AffiniPay Review

AffiniPay is a payment processing platform built specifically for professionals, with a strong emphasis on the legal sector. Unlike general-purpose solutions like Stripe or Square, It is uniquely structured to ensure compliance with trust accounting standards, making it a standout choice for law firms managing client funds. Its primary product, LawPay, is well-regarded for simplifying legal payment workflows while adhering to IOLTA (Interest on Lawyers’ Trust Accounts) compliance. Lets read more about AffiniPay Review.

The features, cost, usability, integrations, security, customer support, and general appropriateness for professional services of AffiniPay will all be covered in this thorough review. For legal and other professional firms, we want to know if AffiniPay is really the best option or if there is a more affordable option.

Even though AffiniPay offers many great features, such as secure processing, robust legal software integrations, and personalized payment links, it might not be the best option for all businesses. It may not be as adaptable for wider use due to its emphasis on legal professionals, and not everyone will find its fee structure appealing.

By the end, you’ll understand whether AffiniPay aligns with your needs or whether exploring other options could be more advantageous. This analysis will remain factual, neutral, and free from promotional influence.

Company Overview | AffiniPay Review

AffiniPay is a niche payment processor that tailors its services to law firms and other professional service providers. Unlike traditional processors aimed at mass markets, It prioritizes legal compliance and secure financial transactions for regulated industries.

History and Background

Since its founding in 2005, AffiniPay has expanded to provide services to thousands of professional practices and law firms. Its flagship product, LawPay, is designed to assist lawyers in managing client money while adhering strictly to IOLTA compliance and trust accounting regulations. It has grown over time to serve other regulated professions, including accountants and architects.

Mission and Key Offerings

AffiniPay’s mission is to deliver secure, easy-to-use, and compliant payment solutions tailored for professionals. Its offerings include:

Processing for major credit and debit cards

ACH and eCheck payment capabilities

Custom payment link generation and online invoicing

Integrations with platforms like Clio, QuickBooks, and MyCase

Industries Served

While AffiniPay supports various professionals, including architects and accountants, it’s most effective in legal environments. Businesses outside regulated industries may not benefit as much from its specialized features and could find more generic platforms more appropriate.

How AffiniPay Works

While adhering to stringent industry regulations, professionals can accept payments with AffiniPay. Its system is made for ease of use, legal compliance, and safe financial management, all of which are crucial for lawyers who oversee client retainers.

Payment Processing Workflow

The workflow is streamlined. Clients receive invoices with secure links, payments are processed through AffiniPay, and funds are routed to either trust or operating accounts based on the transaction. This separation is essential for law firms to meet ethical and legal obligations.

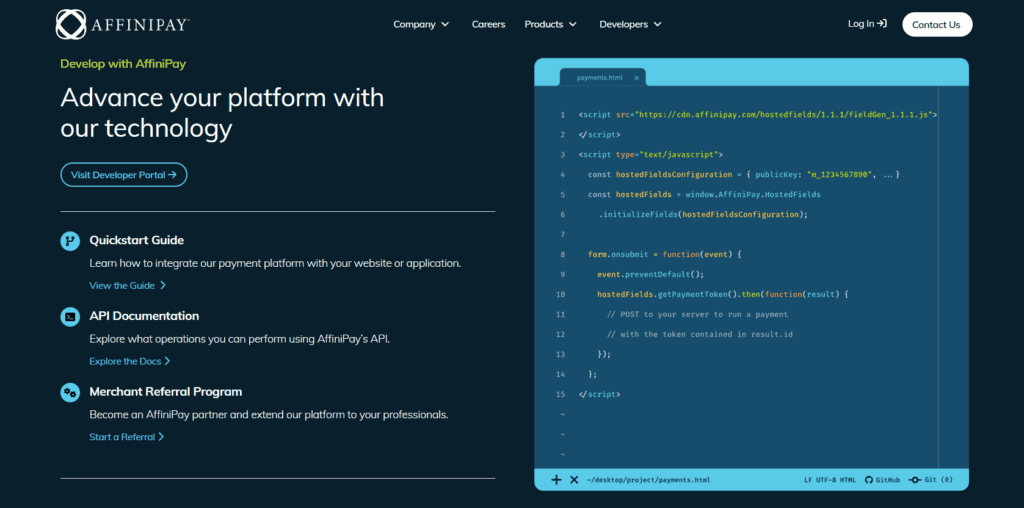

Integration with Professional Software

AffiniPay integrates easily with legal and accounting tools including Clio, PracticePanther, MyCase, QuickBooks, and Xero. These integrations automate tasks like invoice creation, payment tracking, and reconciliation, reducing manual effort and improving accuracy.

