Lets read more about JetPay Review.

In 2018 JetPay was acquired by NCR Corporation, a big player in digital banking and POS technology. This acquisition expanded JetPay’s capabilities and aligned with NCR’s goal of creating a commerce ecosystem. While the JetPay brand is not as prominent anymore, their services are still under the NCR umbrella and offer more support and infrastructure to users.

Today, JetPay operates within NCR’s suite of offerings. This means clients benefit from integrated hardware, software, and processing solutions. For larger businesses, this offers scalability and a cohesive tech stack. For smaller businesses, the shift may feel like a move away from JetPay’s original personalized approach.

Core Payment Processing Features | JetPay Review

JetPay enables businesses to accept a wide range of payment types. These include credit and debit cards, electronic checks, ACH transfers, and mobile wallets. Its multichannel support ensures businesses can receive payments in person, online, or over the phone. It is known for its reliability and consistent processing speeds. Settlements are handled within standard timelines, and the platform is stable with minimal downtime. ACH and eCheck features are especially useful for businesses handling subscriptions or large invoices.

Security is a key feature, with support for EMV chip cards and end-to-end encryption. The system also accepts contactless payments, meeting the demands of today’s retail environment. However, the user interface may not feel as modern or intuitive as newer platforms. For some users, especially those less familiar with tech systems, the learning curve may be steeper. Still, JetPay remains a solid choice for businesses focused on function and security.

POS Integration and Retail Tools

Through NCR, It offers POS solutions for retail, hospitality and service industries. Merchants can choose from countertop terminals, mobile POS units and full retail systems with inventory and customer management. JetPay’s processing now integrates with NCR’s hardware and software. Businesses using NCR POS systems can add JetPay without third party gateways. This means smoother checkout and better backend reporting.

Mobile POS units, including tablet readers, are for vendors who need flexibility like food trucks, delivery services or event based sellers. These systems support contactless and chip card payments so merchants are current with payment standards. One thing to consider is that NCR’s enterprise background can make JetPay’s POS options feel too complicated for smaller businesses. Setup may require coordination with multiple departments which can be a pain for users who want a more streamlined experience. Overall JetPay’s POS is powerful and good for businesses that need more than just basic transaction tools.

E-commerce and Virtual Terminal Support

JetPay includes strong support for e-commerce through its virtual terminal and hosted payment page options. Merchants can either integrate secure payment forms on their websites or redirect customers to JetPay’s hosted pages, which require less technical setup. The web-based virtual terminal allows for manual entry of credit card transactions, ideal for phone or mail orders. Features such as recurring billing, card tokenization, and saved customer profiles are also supported. This makes it a practical option for subscription-based services.

Security is well handled. The system uses encryption and tokenization to protect sensitive data. It complies with PCI DSS standards and includes tools to help merchants maintain compliance. Compared to newer platforms like Stripe or Square, JetPay’s e-commerce tools may lack ease of use. The absence of plug-and-play features means some technical help may be needed for customization. Businesses looking for a quick setup with minimal coding may want to assess whether JetPay aligns with their needs. Despite this, It delivers reliable online payment support, especially for merchants who prioritize secure transactions over visual customization.

Payment Security and Regulatory Compliance

It puts data protection and regulatory compliance first. The platform is PCI DSS compliant and has tools to help merchants stay compliant through regular audits and system updates. It uses tokenization and end to end encryption so sensitive data is not exposed during transactions. This reduces the risk of data breaches and protects customer information.

Additional security features include transaction monitoring, CVV and AVS checks and fraud alerts. These help reduce chargebacks and flag suspicious transactions. For ACH and eCheck processing JetPay has validation tools to help verify bank info and prevent fraudulent or returned payments. The platform follows NACHA guidelines for electronic transactions. One drawback is advanced fraud controls need to be set up manually or through third party plugins. Businesses that want automated fraud detection or comprehensive dashboards may find JetPay’s options limited. But the core security features are good enough for any size business.

Payroll and Human Resource Features

A standout feature of JetPay is its integrated payroll and HR management tools. This includes automated payroll, tax filings, employee onboarding, and benefits management. Businesses looking to consolidate financial and workforce operations may find this especially useful. It supports payroll for hourly and salaried workers with flexible scheduling options. The platform calculates and files taxes at all levels and offers direct deposit and pay card options.

Beyond payroll, HR tools include self-service portals for employees, time tracking, and compliance monitoring. These features help reduce administrative tasks for HR teams or business owners. However, companies already using third-party HR tools may find JetPay’s offerings redundant. While functional, the user interface may appear dated when compared to newer platforms. Nevertheless, for those looking for an all-in-one financial and HR solution, JetPay offers notable value.

Payment Gateway and Developer Options

The JetPay gateway acts as the main connection between merchants and processors. It supports integration through APIs, SDKs, and batch file uploads. Developers can use RESTful APIs to create custom setups for websites and apps. JetPay’s gateway works with many CRM systems and shopping carts, allowing businesses to retain their existing infrastructure. Features include recurring payments, refunds, and secure checkouts. Documentation and sandbox environments are available to support development.

However, developers have noted that JetPay’s technical resources are not as extensive or user-friendly as those from competitors like Stripe. The documentation may lack clarity, making the learning process harder for beginners. Fraud prevention within the gateway includes tools like transaction limits and IP filtering. For more advanced fraud management, third-party solutions may be needed. JetPay’s gateway is dependable but better suited for businesses with in-house tech capabilities.

Reporting, Analytics, and Account Controls

JetPay provides a reporting suite that helps businesses monitor payments, review revenue data, and manage operations. Reports can be customized by transaction type, settlement status, or date range. Daily batch summaries, settlement reports, and tax-ready data exports help accounting teams stay organized. Businesses can export data into formats compatible with software like Excel or QuickBooks.

User management features allow admins to set role-based permissions, limiting access to certain functions or data. This is helpful for companies with multiple locations or teams. One drawback is the interface, which can feel outdated. While all necessary tools are present, navigation may take time for new users. Still, JetPay’s reporting tools are accurate and sufficient for most operational needs without requiring external analytics software.

