BlueSnap Review

Businesses in today’s digitally driven economy want comprehensive payment platforms that manage everything from subscriptions to international trade, not just the ability to process credit cards. BlueSnap enters this market as a scalable integrated payment solution. On a single platform, it facilitates international transactions, SaaS billing, eCommerce, and mobile payments. BlueSnap markets itself as a one-stop shop that reduces friction in the purchasing process with the aim of streamlining complex payment operations. Its global-first strategy, which supports a variety of currencies, payment options, and languages, is what sets it apart. Because of this, SaaS providers and eCommerce companies with a global presence find it particularly appealing. Lets read more about BlueSnap Review.

Rather than managing separate tools for billing, fraud checks, and checkout experiences, BlueSnap merges them all into a single system. This not only streamlines the buyer experience but also reduces backend complexity for merchants. Still, there’s a tradeoff. While BlueSnap offers powerful features, it may take more time and expertise to navigate than simpler plug-and-play options. For businesses needing international reach and tailored payment systems, however, BlueSnap is a strong candidate that delivers depth and flexibility.

Company Overview and Background | BlueSnap Review

Founded in 2001 and based in Waltham, Massachusetts, BlueSnap has grown into a global platform aimed at simplifying payments for modern businesses. Whether it’s online, mobile, or invoice-based payments, BlueSnap provides a streamlined way to accept them; all through a single point of integration. Unlike more conventional processors, BlueSnap bundles tools like merchant services, analytics, recurring billing, and fraud protection into one system. It’s this consolidated experience that makes it particularly appealing to businesses operating in or expanding to international markets.

It caters to a wide range of sectors including SaaS, eCommerce, professional services, travel, and education. Supporting both B2B and B2C transactions, its flexibility is one of its strongest selling points. Its Intelligent Payment Routing system routes payments through the most efficient path, optimizing for approval rates and reducing costs. Though not as widely recognized as PayPal or Stripe, BlueSnap has carved out a niche for itself among companies seeking more customized payment operations. Its tools are geared toward enterprises that want more than basic transaction handling; they want full control and transparency across global operations.

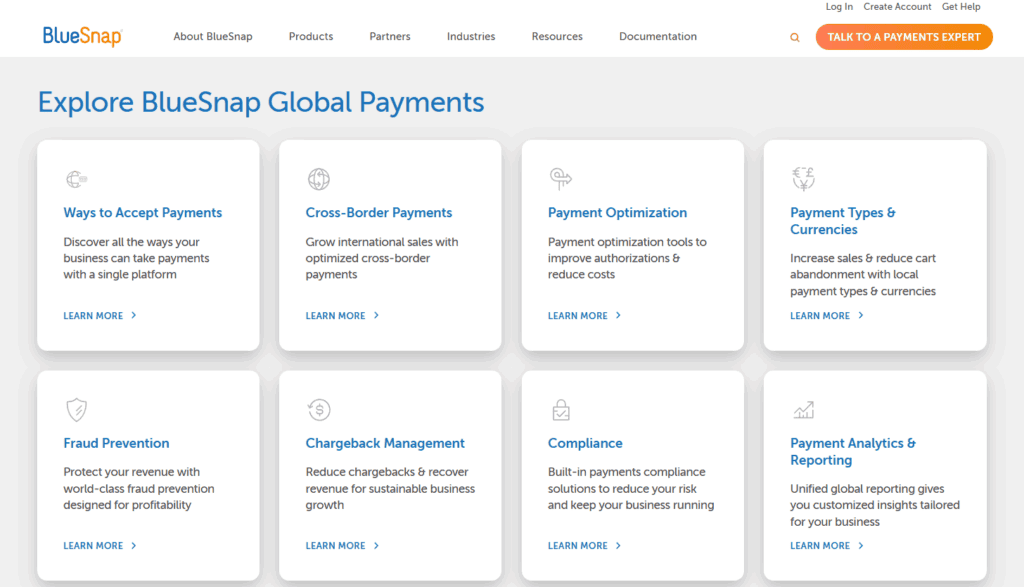

Key Features and Capabilities

BlueSnap combines merchant accounts, gateway services, billing, and other crucial payment functions into a single, cohesive ecosystem. This lessens the burden of coordinating various systems or managing several vendors. The Intelligent Payment Routing engine is one of its superior tools. Using its global network of more than 30 banks, BlueSnap dynamically chooses the optimal path to increase transaction success and reduce failures. For multinational companies, this feature greatly lowers checkout friction. Additionally, it has strong recurring billing capabilities. Fixed, usage-based, and tiered billing are among the pricing models that businesses can set up. With dunning management features, you can retain customers and recover unsuccessful payments without having to manually follow up.