How Funds Are Handled (IOLTA Compliance for Law Firms)

Maintaining the separation of trust accounts is a must for law firms. By ensuring that customer funds are kept separate from business accounts, AffiniPay promotes IOLTA compliance and lowers the possibility of ethical violations.

Key Features of AffiniPay

It distinguishes itself through features specifically crafted for legal and professional service needs. These features ensure compliance, improve payment efficiency, and strengthen security.

Payment Processing Capabilities

AffiniPay supports Visa, Mastercard, American Express, Discover, and ACH payments. It offers a secure gateway that ensures fast and compliant processing of transactions.

Trust Accounting Compliance (IOLTA & ABA Rules)

By ensuring that client funds are automatically deposited into the right accounts and strictly adhering to IOLTA and ABA standards, the platform lowers the possibility of accounting errors.

Integration with Legal and Professional Software

Seamless integrations with software like Clio, MyCase, and QuickBooks streamline payment collection, automate reconciliations, and simplify invoice generation—all within the tools professionals already use.

Security & PCI Compliance

As a PCI Level 1 compliant provider, It uses advanced encryption, tokenized payments, and fraud detection to protect sensitive financial data and reduce chargebacks.

Custom Payment Links & Online Invoicing

Professionals can generate unique payment links, shareable via email or text, that enable clients to pay directly—no login needed. This makes the payment experience smoother for both parties.

Recurring Payments & Installment Plans

With AffiniPay’s automated recurring billing and installment options, businesses can effectively manage subscription-based services and ongoing retainers.

Because of these characteristics, It is a great choice for professionals under regulation who require safe, efficient, and legally compliant payment methods.

Pricing & Fees

AffiniPay’s pricing reflects its specialized nature. While generally comparable to other premium processors, some businesses may find it less cost-effective if they don’t need compliance features.

Breakdown of Processing Fees

There are no setup or monthly fees. The primary charges include:

Credit/Debit Card Transactions: 2.95% + $0.20 per transaction

ACH/eCheck Payments: Flat $2 per transaction

Chargebacks: A dispute fee may apply depending on the case

Monthly or Hidden Fees

Without monthly maintenance, PCI compliance, or contract cancellation fees, It offers a transparent fee structure. However, there may be additional fees for advanced integrations or unique features.

How AffiniPay Compares on Pricing

Stripe: 2.9% + $0.30 per transaction; lacks legal compliance tools

Square: 2.6% + $0.10; focuses on retail, not legal services

PayPal: 3.49% + $0.49; higher cost, limited legal integrations

Is AffiniPay Worth the Cost?

It provides excellent value for those in the legal industry and those who require trust compliance. However, when weighed against more flexible options, its higher fees might not be worth it for typical businesses.

Ease of Use & User Experience

AffiniPay is thoughtfully built for non-tech-savvy professionals. Despite offering advanced compliance tools, the platform remains intuitive and easy to navigate.

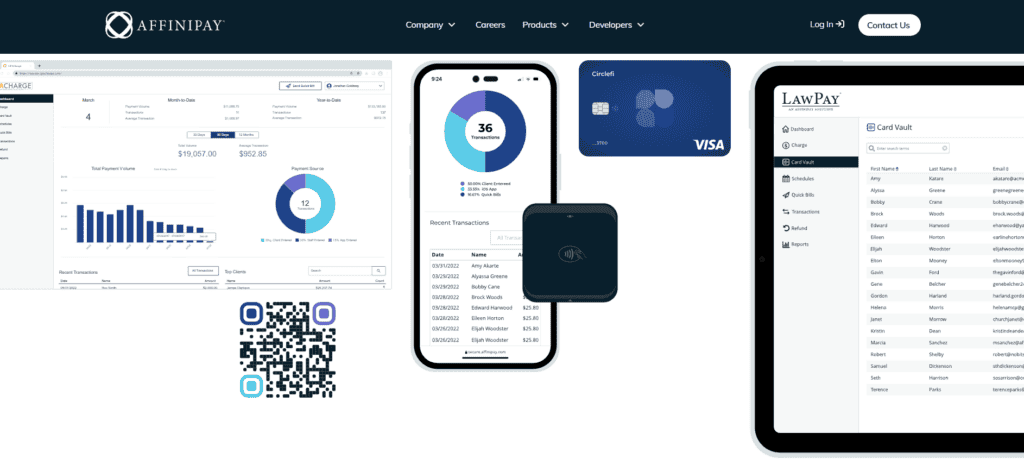

Platform Interface and Dashboard

The dashboard presents real-time data, payment statuses, and client information in a clean layout. Professionals can easily create links, manage accounts, and track payments without getting overwhelmed.