Pricing and Contract Considerations

JetPay does not publish flat-rate pricing. Costs vary depending on business size, industry, and processing volume. This can benefit larger businesses that negotiate lower rates, but it adds uncertainty for smaller merchants. Pricing models often include interchange-plus or tiered rates. Extra charges may apply for virtual terminals, PCI compliance, or gateway use. Some merchants have reported monthly minimum fees, setup charges, or statement fees.

It usually requires multi-year contracts and may charge termination fees. This lack of flexibility could deter businesses looking for short-term or no-contract options. Despite these concerns, pricing can be competitive for businesses with high transaction volumes or those using multiple services like payroll. However, it is essential to request a full fee breakdown and review contract terms before signing.

Customer Support Experience

JetPay offers phone and email support. Larger clients also get dedicated account managers. Initial setup includes PCI compliance support and system training. For new users especially those who are not familiar with payment systems this can be helpful. Larger clients get more personalized service and ongoing optimization support.

Some smaller users however report difficulty in reaching the right support teams after JetPay became part of NCR. Response times vary depending on the department. Documentation is available but not always comprehensive. Businesses that rely on self-help tools like chatbots or video guides may find the resources limited. Overall support is functional but not consistent across user types.

FAQs

Q1: Is JetPay a good option for small businesses?

JetPay can work for small businesses, but its comprehensive services and NCR integration often make it more attractive to mid-sized or larger companies. Smaller firms might prefer a simpler platform with flat-rate pricing.

Q2: Does JetPay accept mobile and contactless payments?

Yes. It supports mobile wallets like Apple Pay and Google Pay, along with contactless card transactions. These are available through compatible POS terminals.

Q3: What changed after JetPay’s acquisition by NCR?

While JetPay’s brand is less visible, its core services remain available under NCR. Businesses gain access to a broader range of integrated technologies for retail and financial operations.

By 10topmerchantservices June 24, 2025

Intuit QuickBooks Payments is a payment processing service built to work seamlessly with QuickBooks accounting software. Developed by Intuit, a trusted name in financial tools, this service enables small business owners to accept payments through credit cards, debit cards, ACH bank transfers, and mobile payment options. It’s particularly well-suited for those already using QuickBooks Online or Desktop, thanks to its native integration. Lets read more about Intuit QuickBooks Payments Review.

The core value lies in its simplicity. Once activated, users can send invoices with secure payment links, allowing clients to pay instantly. This direct connection between invoicing and payment collection speeds up cash flow and reduces the chances of data entry errors. Businesses can also automate parts of the reconciliation process.

However, when utilised within the QuickBooks ecosystem, its advantages become most noticeable. The advantages might seem limited if QuickBooks isn’t your current accounting program. Support for international transactions is weak, and there is little integration with other platforms. But QuickBooks Payments is a reliable option if you’re looking for a single accounting and payment system.

Getting Started and Onboarding Experience | Intuit QuickBooks Payments Review

QuickBooks Payments offers a quick and easy sign-up process, especially for users already on QuickBooks. You’ll need to provide standard business details like your company name, tax ID, bank account info, and contact data. In most cases, approval is fast, although some businesses may be asked for extra verification documents.

For QuickBooks Online users, the onboarding process is nearly effortless. You can enable payments right from the dashboard, and everything is integrated into the familiar QuickBooks interface. This consistency is a major plus for users who prefer not to juggle between multiple platforms. That said, if you’re not a current QuickBooks user, the setup may feel less intuitive. The features are tailored for users inside the QuickBooks ecosystem, and standalone functionality is limited. High-risk industries may also encounter more detailed underwriting processes or slower approval times.

Still, the onboarding experience earns high praise for its speed and ease; particularly for small and midsize businesses with basic payment needs.

Payment Methods and Supported Transactions

QuickBooks Payments supports a solid range of transaction types, giving customers flexibility in how they pay. The platform accepts all major debit and credit cards, including Visa, Mastercard, Discover, and American Express. ACH bank transfers are also supported, offering a lower-cost alternative for recurring or high-ticket payments. Invoices can be sent via email with a built-in “Pay Now” button, making it easy for customers to complete payments online. Businesses can also set up recurring billing or generate quick payment links for one-time transactions. This is ideal for businesses that collect deposits or partial payments.

QuickBooks provides a card reader and GoPayment mobile app for in-person transactions. This makes it possible for vendors, small merchants, and service providers to take payments while on the go with a mobile device. The absence of strong international support is one disadvantage. The absence of cross-border capabilities and multi-currency payments may be a barrier for companies with international operations. Even though they are less expensive, ACH payments settle more slowly than card transactions.

Overall, QuickBooks Payments covers the core payment methods most small businesses need and does so from a unified interface.

Integration with the QuickBooks Ecosystem

The biggest draw of QuickBooks Payments is how well it integrates with the wider QuickBooks suite. When a payment comes in, it’s automatically applied to the correct invoice, and your books are updated in real time. This kind of automation saves time and minimizes accounting errors. You can view payment statuses, track overdue invoices, and keep tabs on cash flow without leaving your accounting dashboard. During tax season, this integration is a major benefit. With categorized transactions and automated reporting, pulling financial reports becomes far less stressful.

You can also set rules for how payments should be recorded, adding a layer of customization. However, this tight link to QuickBooks comes with a downside. If you switch to another accounting platform later, moving data out of the system may be challenging. Businesses that rely on third-party accounting software will miss out on these integrated features. But for businesses already committed to QuickBooks, having payments, invoicing, and bookkeeping under one roof offers unbeatable convenience.

Pricing and Transaction Fees

QuickBooks Payments uses a transparent, pay-as-you-go pricing model. For online card payments, the typical rate is 2.9% + $0.25 per transaction. ACH bank transfers are more affordable, usually at a 1% flat fee, often with a maximum cap.

In-person card payments processed through GoPayment are a bit cheaper; around 2.4% + $0.25 per swipe. There are no monthly fees for the basic version, which makes it attractive to businesses with lower or irregular transaction volumes. Additional hardware or premium features may involve extra costs.

Although it’s not always the most affordable choice for high-volume retailers, QuickBooks Payments offers pricing comparable to rivals like Stripe or Square. Custom pricing options should be compared by businesses that handle a lot of payments. Additionally, keep in mind that chargebacks have costs and that processing fees are not reimbursed for transactions that are returned. Users have occasionally complained about minor updates or changes that aren’t clearly explained, even though Intuit is transparent about its pricing.