B2B users benefit from tools like invoicing, PO-based payments, and ACH support. On top of that, BlueSnap includes features for tax compliance, fraud protection, and insightful analytics.That said, the platform’s expansive toolset may appear overwhelming to newcomers or very small businesses. While BlueSnap delivers high functionality, setup and integration can require more technical skill than platforms designed for plug-and-play simplicity.

Supported Payment Methods

BlueSnap gives businesses the tools to accept a wide variety of payment types, supporting diverse buyer preferences across the globe. Traditional credit and debit cards; including Visa, Mastercard, Discover, and American Express; are just the beginning. Digital wallets like PayPal, Apple Pay, and Google Pay are also accepted, appealing to users who prefer mobile-first transactions. Additionally, local payment methods such as iDEAL in the Netherlands, SEPA in Europe, and Sofort in Germany make the platform globally versatile. For B2B needs, ACH debits, wire transfers, and bank transfers are supported, especially useful for businesses handling large or recurring invoices. These options lower processing costs while providing trusted alternatives to cards.

BlueSnap also accommodates over 100 global currencies, with settlement options in multiple ones. This allows a shopper in Japan to pay in JPY while the business settles in USD; ensuring both convenience and consistency. Overall, the platform’s extensive payment coverage makes it a valuable tool for international businesses. Just be aware that some payment methods may require activation or configuration based on region or business type.

Geographic Reach and Currency Support

Designed to support global commerce, BlueSnap allows merchants to accept payments from more than 200 countries in over 100 currencies. This international reach enables companies to grow without needing multiple service providers or new integrations for every market. Automatic currency conversion helps customers pay in their local currency, which improves the checkout experience and reduces cart abandonment. Meanwhile, businesses can settle in the currency of their choice, aiding in smoother cash flow management.

Additionally, BlueSnap facilitates adherence to global data and tax laws. The platform has built-in tools to help businesses stay compliant as they grow, whether it’s with PSD2 requirements or VAT collection in Europe. Another benefit is intelligent payment routing, which lowers geographic mismatches that often result in declines and raises acceptance rates by directing payments through regional acquiring banks. However, despite its broad reach, some businesses may encounter restrictions or approval barriers, particularly those in regulated or high-risk industries. Furthermore, some regional support might not be as comprehensive or robust as that provided by more localized providers.

Payment Gateway and API Integration

BlueSnap offers a powerful, developer-friendly payment gateway backed by RESTful APIs and SDKs for languages like Java, PHP, Python, and .NET. These tools allow companies to embed payment capabilities directly into their websites or apps. Its API gives businesses full control; allowing them to build custom checkout flows, handle subscriptions, retrieve reports, and manage customer data. This kind of flexibility is invaluable for companies with unique processes or branding needs.

Prebuilt integrations are available for platforms like Shopify, WooCommerce, Magento, and BigCommerce. These reduce development time for smaller businesses while still offering basic flexibility. Hosted Payment Pages are available for companies that don’t want to handle card data directly. These pages help meet PCI requirements and offer a faster path to deployment. That said, the richness of features may result in a steeper learning curve. Businesses without technical teams may need extra support during implementation or may have to rely on BlueSnap’s onboarding services for full functionality.

Checkout Experience and Customization

BlueSnap offers merchants multiple options for customizing the checkout process. From hosted pages to API-driven designs, businesses can choose the level of integration and control that fits their capabilities. Hosted checkout pages are quick to deploy and PCI compliant, ideal for businesses that want to start accepting payments without custom coding. These pages can be customized to reflect brand colors, logos, language, and currency.

Embedded checkout forms are another option for companies looking to provide more seamless customer experiences. Developers can design customized checkout processes that blend in with the overall look and feel of the website by utilizing BlueSnap’s APIs. Customers can shop in their native language and pay with their local currency thanks to integrated language localization and currency selection. This decreases drop-offs during the checkout process and promotes trust. Despite its customization capabilities, BlueSnap may not offer as many design options for companies seeking unique, high-quality visual templates. Developer input is frequently needed for deep personalization, which may not be suitable for small or non-technical teams.

