Adyen Review

Adyen is a premier global payment processor renowned for its advanced infrastructure, sophisticated fraud prevention mechanisms, and seamless omnichannel payment solutions. Established in 2006 in the Netherlands, It has evolved into a top-tier choice for businesses seeking a unified platform that supports various payment methods, including credit and debit cards, digital wallets, and local payment systems. Lets read more about Adyen Review.

Adyen addresses these requirements by providing a comprehensive platform that manages payment processing, risk management, and data analytics, removing the necessity for third-party intermediaries. In contrast to traditional processors, It links directly with card networks and local payment providers, reducing transaction expenses and improving reliability. This capability to avoid intermediaries also guarantees quicker settlements and a smoother payment experience for both merchants and customers.

Company Background and Global Reach | Adyen Review

As businesses continue to expand their digital presence and embrace cross-border commerce, having a payment processor that seamlessly handles multiple payment methods is crucial. Adyen’s commitment to providing a streamlined, scalable infrastructure allows businesses to process transactions in different currencies without friction. This makes it particularly beneficial for e-commerce companies, hospitality brands, and multinational enterprises looking for a robust and flexible payment solution.

Origins and Evolution

Founded in Amsterdam by payment industry veterans Pieter van der Does and Arnout Schuijff, Adyen was built to modernize the outdated financial infrastructure. The name “Adyen,” meaning “Start Over” in Surinamese, reflects its mission to revolutionize payment processing by eliminating inefficiencies and dependencies on legacy banking systems.

Adyen allows businesses to expand their operations by offering a unified, simplified payments platform, eliminating concerns about complicated integrations or reliance on third-party services. This strategy has enabled Adyen to attract global corporations and high-volume retailers in search of a dependable, future-ready payment processor.

Expansion and Global Footprint

Over the years, Adyen has expanded across Europe, North America, Asia-Pacific, and Latin America, serving major enterprises such as Uber, Netflix, Spotify, and eBay. Its extensive reach makes it a preferred solution for businesses looking to scale internationally while ensuring a seamless payment experience.

Holding acquiring licenses for Visa, Mastercard, and American Express, It processes payments directly, bypassing third-party banks, reducing costs, and improving transaction speeds. This strategic advantage positions Adyen ahead of many traditional processors. Moreover, its partnerships with major financial institutions and local banks allow it to process transactions efficiently in various countries, minimizing friction and optimizing payment acceptance rates.

Industry Presence

Adyen mainly targets large corporations and rapidly growing businesses, but its scalable offerings also accommodate medium-sized companies. It functions in multiple sectors, such as retail, hospitality, travel, digital services, and e-commerce, making it a flexible and powerful payment solution. Furthermore, It has been broadening its reach in developing markets, offering companies enhanced access to localized payment solutions that meet the requirements of various consumer demographics.

Adyen’s Payment Processing Solutions

It provides a comprehensive suite of payment processing solutions tailored to businesses of all sizes, particularly those operating in multiple markets. Unlike conventional processors that require different systems for online, in-store, and mobile payments, It unifies all transactions under a single platform, enhancing reporting, lowering costs, and improving customer experience across channels.

Payment Channels

Online Payments: Secure e-commerce transactions via APIs, hosted payment pages, and direct integrations with platforms such as Shopify, Magento, and WooCommerce.

In-Store Payments: POS terminals with contactless, chip, and PIN functionality, ideal for retailers and hospitality businesses.

Omnichannel Payments: Unifies online and offline transactions, enabling seamless shopping experiences (e.g., buy online, return in-store).

Supported Payment Methods

It supports a wide range of payment methods, including:

Cards: Visa, Mastercard, American Express, Discover

Digital Wallets: Apple Pay, Google Pay, PayPal, Alipay

Local Payment Systems: iDEAL, Sofort, WeChat Pay, UPI

It also continuously innovates by incorporating emerging payment trends such as cryptocurrency payments and biometric authentication, ensuring that businesses stay ahead of evolving consumer preferences.

Developer-Friendly Integration

Adyen provides a wide array of APIs, SDKs, and plugins for companies seeking to incorporate payments into their websites, mobile apps, and point-of-sale systems. Its developer-centric strategy offers adaptability and personalization options. Through comprehensive integration guides, companies can customize Adyen’s capabilities to fit their specific operational needs, guaranteeing a seamless and individualized payment experience for clients.