Invoicing, Estimates, and Customer Experience

QuickBooks Payments allows you to generate professional invoices directly within the platform. You can customize line items, tax rates, due dates, and even upload your business logo. These invoices are sent by email and include a direct payment link, making it easy for customers to pay via card or bank transfer. For recurring clients, invoices can be automated. You can also send reminders for overdue payments, reducing the time spent on manual follow-ups. Service providers and freelancers can take advantage of the estimates feature, which lets them send project quotes that can be converted into invoices later.

While customization is available, it’s not as deep as some standalone invoicing platforms. You can change colors, logos, and messages, but multilingual support and advanced formatting are limited. Still, the payment process for customers is smooth and hassle-free, which encourages quicker turnaround times on payments. For many small businesses, the level of customization and functionality is more than enough.

Reporting, Analytics, and Financial Insights

QuickBooks Payments includes basic but functional reporting tools. From the dashboard, users can view payment statuses, transaction histories, and upcoming deposits. Every payment is automatically linked to its corresponding invoice, so your records stay clean and accurate. You can also track metrics such as sales volume, outstanding invoices, and customer payment patterns. These insights help businesses stay on top of their cash flow and identify areas that may need attention.

Reports can be used when preparing taxes or exported for additional analysis. Additionally, users can easily access more comprehensive reports like balance sheets, tax summaries, and profit and loss statements because the tool is integrated into the QuickBooks ecosystem. However, there aren’t many features for detailed analytics or advanced financial forecasting. Additional tools may be required by businesses seeking long-term trends or in-depth data segmentation.

But for most small businesses, the included analytics offer just enough visibility to stay informed and make confident financial decisions.

Hardware and In-Person Payment Solutions

Though best known for online payments, QuickBooks Payments also supports in-person transactions through the GoPayment app. Paired with a mobile card reader, the app turns a smartphone or tablet into a payment terminal. The available hardware supports EMV chip cards, tap-to-pay options, and magstripe swipes. It connects via Bluetooth and is compact enough for on-the-go usage. This setup is ideal for pop-up vendors, contractors, or field service professionals who want to accept payments on-site.

Once a payment is processed, it syncs instantly with your accounting data, eliminating the need to manually update records. The GoPayment setup isn’t as robust as a full POS system. It lacks features like detailed inventory tracking, employee management, or loyalty programs. But for businesses with light in-person sales needs, it covers the essentials well.

Security, Compliance, and Customer Support

QuickBooks Payments takes security seriously. The system is PCI-compliant and uses strong encryption to protect payment data. Additional tools such as fraud monitoring, account alerts, and multi-factor authentication help further secure sensitive information. Team access can be restricted based on roles, allowing business owners to control who sees financial details. These measures help maintain trust with customers and ensure a safe transaction environment.

Support is offered via phone, live chat, and a comprehensive help centre with video tutorials and guides. Another useful tool for resolving typical problems is the QuickBooks community forums. The quality of customer service, however, can differ. During busy times, some users complain about lengthy wait times or trouble handling chargebacks. Others feel non-accountants cannot understand the documentation because it is too technical.

Even so, the platform provides solid security and enough support channels to address most concerns. Businesses with sensitive data can use it confidently, though patience may be needed during busy times.

Pros and Cons Summary

QuickBooks Payments offers strong value for businesses already using QuickBooks for their accounting. It simplifies invoicing, reporting, and reconciliation while allowing customers to pay in multiple ways. Its benefits include fast setup, integrated financial tools, and flexible payment methods. Service providers, freelancers, and small shops will find the platform especially convenient.

On the downside, limited international support, basic customization, and reliance on the QuickBooks ecosystem may deter some users. Also, while pricing is fair, it’s not the most cost-effective for high-volume merchants. Still, for small businesses seeking a streamlined, reliable, and integrated payment solution, QuickBooks Payments is a solid option.

FAQs

Q1. Can I use QuickBooks Payments without QuickBooks Online or Desktop?

QuickBooks Payments is built to work best with QuickBooks Online and Desktop. While limited usage without the accounting software is technically possible, the platform’s true advantages come from full integration.

Q2. How quickly are payments deposited into my account?

Credit card payments typically settle within 1 to 2 business days. ACH transfers may take up to 5 business days. Some users may qualify for next-day deposits, depending on account status.

Q3. Does QuickBooks Payments support international or multicurrency payments?

Currently, QuickBooks Payments only supports transactions in USD for U.S.-based businesses. It does not handle cross-border payments or multi-currency billing, which can be a limitation for international operations.

By 10topmerchantservices June 22, 2025

Ingenico has been a key player in the payment technology sector since its founding in France during the 1980s. Initially recognized for its hardware-focused offerings, the company has grown into a significant force in the broader payments ecosystem. With operations spanning more than 170 countries, Ingenico handles millions of transactions daily across industries such as retail, banking, hospitality, and transportation. Lets read more about Ingenico Review.

The brand has long enjoyed the trust of merchants thanks to its extensive use in physical payment systems. Formerly a part of Worldline until 2023, Ingenico is still growing while holding fast to its core competency: dependable card-present solutions. Working as a link between digital systems and physical terminals, Ingenico differs from many contemporary fintech companies that only concentrate on software. This puts the business in a position to serve as a key supplier for companies looking for scalable and safe payment infrastructure.

Though it faces competition from newer digital-first platforms, Ingenico remains a preferred choice for enterprise-scale businesses seeking robust, compliant, and globally accepted payment solutions.

A Broad Product Suite Covering Hardware and Software | Ingenico Review

Ingenico’s product lineup is engineered to meet a variety of merchant needs across different transaction settings. Its hardware range includes terminal families like Lane, Move, Desk, and the Android-based Axium series. These are tailored for everything from stationary retail counters to mobile and unattended environments.

Security and performance are central to Ingenico’s design. Most terminals feature EMV chip compatibility, NFC for contactless payments, and strong encryption. The Axium line, built on Android OS, reflects Ingenico’s shift toward enabling app-based commerce. These terminals support more than just transactions, they offer loyalty integrations, business applications, and analytics features.