Pricing, Fees, and Contracts

BlueSnap doesn’t use a flat pricing model; it typically works with interchange-plus pricing. That means businesses pay the actual interchange fee from the card networks, plus a markup from BlueSnap. This structure is generally more transparent but also more variable. Because rates depend on the merchant’s transaction volume, industry, and geography, businesses must contact BlueSnap for a custom quote. This makes it harder to compare against other platforms without going through the sales cycle.

Additional fees may apply for things like chargebacks, currency conversions, or add-on features like recurring billing. While some users find BlueSnap competitively priced, others express concerns about the lack of clarity before signing up. On the plus side, BlueSnap usually avoids long-term contracts or stiff cancellation fees, which offers more flexibility. However, terms can vary, so it’s important to read the agreement closely before committing. In short, BlueSnap is priced for businesses that need a feature-rich, international platform; possibly more than basic providers, but also offering more comprehensive value.

Security and PCI Compliance

Security is at the core of BlueSnap’s offering. It maintains Level 1 PCI-DSS compliance, the highest certification in the industry, and uses encryption and tokenization to secure customer payment data. Its fraud prevention suite includes tools like behavioral analytics, velocity rules, and device fingerprinting, all designed to stop fraudulent activity before it impacts the business. These tools are automated but customizable, letting merchants tweak their fraud rules as needed. BlueSnap also supports tokenization, replacing sensitive card details with unique tokens that are stored securely. This helps reduce the risk of data breaches and simplifies compliance for merchants managing recurring payments.

Intelligent Payment Routing again plays a dual role here; by routing payments through local acquirers, it reduces not just failed transactions but also exposure to fraud-prone regions. While BlueSnap provides extensive resources for PCI compliance, merchants are still responsible for configuring their own systems securely. Businesses must follow implementation best practices to fully leverage BlueSnap’s security benefits.

Recurring Billing and Subscription Management

BlueSnap provides an integrated recurring billing solution that is perfect for membership services, subscription boxes, and SaaS platforms. Custom plans with adjustable billing intervals; monthly, yearly, usage-based, or tiered; are simple for merchants to set up. Free trials, discounts, renewals, and mid-cycle upgrades or downgrades are all supported by the system. Every change is automatically reflected in subsequent invoices, which improves accuracy and minimizes manual administrative labor.

Dunning tools are included to reduce churn; BlueSnap automatically emails users when a payment fails and retries the transaction based on preset rules. These recovery strategies can have a meaningful impact on recurring revenue. The recurring billing engine is powerful, but deeper CRM or ERP integrations may require development resources. Some users may also find the UI less intuitive compared to platforms built specifically for subscriptions. Still, for businesses wanting one system to manage payments and billing, BlueSnap offers a well-integrated and customizable solution that reduces the need for multiple software tools.

Reporting, Analytics, and Dashboard

BlueSnap’s dashboard offers a comprehensive overview of payment activity, including real-time and historical transaction data. It’s designed to give businesses insight into sales performance, chargebacks, revenue trends, and approval rates. Prebuilt reports include daily summaries, refund history, and subscription health. Businesses can filter these by date, region, payment type, and more to drill down into specifics. One of its most useful features is real-time monitoring. Businesses can identify changes in approval rates or payment failures immediately and take action before it affects revenue.

Segmenting users by geography, device, or behavior allows for targeted marketing and checkout optimization. These insights can boost sales and reduce drop-off rates. That said, BlueSnap’s data visualization tools are less advanced than some newer platforms. While the data itself is robust, the visuals may feel dated to users expecting dashboard aesthetics similar to Stripe or Square. Still, the analytics depth is impressive, and for businesses that need operational transparency, BlueSnap delivers solid reporting capabilities.

Customer Support and Developer Resources

BlueSnap provides a number of customer service channels, such as email, phone support, and live chat. Dedicated account managers are often made available to high-volume clients, guaranteeing a more individualized support experience. Users’ opinions vary; some praise the promptness, while others point out that technical problems take a while to resolve. BlueSnap provides a wealth of resources for developers through its Developer Hub. This includes comprehensive SDKs, integration manuals, well-organized API documentation, and testing access to a sandbox. For popular platforms like Magento, WooCommerce, and Salesforce, sample code is available, which makes it easier for technical teams to integrate.

