CardConnect Review

Established in 2006, CardConnect has carved a significant niche in the payment processing industry, catering especially to businesses that prioritize integrated and secure transaction solutions. Based in Pennsylvania, the company became part of First Data in 2017, which later merged into Fiserv. Despite the acquisition, CardConnect continues to maintain its brand identity, focusing on offering flexible and secure payment services to businesses of all sizes. Lets read more about CardConnect Review.

CardConnect goes beyond basic payment processing, offering solutions designed to streamline operations through ERP integrations and eCommerce platforms. Its proprietary tools, such as CardPointe, provide businesses with a centralized, secure system to manage transactions and customer data.

However, CardConnect is not without its challenges. While many users praise its technology and security features, concerns around pricing transparency and customer support do surface. This review will provide a comprehensive look at CardConnect’s services, pricing structure, integrations, customer support, and suitability for various business types.

Key Features and Services | CardConnect Review

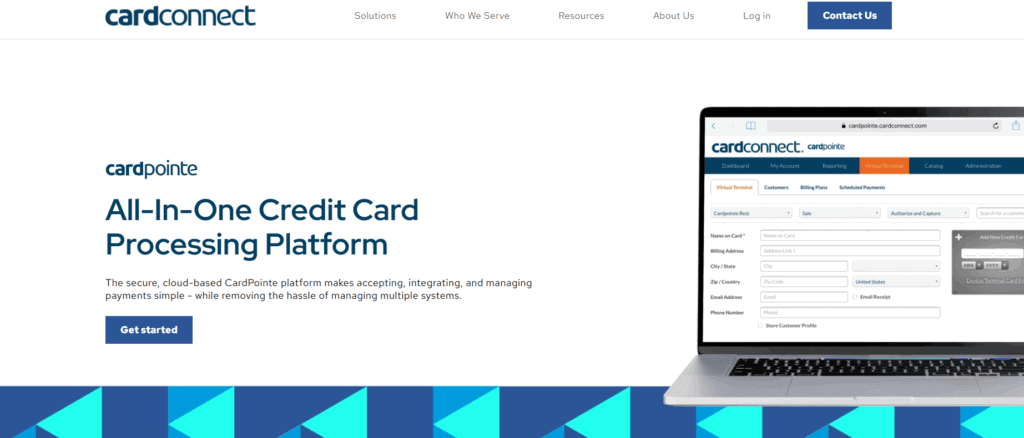

CardConnect provides a comprehensive suite of services aimed at simplifying payment acceptance and strengthening transaction security. At the core of its offerings is the CardPointe platform, a cloud-based solution that enables businesses to monitor real-time transactions, manage disputes, and create detailed reports from an intuitive dashboard accessible via both desktop and mobile devices.

CardConnect also integrates seamlessly with Clover POS systems, offering tailored solutions for industries such as retail, hospitality, and professional services. These POS systems come with customizable software to suit different operational needs.

Security is another major strength. CardConnect implements point-to-point encryption (P2PE) and tokenization to protect sensitive cardholder information, a particularly valuable feature for highly regulated sectors like healthcare.

In addition, CardConnect supports ERP integrations, most notably with SAP, enhancing payment workflows for larger enterprises. For businesses seeking custom payment applications, robust APIs are available to support specialized development needs.

While CardConnect’s features suit a broad range of businesses, smaller merchants may find the system’s complexity more than they require depending on their technical capacity.

Pricing and Fees

CardConnect’s pricing model is not openly published, which can make upfront comparisons challenging. Generally, it follows an interchange-plus pricing structure—often preferred for its transparency compared to flat-rate models. However, actual fees are typically customized during contract negotiations and can vary by business size, industry, and transaction volume.

Common additional charges may include monthly account fees, gateway fees for CardPointe access, PCI compliance fees, and early termination penalties. Businesses opting for Clover POS systems might also face equipment leasing and maintenance costs.

While CardConnect’s pricing can be highly competitive for high-volume businesses, smaller merchants should scrutinize potential add-on fees carefully. The best pricing tends to go to businesses processing substantial transaction volumes, where customized quotes reflect card mix and industry type.

In short, CardConnect can offer excellent value—especially for businesses willing to negotiate and carefully review contract terms upfront.

CardPointe Platform Overview

CardPointe is one of CardConnect’s signature products, providing a cloud-based system where businesses can manage all payment-related activities. From real-time transaction monitoring to detailed reporting and account reconciliation, CardPointe centralizes payment management in one accessible dashboard.

Key features include a virtual terminal for accepting card-not-present payments, ideal for remote billing and telephone orders. The CardPointe mobile app further enhances flexibility, allowing businesses to manage payments on the move.