Software tools complement the hardware, including estate management systems, configuration platforms, and APIs. These enable merchants to remotely monitor and manage devices at scale, which is particularly valuable for multi-location operations. While this integrated ecosystem provides convenience and consistency, it may limit flexibility for businesses that prefer open systems or more modular approaches. Overall, the product suite is dependable, secure, and well-suited for complex environments.

Security and Compliance as a Core Value

Security has been central to Ingenico’s offerings for decades. All devices comply with PCI PTS standards, ensuring they are tamper-resistant and capable of securely processing transactions. This is critical for merchants operating in sectors where compliance and trust are non-negotiable.

Ingenico supports both end-to-end encryption and point-to-point encryption. These technologies ensure that payment data is protected throughout its journey, from the terminal to the payment processor. P2PE, in particular, reduces PCI DSS compliance scope for merchants by encrypting card data immediately upon entry.

Another crucial feature is tokenisation, which substitutes secure tokens for private card information. In omnichannel settings, where a customer’s card may be used on several platforms, this is extremely helpful. Regular security patches and updates are also applied to Android-based devices. Merchants must, however, make sure that their operational procedures uphold these safeguards. Although Ingenico provides a solid technical basis, merchant diligence is also essential to the larger security ecosystem.

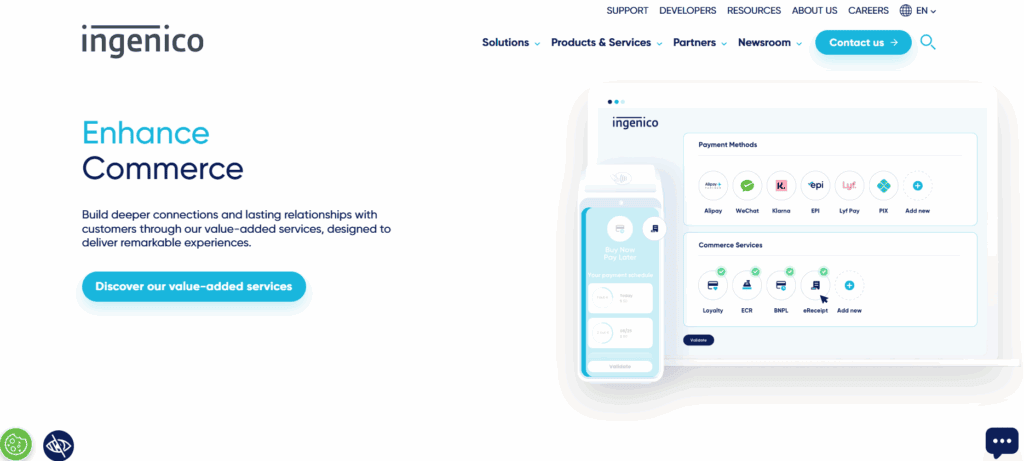

Omnichannel Commerce and Digital Enablement

Ingenico has expanded beyond hardware to support unified payment experiences across in-store, mobile, and online channels. Its omnichannel capabilities are built around cloud-based services and APIs that connect various payment touchpoints into a single system. One of the standout tools is Ingenico’s estate management platform, which allows for remote monitoring and updating of terminals. This is especially beneficial for businesses with wide retail footprints, where consistency and uptime are vital.

Ingenico also offers developer kits and APIs that enable integration with loyalty programs, CRMs, and eCommerce platforms. The Axium series furthers this with the ability to run apps directly on the terminal, allowing tasks like inventory lookup or customer engagement alongside payment processing. Although Ingenico’s progress in digital integration is solid, it lags behind some newer platforms in areas like AI and personalization. Still, for businesses seeking operational continuity and unified commerce, Ingenico provides a dependable and structured framework.

Industry-Specific Solutions for High-Volume Use

Ingenico’s value grows significantly when viewed through the lens of industry-specific solutions. Its technology is tailored to meet the needs of different sectors, including retail, hospitality, healthcare, transportation, and financial services. In retail, Ingenico supports high-speed processing and integrates with major POS platforms. For quick-service restaurants or small-format retail, mobile terminals allow for efficient order-taking and payment collection. In the hospitality sector, features like tipping and dynamic currency conversion are integrated for seamless guest transactions.

Rugged devices that are made for high-use or outdoor environments are advantageous for transportation and unattended systems. Secure patient billing and privacy are the main concerns of healthcare deployments. In the financial industry, Ingenico terminals are often found in ATMs, bank branches, and kiosk settings. These customised solutions offer a great deal of functionality, but they also have a platform structure that might not be as flexible for smaller or non-traditional business models. Ingenico is a good fit for the enterprise market, but it might not be as suitable for micro-merchants.

Global Operations and Local Adaptability

Ingenico’s reach is undeniably global. With solutions operating in more than 170 countries, the company is positioned to support multinational corporations and local merchants alike. Its ability to accommodate regional payment methods and certifications gives it an edge in global commerce. Devices support both international card schemes and local payment networks, making them suitable for cross-border commerce and in-country use. Ingenico’s infrastructure is supported by a network of partners including ISVs, banks, and system integrators.

This partner model extends support for installation, maintenance, and compliance. Localized support materials and updates help businesses remain aligned with country-specific regulations. However, the level of service may vary depending on the region and the partner’s capabilities. While the global footprint and adaptability are strong advantages, some inconsistencies in support and deployment can emerge. Businesses operating in regions with limited partner infrastructure may face slower service or integration timelines.

A Measured but Consistent Approach to Innovation

While many newer payment providers focus on rapid feature rollouts, Ingenico adopts a more measured approach to innovation. The company focuses on long-term reliability, compliance, and interoperability rather than frequent experimental updates.

The adoption of Android OS in the Axium product line is a noteworthy evolution. These terminals support business apps and smart features, enabling retailers to do more with their POS systems. App-based features like surveys, inventory management, and CRM integration are now possible directly from the payment device.

In keeping with the trend towards software-defined experiences, Ingenico is also making investments in cloud services and terminal-as-a-service models. However, Ingenico’s innovations put stability ahead of trend adoption, in contrast to agile fintech startups. Because of this, large businesses would benefit more from it than startups seeking rapid iteration.