The sandbox environment allows developers to test payment flows, simulate different transaction types, and troubleshoot before going live. This is particularly useful for businesses with complex requirements or custom workflows that need assurance before launching. There’s also a searchable knowledge base for less technical users. It includes FAQs, how-to articles, and setup instructions that can help during onboarding or when troubleshooting common issues. However, support quality and response times tend to scale with business size. Small companies might find themselves waiting longer or needing to escalate tickets more often. If fast and high-touch support is a must, businesses should clarify the level of service included before signing up.

BlueSnap for B2B vs. eCommerce vs. SaaS

BlueSnap is designed to be adaptable across industries, but its strongest use cases are found in SaaS and B2B models. For SaaS companies, the platform’s flexible billing engine, subscription management, and dunning features are highly relevant. It allows vendors to offer monthly, tiered, or usage-based plans without needing third-party billing software. In B2B, BlueSnap’s ability to process ACH transfers, wire payments, and PO-based invoicing makes it more suited to corporate payment structures. This is especially helpful for businesses dealing with long sales cycles or custom billing agreements. Its tax and compliance features also assist in navigating the complexities of B2B sales across borders.

BlueSnap offers strong eCommerce tools, including fraud prevention, mobile optimization, and multi-currency checkout. It might not have as many marketing features as platforms that are more focused on Shopify (such as loyalty integrations or upsell prompts), but it has a stronger backend. Industry-specific tools may be preferred by companies with highly specialized needs or limited development resources. However, BlueSnap’s offering is ideal for businesses in growth mode, particularly those with multiple sales models, if flexibility, scalability, and unified global payments are the goals.

Pros and Cons Summary

BlueSnap brings a wide array of advanced features under one roof, making it a compelling solution for businesses that want to manage everything from checkout to compliance in a single system. Its global reach, support for multiple currencies and payment methods, and recurring billing tools are particularly strong.

Pros include:

Intelligent Payment Routing

Broad global coverage

Flexible subscription billing

Advanced fraud tools

Developer-friendly APIs

Real-time analytics

Cons include:

Lack of transparent pricing

Learning curve for setup

Inconsistent customer support for small businesses

Customization may require technical skill

Ultimately, BlueSnap is ideal for businesses that want a robust, all-in-one payment solution capable of scaling across countries and handling complex billing needs. It’s less ideal for merchants looking for simplicity or entry-level tools, but shines for companies with long-term global ambitions.

Final Verdict : Who Is BlueSnap Best For?

For larger and mid-sized businesses that require an end-to-end payment infrastructure, BlueSnap is a good option. SaaS platforms, international eCommerce brands, and enterprise vendors find it especially appealing due to its capacity to manage B2B transactions, recurring billing, and international payments. The integration of numerous features, including analytics, fraud protection, merchant accounts, and gateways, into a single platform is what distinguishes BlueSnap. This lessens dependency on several vendors and streamlines operations. The possibility of customization is also advantageous for companies that have access to development resources or technical teams.

However, businesses just starting out or those without dedicated tech support may find the setup process too intensive. Platforms like Stripe or PayPal offer easier onboarding, albeit with fewer options for scaling globally or handling nuanced billing needs. If your company is ready to scale internationally and needs advanced features baked into a customizable payment solution, BlueSnap is well worth considering. It may require more investment upfront, but the long-term operational efficiency and control can pay off.

FAQs

Q1: Is BlueSnap suitable for small businesses or startups?

BlueSnap is best suited for businesses that are mid-sized or scaling. Its feature set is powerful, but smaller startups may find the setup too complex without tech resources.

Q2: How does BlueSnap compare with Stripe or PayPal?

BlueSnap offers stronger global tools and B2B billing features. Stripe and PayPal, however, are easier to set up and may better suit small businesses or solo entrepreneurs.

Q3: Can BlueSnap handle complex global tax and compliance issues?

Yes. BlueSnap includes VAT handling, PSD2 compliance, and tax automation tools. It’s built to support international sales without requiring external tax services.