Security is deeply embedded in the platform, offering built-in tokenization and P2PE to minimize exposure to cardholder data and maintain PCI compliance. The user interface is straightforward and accessible, even for businesses without dedicated IT support.

For most small to medium-sized businesses, CardPointe covers daily operational needs effectively. Larger businesses with complex reporting requirements may need additional customizations, but the platform provides an excellent starting point for streamlined payment management.

Security and Compliance

Security is a cornerstone of CardConnect’s services. The company leverages point-to-point encryption and tokenization to protect sensitive data from the moment it is captured until it reaches secure servers.

Rather than storing raw card information, It replaces it with unique tokens, significantly reducing the risk of breaches. This approach not only safeguards customer data but also simplifies PCI DSS compliance for merchants.

CardConnect also actively supports businesses in completing their PCI compliance requirements, offering tools, resources, and expert guidance to help navigate the process. This is especially critical for industries like healthcare and education, where data protection regulations are stringent.

While some small businesses may initially find PCI compliance procedures daunting, CardConnect’s support systems are designed to ease this transition and mitigate long-term risk.

Integration and Compatibility

Integration flexibility is one of CardConnect’s standout features. The platform connects seamlessly with major ERP systems such as SAP, Oracle, and Microsoft Dynamics, enabling enterprises to incorporate payment processing directly into their core business operations.

It also supports eCommerce integration with platforms like Shopify, Magento, and WooCommerce through ready-to-use plugins, simplifying secure online transactions.

For businesses with unique needs, CardConnect’s robust APIs allow developers to create tailored payment applications. Additionally, the compatibility with Clover POS systems gives merchants access to a variety of hardware solutions, from portable card readers to fully integrated terminals.

While the integration capabilities are extensive, setting up more complex connections—particularly with ERP systems—may require technical expertise and onboarding assistance.

Customer Support and Service

CardConnect offers 24/7 customer support via phone, email, and live chat, supplemented by a self-service knowledge base featuring FAQs and troubleshooting guides.

However, customer feedback on support experiences is mixed. Some businesses report smooth onboarding and helpful account management, while others cite challenges such as delayed responses to billing inquiries or difficulty resolving disputes.

Larger businesses or those assigned dedicated account managers tend to experience better service quality. Setting clear communication expectations and maintaining direct contact with a representative from the beginning can improve overall satisfaction.

Smaller merchants should be mindful that support experiences can vary and may need proactive management to ensure consistent assistance.

Pros and Cons of CardConnect

Pros

Strong security features, including tokenization and point-to-point encryption

Powerful integrations with ERP and eCommerce platforms

User-friendly CardPointe platform

Mobile-friendly payment management

Customizable APIs for developers

Cons

Lack of publicly available pricing information

Potential for hidden or ancillary fees

Inconsistent customer service experiences

Equipment costs for POS hardware can add up

Ideal Businesses for CardConnect

CardConnect’s wide range of services makes it a solid fit for mid-sized and large businesses, particularly those in sectors like healthcare, education, retail, and B2B services where security and regulatory compliance are priorities.

It is especially effective for businesses requiring:

ERP integrations with systems like SAP or Oracle

Omnichannel payment support across online, mobile, and in-person sales

Advanced reporting and real-time transaction management

On the other hand, very small businesses or startups with low transaction volumes may find the service costs comparatively higher than those of more basic, flat-rate payment processors like Square or PayPal.

Final Verdict: Is CardConnect Worth Considering?

For businesses seeking a highly secure, flexible, and integration-ready payment processor, CardConnect is a compelling option. Its powerful CardPointe platform, robust security protocols, and deep ERP compatibility make it an ideal choice for organizations aiming to scale efficiently.

However, potential customers should carefully evaluate contract terms and fee structures to avoid hidden costs. Businesses willing to invest the time in setting up a strong relationship with CardConnect and understanding the full cost structure will likely find it a valuable long-term partner.

In conclusion, CardConnect is best suited for growing businesses and enterprises looking for secure, scalable, and customizable payment processing solutions.

FAQs

Is CardConnect a good option for small businesses?

CardConnect offers advanced features that might be more suitable for mid-sized and larger businesses. Small businesses seeking simple, transparent pricing may prefer processors like Square unless they specifically require strong security and ERP integrations.

How does CardConnect protect payment data?

CardConnect employs tokenization, point-to-point encryption (P2PE), and helps businesses achieve PCI DSS compliance, offering multiple layers of protection for sensitive cardholder data.

What benefits does the CardPointe mobile app offer?

The CardPointe mobile app enables businesses to monitor transactions, process payments, and manage account activities remotely, offering flexibility for merchants operating outside traditional storefronts.