Usability and Merchant Experience

From a usability perspective, Ingenico has consistently delivered devices that balance function and form. Terminals are ergonomically designed, with clear interfaces and responsive keypads or touchscreens. This improves transaction speed and reduces friction at checkout. The Axium series introduces enhanced displays and app compatibility, offering a more dynamic interaction point for merchants and customers. Pre-loaded configurations simplify setup, and remote management tools ease the process of updates and maintenance.

From the customer’s point of view, Ingenico devices support fast tap-and-go experiences, mobile wallet compatibility, and multilingual interfaces. However, older models still in circulation may not deliver the same responsive feel as newer devices. While usability is generally high, some merchants may encounter limitations in customizing workflows or branding due to proprietary software layers. Overall, it strikes a solid balance between ease of use and durability.

Pricing Structures and Integration Models

Ingenico’s pricing is largely determined through its network of partners and resellers. There is no universal price listing, and costs can vary based on device type, service level, region, and included software. This can make it challenging for businesses to estimate expenses without going through a partner.

The business offers leasing as well as outright purchases. Enterprise clients looking for predictability favour its terminal-as-a-service model, which bundles hardware, updates, and support into one package. Generally, SDKs and APIs are used to integrate with POS systems and other platforms. Despite their strength, these integrations are usually partner-dependent, and smaller merchants may find onboarding more difficult. Partnerships play a major role in Ingenico’s market approach. This enables scale but also adds a layer between the end user and the technology provider, which can complicate support and customization.

Market Relevance and Competitive Outlook

Ingenico continues to hold a strong position in the global payments market. It is trusted by enterprises and financial institutions that prioritize scale, security, and long-term dependability. Its diverse terminal portfolio, global compatibility, and compliance leadership ensure it remains a serious contender in the space.

However, its limited agility, opaque pricing, and conservative innovation approach may not appeal to newer businesses or those seeking rapid customisation. Fintech disruptors with open platforms and flexible APIs might appeal more to this market. However, this has no impact on Ingenico’s reputation as a dependable, enterprise-level solution. It is particularly well-suited for high-volume merchants, regulated industries, and multinational corporations that need a dependable, secure platform.

FAQs

Is Ingenico compatible with third-party payment gateways?

Yes. Ingenico terminals can be integrated with third-party platforms through SDKs and APIs. However, compatibility depends on the specific terminal and integration provider.

Does Ingenico support mobile wallet and contactless payments?

Yes. Most Ingenico terminals include NFC capabilities for accepting Apple Pay, Google Pay, Samsung Pay, and contactless cards.

Can Ingenico terminals be used for self-service or unattended environments?

Yes. Ingenico offers ruggedized terminals designed for kiosks, parking systems, and vending machines, with features suitable for 24/7 operation.

By 10topmerchantservices June 17, 2025

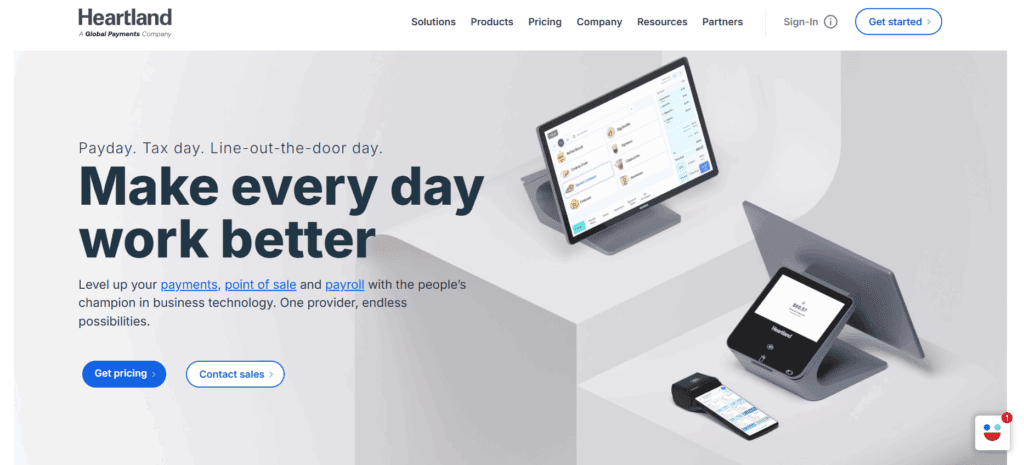

Heartland Payment Systems is a U.S.-based provider of merchant services that focuses on supporting small and medium-sized businesses. Founded in 1997 and acquired by Global Payments in 2016, Heartland continues to operate under its own brand name. Over the years, it has built a strong presence among traditional business types such as restaurants, retailers, and local service providers. Its longevity in the payments space gives it a reputation for reliability and domain expertise. Lets read more about Heartland Payment Systems Review.

Heartland provides a wide range of services, such as marketing tools, payroll management, POS systems, and credit card processing. Business owners who want to use a single provider to streamline their financial operations will find this bundled offering appealing. Although the company has traditionally prioritised physical operations, its digital services for mobile payments and e-commerce have been growing steadily.

One of Heartland’s key brand values is transparency in pricing and business practices. However, customer feedback reveals a range of experiences regarding fees and contracts. While many businesses value the convenience and breadth of services, some have raised concerns over unclear costs and contract terms. Despite these mixed reviews, Heartland continues to be a preferred provider for businesses seeking a well-rounded platform. Its investments in industry-specific tools and its effort to deliver personalized service help maintain its relevance in a highly competitive market.