Accessibility (Desktop & Mobile)

Being cloud-based, AffiniPay works well on desktop and mobile browsers. While mobile functionality is decent, it lacks a dedicated mobile app like Square or Stripe, which may be a limitation for some users.

Onboarding & Setup Process

Signing up involves submitting business details, linking bank accounts, and verification. AffiniPay also assists with onboarding, especially for law firms configuring trust accounts.

Learning Curve

The majority of users find the platform easy to use. Additional assistance may be needed by those who are not familiar with IOLTA regulations, but AffiniPay’s onboarding materials facilitate the process.

Overall User Experience

Although it could improve mobile support to match competitors’ convenience, AffiniPay strikes a balance between professional-grade tools and ease of use.

Security & Compliance

Security and legal compliance are central to AffiniPay’s value, making it an ideal platform for firms managing confidential financial data.

PCI Compliance & Data Encryption

AffiniPay is PCI Level 1 certified. It ensures every transaction is encrypted and tokenized, preventing data exposure and minimizing the risk of fraud.

Fraud Prevention & Risk Management

Key features include tokenized payments, AI-driven fraud detection, and mechanisms for resolving disputes, giving professionals peace of mind in financial matters.

Trust Accounting Compliance

The automatic fund segregation feature of AffiniPay complies with IOLTA and ABA regulations. This feature guards against legal violations and guarantees ethical management of customer funds.

Professional circles greatly trust AffiniPay as a payment processor because of its security and compliance measures.

Customer Support & Service

AffiniPay offers tailored customer support via phone, email, and an online help center. The team specializes in legal and trust accounting queries, adding substantial value for law firms.

Support is offered during regular business hours in the United States. Users often report knowledgeable and responsive assistance during operating hours, though the lack of 24/7 help can be a drawback. The help center provides self-service training webinars, comprehensive articles, and how-to manuals.

Overall, the support quality is well-regarded, though response times can be slower for less urgent issues, particularly over email.

Pros and Cons of AffiniPay

Pros

Tailored for professional services, especially legal firms

Strong trust accounting and IOLTA compliance

Integrates with legal and accounting platforms

High security with PCI Level 1 compliance and fraud tools

No long-term contracts or hidden fees

Easy-to-use interface and dashboard

Cons

Limited to U.S. professionals; no international support

Slightly higher processing fees than mainstream providers

No mobile app for on-the-go management

Not suitable for e-commerce or retail businesses

Lacks round-the-clock customer support

While powerful for compliance-heavy industries, AffiniPay’s niche focus may not suit businesses needing broader functionality.

How AffiniPay Compares to Competitors

AffiniPay stands apart for its legal focus but competes with popular processors offering different strengths.

AffiniPay vs. Stripe

Stripe offers flexible APIs, global payments, and reporting tools for digital businesses. It lacks trust accounting, making AffiniPay the better choice for law firms, while Stripe is ideal for global e-commerce and SaaS platforms.

AffiniPay vs. Square

Square is excellent for retail and point-of-sale, but it lacks compliance tools and legal software integrations. It is more advantageous for physical businesses, but AffiniPay is still the best option for legal professionals.

AffiniPay vs. PayPal

PayPal supports international transactions and peer payments but charges higher fees and lacks legal compliance. It is more secure and specialized for domestic professional use.

Who Should Use AffiniPay?

AffiniPay is best for firms needing compliant, secure payment solutions.

Best-Suited Industries

Law Firms – Ensure IOLTA compliance and secure client fund handling

Accounting & Finance – Ideal for consultants needing secure invoicing and ACH payments

Consultants – Benefit from automated billing and secure transaction flows

Healthcare Providers – Use HIPAA-compliant payment tools and recurring billing

Who May Not Benefit?

E-commerce & Retail – Platforms like Square and Stripe offer more retail-oriented features

High-Risk Businesses – AffiniPay doesn’t support industries with high chargeback rates

Global Businesses – Limited to U.S. operations with no international support

Final Verdict: Is AffiniPay Worth It?

For legal and professional service providers, It is a robust, compliance-focused payment processor. For professionals who require trust fund management and legal compliance, its specialized features make it well worth the cost, even though it is more expensive than some alternatives. Broader, less costly options might be advantageous for other businesses.

FAQs

Does AffiniPay support international transactions?

No, AffiniPay is limited to U.S.-based professionals and doesn’t offer international payment support. For global businesses, Stripe or PayPal may be more suitable.

Is there a contract or early termination fee?

AffiniPay has no long-term contract requirements and doesn’t charge early termination fees, allowing businesses flexibility with no binding commitments.

Can I use AffiniPay for a non-legal business?

Yes, It can be used by professionals like accountants and consultants, but it’s most beneficial for those requiring strict compliance. Retail or high-risk businesses should explore alternatives like Square or PayPal.