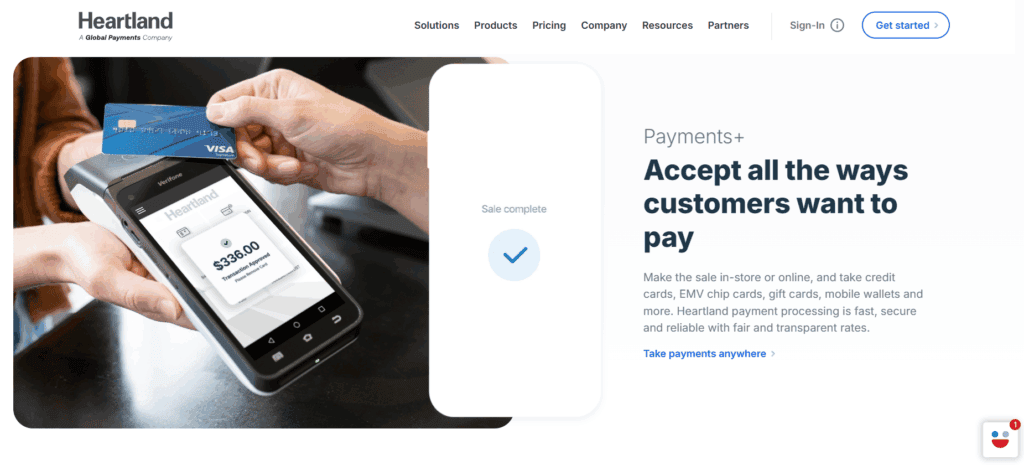

Core Payment Processing Services | Heartland Payment Systems Review

Heartland’s main strength lies in its payment processing platform, which supports a wide range of payment types. This includes all major credit and debit cards, contactless payments, and digital wallets like Apple Pay and Google Pay. This versatility helps merchants accommodate diverse customer preferences at checkout.

The company places strong emphasis on transaction security. Its systems are EMV-compliant and support end-to-end encryption and tokenization, providing an added layer of protection for cardholder data. For merchants, this also means easier compliance with PCI DSS standards, as Heartland provides tools and support for certification.

Heartland also offers real-time transaction reporting. Business owners can access payment data through an online portal or mobile dashboard, allowing them to monitor sales performance in real time. Features like recurring billing and stored card details are also available, making the service suitable for subscription-based models.

Mobile businesses can use Heartland’s portable card readers, which connect to smartphones or tablets. This supports flexibility beyond a fixed retail setting. However, pricing for payment processing varies depending on business type, volume, and contract terms. Some users have reported unclear fee structures or unexpected charges, making it essential to review agreements carefully.

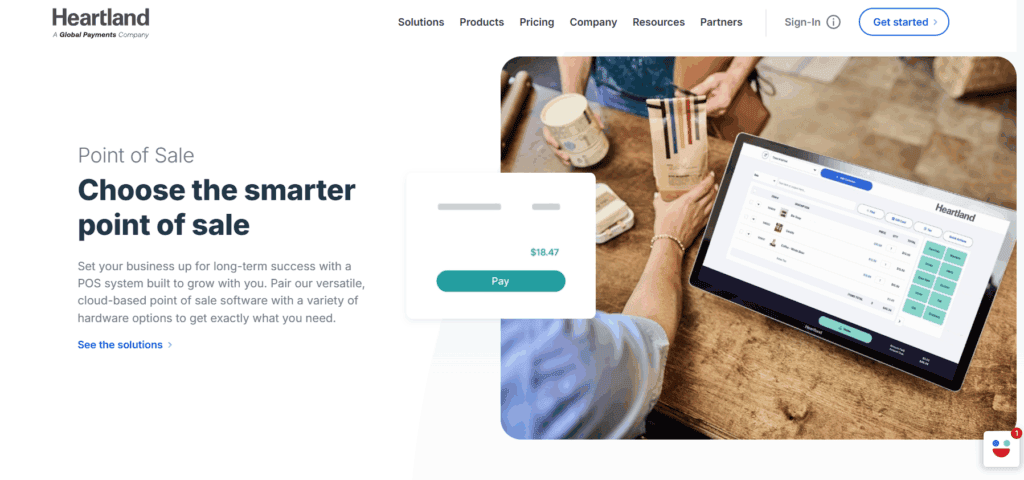

POS Solutions

Heartland’s POS systems are built to serve specific industries, with distinct configurations for restaurants, retail shops, and service providers. This tailored approach ensures that users have access to tools that match their operational workflows.

Restaurant POS setups may include features like table mapping, kitchen order routing, tipping support, and integrations for online food orders. Retail solutions typically include inventory tracking, barcode scanning, employee controls, and multi-store management. These capabilities help businesses optimize daily transactions and reduce manual errors.

Cash drawers, EMV-ready card readers, touchscreen terminals, and receipt printers are among the hardware products that Heartland sells. Since these devices are cloud-connected, remote management access and real-time syncing across locations are made possible.

With its simple interfaces and low training requirements, the POS software is made to be easy to use. Business owners can monitor performance metrics like sales volume, employee productivity, and stock levels with the aid of built-in analytics. However, users have pointed out that response times for hardware problems can differ and that installation might require technical support.

Upfront costs for hardware and recurring software fees should also be clearly understood, as some users report discovering additional charges post-signup.

E-Commerce and Online Payment Capabilities

Heartland has gradually strengthened its offerings for online transactions, though it remains more tailored to businesses that started with in-person sales. The platform now includes features like virtual terminals, hosted checkout pages, and recurring billing capabilities. A virtual terminal enables merchants to manually input card details, which is helpful for phone orders or invoice payments. Hosted payment pages allow non-technical users to create branded checkout experiences quickly and securely.

Heartland’s API infrastructure supports integration with popular e-commerce platforms like WooCommerce, Shopify, and BigCommerce. This flexibility lets businesses retain their existing website design while using Heartland’s payment gateway for secure processing.

Recurring billing and tokenized card storage support subscription-based revenue models. These tools are especially useful for service providers and membership businesses.

However, Heartland does not offer the full suite of e-commerce features found in platforms built specifically for digital retail. There are no built-in cart systems or advanced marketing automations. As a result, the platform is better suited to hybrid businesses expanding online rather than digital-first retailers.

Payroll and HR Services

Heartland’s payroll and human resources services aim to simplify internal operations for growing businesses. These tools cover direct deposit, automated tax filings, year-end documentation, and more. Employers can run payroll from anywhere using cloud-based software and offer employee self-service portals for pay and benefits access.

Time tracking, onboarding new hires, and regulatory compliance tools are among the HR management features offered by the platform. Integrated modules allow businesses to create handbooks, manage benefits, and keep policy records. One of the main advantages is the integration of time tracking, payroll, and POS systems. For instance, payroll can receive data straight from the POS platform, which minimises administrative effort and manual data entry.

However, these services may come at an additional cost and are not automatically bundled with core payment tools. Some users also feel that the interface is dated compared to modern HR tech platforms, although the functionality is largely robust for small to mid-sized businesses.

Customer Engagement and Loyalty Programs

To support customer retention, Heartland offers several tools aimed at improving engagement. These include digital gift card programs, loyalty schemes, and integrated email marketing. Gift cards can be sold both in-store and online and include balance tracking and reload features. They serve as a reliable source of upfront revenue while helping customers share brand value with others.

Loyalty programs can be customized using points, visits, or spend thresholds. These rewards can be easily integrated into the POS system, enabling automated redemption at checkout. Basic email marketing features are also available, allowing businesses to send targeted campaigns based on purchase history. Performance metrics like open rates and redemptions are tracked through the platform.

While these tools are valuable, they may lack the depth and sophistication of standalone CRM platforms. Businesses with advanced marketing strategies may still require external integrations for deeper customer segmentation or campaign automation.

Industry-Specific Solutions

Heartland has developed a suite of tools customized for sectors like restaurants, healthcare, education, salons, and fitness centers. These industry-focused features are built to resolve common pain points faced by operators in each field. For example, restaurants benefit from options like tableside ordering and kitchen display systems. Educational institutions get school payment portals and campus card management. Healthcare practices receive HIPAA-compliant payment solutions and recurring billing tools for treatment plans.

Appointment-driven models are supported in the personal services industry by tools for scheduling, customer profiling, and membership billing. For companies with particular operational requirements, these specialised tools help in establishing a more efficient workflow. Businesses might, however, become dependent on Heartland’s ecosystem, which would make it more difficult to connect third-party tools or switch providers. For people who value simplicity over modular flexibility, this trade-off might be acceptable.

Pricing and Contract Clarity

Heartland markets itself as a provider of “fair and honest” pricing, typically offering interchange-plus pricing models. This format is usually more transparent than flat-rate systems, but additional costs such as monthly service fees, PCI compliance charges, and statement fees can add up. Some merchants appreciate the detailed quotes and predictability of their fees, while others report discrepancies between quoted rates and actual charges. Concerns also surface around contract renewals, cancellation policies, and early termination fees.

To avoid surprises, it’s recommended that businesses request an itemized cost breakdown upfront. Understanding what is included and what may incur extra charges over time is crucial for long-term budgeting. Heartland’s pricing tends to benefit businesses with consistent processing volumes, while those with seasonal or low-volume operations may find more flexibility with alternative providers.

Security, Compliance, and Data Protection

The Heartland has prioritised security. Tokenisation, advanced encryption, and EMV-compliant technologies are all used by the platform to secure transactions at every stage. This is included in Heartland Secure, a proprietary security suite that offers coverage for breach warranties. Tools for PCI DSS compliance, such as risk analyses and continuous security scans, are also available to merchants. For companies that are not familiar with the technical requirements of card data protection, these services are extremely helpful.

For healthcare providers, Heartland offers HIPAA-compliant solutions that help maintain patient data privacy and meet federal regulations. These layers of compliance and protection are essential in today’s cyber-threat landscape. While the tools are comprehensive, users still need to ensure good internal security practices, as human error remains a key risk factor in data breaches.

Customer Support and User Experience

Heartland provides 24/7 phone support through U.S.-based representatives. Additional resources, such as setup guides, training materials, and online account management tools, are available through its website. Customer feedback on support is mixed. Some report responsive and effective service, while others describe delays and difficulty getting issues resolved, especially when using multiple products simultaneously.

Though they might not be as well-designed as those from more recent fintech companies, user interfaces across platforms are usually functional. There are mobile applications available, but some users feel that they are not as responsive as desktop tools. Modern, self-service platforms may be preferred by companies that value hands-on support, while Heartland’s support model may be useful for those that want plug-and-play simplicity.

FAQs

Q1: Is Heartland Payment Systems suitable for small businesses?

Yes, Heartland offers solutions designed for small and mid-sized businesses. However, smaller merchants should evaluate pricing and contract terms closely to ensure alignment with their operational needs.

Q2: Does Heartland support integration with e-commerce platforms?

Yes, Heartland supports integration with Shopify, WooCommerce, BigCommerce, and other platforms using APIs, allowing businesses to process payments online without major changes to their website.

Q3: What kind of support does Heartland provide?

Heartland offers 24/7 U.S.-based phone support and online training resources. Service experiences vary by user, so prospective customers may want to ask about service SLAs and onboarding assistance.

By 10topmerchantservices June 14, 2025

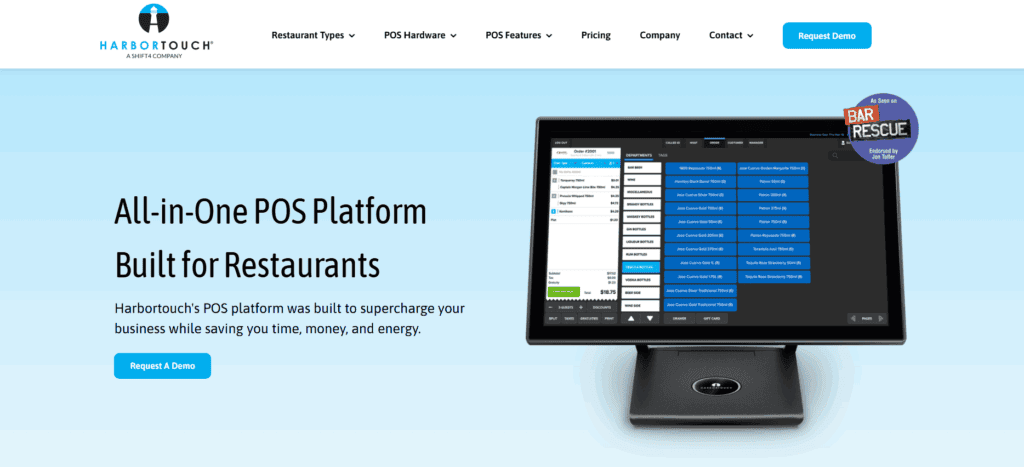

Harbortouch, established in 1999, is a well-known brand in the POS ecosystem, serving diverse businesses like retail, dining, and salons. It has grown significantly by offering an “alluring business plan” centered on a “free” POS system. This model particularly appeals to small and mid-sized businesses seeking high-quality POS software and hardware without substantial upfront investment. The brand’s reputation comes from its integrated solutions and end-to-end payment processing, backed by its parent company, Shift4 Payments, positioning itself as an all-in-one solution for affordability, flexibility, and convenience. Lets read more about Harbortouch Review.

But it’s important to know what “free” means. Companies frequently sign long-term agreements that require them to use Harbortouch’s payment processing, which has terms and fees. In the end, Harbortouch works well for companies that require a complete POS system and are at ease with a contract-based arrangement. It might not be the best option for people who value complete pricing transparency or who want to use their own payment processor. Before committing, it’s important to consider the whole picture, including the product’s features, costs, contract terms, and support.

Point of Sale System Overview | Harbortouch Review

Harbortouch offers two main POS systems: Harbortouch Elite for high-volume environments (restaurants, large retailers) and Harbortouch Echo, a more compact, tablet-style system for smaller or quick-service locations. Both feature touchscreen interfaces, preloaded software, and integrate seamlessly with Harbortouch’s payment processing. The software is customized for each business type, offering restaurant table management, retail inventory, or salon appointment scheduling.

A notable feature is their plug-and-play capability; hardware and software arrive pre-configured, streamlining setup. Systems update remotely for security patches or new features. Harbortouch systems support both cloud-based and local data storage, ensuring operations continue even if internet connectivity is lost. While POS equipment is “free,” businesses commit to a fixed-term contract for Harbortouch’s services, including bundled software licensing, customer support, and processing fees.

Key Features and Tools

Harbortouch’s POS systems include various built-in features to streamline daily operations, varying slightly by industry and POS model, but with a strong baseline across all systems.

Inventory management is essential, allowing automatic reorder thresholds, low-stock alerts, and real-time stock monitoring. Restaurants benefit from highly detailed menu customization with modifiers, combos, and kitchen printer routing. Employee management tools enable supervisors to monitor staff hours, assign permissions, create roles, and generate labor reports for scheduling and payroll.

For customer-facing features, Harbortouch supports loyalty programs and gift cards. Businesses can capture customer data at checkout for marketing or rewards. CRM tools are basic but offer a starting point. Reporting tools cover sales, labor, inventory, and other metrics, viewable on the terminal or remotely via the online dashboard. While not as advanced as some enterprise systems, the reporting suite is adequate for most small and medium operations.

Payments and Processing Capabilities

Harbortouch systems are tightly integrated with Shift4 Payments, their in-house processor, enabling fast, secure transactions across various payment methods (EMV chip cards, magnetic stripe, contactless, mobile wallets). This bundling offers a single-vendor experience, meaning one point of contact for support, fewer compatibility issues, and easier reconciliation.

This also implies that you are unable to use a different processor. Price comparison is difficult because merchants must request a quote and the website does not display rates transparently. With data tokenisation for extra security, Harbortouch conforms with industry standards for PCI-DSS and end-to-end encryption. Recurring billing, split payments, tip adjustments, and refunds are among the supported features. The system works with signature capture screens and PIN pads that face customers. Payment processing is reliable overall, but companies should carefully read the terms to be aware of all the costs.

Software Usability and Interface

One of Harbortouch’s strengths is its intuitive and minimalistic user interface, making it easy for staff to learn. For restaurants, the layout features drag-and-drop table maps, customizable menus, and visual modifiers. In retail, the product catalog and search functions are quick and responsive, enabling fast transactions.

The interface is responsive on all hardware and supports touch gestures. Settings and administrative features are accessed via a password-protected portal, ensuring only authorized personnel can make changes. User permissions can be adjusted for different roles (managers, servers, cashiers), keeping the interface clear for frontline users and secure for business owners.

While beginner-friendly, some users report needing support for advanced features like custom reporting or loyalty configurations. There can also be a slight delay in data syncing across devices, especially with poor network conditions. Still, the interface balances ease of use with functionality depth for most businesses.

Mobile and Remote Access

Harbortouch addresses mobility and remote control with its Harbortouch Online platform, allowing owners and managers to monitor operations remotely. From any internet-connected device, users can view real-time sales reports, track employee hours, check inventory, and run basic reports. This is especially useful for multi-location businesses or owners on the move.

With support for major payment methods and the ability to connect to the backend for synchronised reporting, mobile POS options are available for quick-service or line-busting settings. Although Harbortouch does not have a fully functional mobile app like some of its cloud-native competitors, its web dashboard offers adequate remote oversight. Important incidents like system failures or low inventory can set off alerts and notifications.

Limitations exist in remotely editing settings or configuring the POS; most changes still require direct terminal access or support assistance. Nevertheless, these remote access features are a meaningful inclusion, reflecting Harbortouch’s effort to remain competitive in a mobile-first business environment.

Hardware Packages and Build Quality

Harbortouch provides hardware as part of its bundled offering, including touchscreen terminals, cash drawers, receipt printers, barcode scanners, and card readers. Restaurant packages also include kitchen display systems and kitchen printers. The hardware build quality is generally solid. The Elite terminal has a sleek, professional design with a high-resolution touchscreen and durable casing, designed for heavy daily use.

The Echo model is more compact and cost-effective, resembling a tablet, ideal for limited counter space. While less powerful than Elite, it delivers reliable performance for low to moderate transaction volumes. Harbortouch also offers customer-facing displays for enhanced checkout transparency and tip prompting. Integrated peripherals ensure seamless component functionality with the software.

If hardware malfunctions, support is available, though fees may apply based on warranty and contract terms. Businesses should also note that while hardware is “free,” returning or canceling service might incur charges for equipment recovery or refurbishment. Overall, the provided hardware is professional-grade, matching leading POS vendors.

Pricing Structure and Contracts

Harbortouch’s pricing model is widely discussed due to its “free POS system” marketing. While hardware and software are provided without upfront charges, businesses typically enter a multi-year service contract, including mandatory payment processing through Shift4 Payments.