Competitive Edge: How Adyen Stands Out

Adyen competes with major payment processors like Stripe, PayPal, Square, and Worldpay, differentiating itself through its proprietary infrastructure, extensive global reach, and enterprise-level solutions.

Key Differentiators

End-to-End Payment Processing: Unlike Stripe and PayPal, which rely on external banks, Adyen handles everything in-house, resulting in faster settlements and fewer failures.

Interchange++ Pricing: A transparent pricing model that is often more cost-effective for high-volume merchants compared to flat-rate models used by competitors.

Advanced Fraud Prevention: Adyen’s AI-driven RevenueProtect system minimizes chargebacks while allowing legitimate transactions.

Comparison with Major Competitors

Stripe: While Stripe is known for its developer-friendly solutions, it offers direct acquiring capabilities and broader international support.

PayPal: PayPal is easier to set up but lacks the analytical depth, customization, and competitive pricing Adyen provides.

Square: Square is better suited for small businesses, whereas Adyen caters to large-scale enterprises with higher transaction volumes.

Pricing and Fee Structure

Adyen uses an Interchange++ pricing model rather than a flat-rate structure. Businesses are charged interchange fees set by card networks, a small Adyen processing fee, and additional assessment fees.

Unlike PayPal or Stripe, which charge a fixed percentage per transaction, Adyen’s pricing varies based on card type, region, and transaction volume. International payments may incur higher costs due to currency conversion and cross-border fees.

Adyen does not charge setup fees, monthly subscriptions, or account maintenance fees, appealing to businesses wanting to steer clear of recurring expenses. Nonetheless, retailers need to be mindful of extra costs like chargeback management and payouts in foreign currencies. Moreover, it provides discounts based on transaction volume, allowing businesses that frequently handle large transactions to save on costs.

Security and Compliance

Customer Experience and User Interface

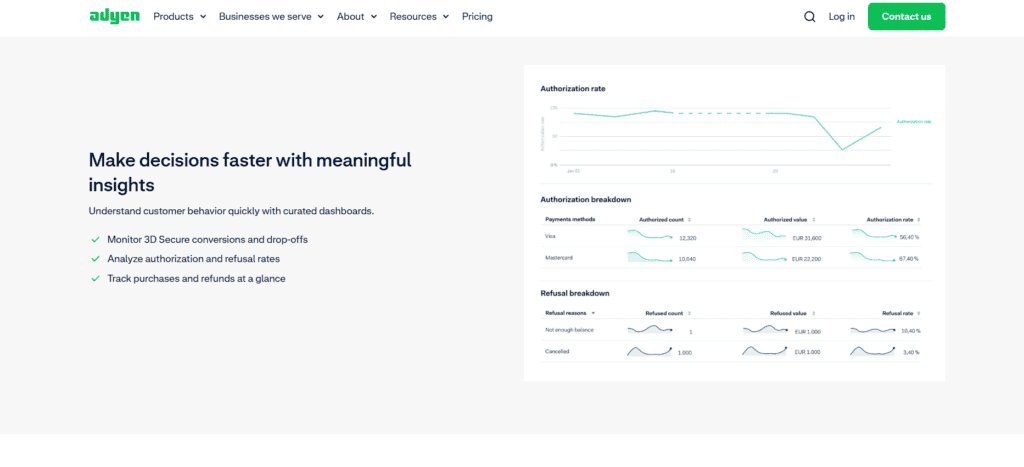

Adyen offers a seamless user experience with an intuitive interface designed for both business owners and developers. The dashboard provides real-time insights into transaction data, revenue trends, and fraud analytics. Businesses can customize their reporting tools and access detailed analytics to track payment performance. Additionally, merchants can easily manage refunds, chargebacks, and reconciliation from a single interface, reducing administrative burdens and improving operational efficiency.

Merchant Onboarding Process

Adyen’s onboarding process is designed to be straightforward for businesses of all sizes. The platform requires businesses to submit essential documentation, including business verification details and compliance information. Once approved, merchants can quickly integrate Adyen’s payment system through APIs or pre-built plugins. Unlike some competitors that require lengthy verification times, It streamlines the onboarding process, allowing businesses to start processing payments quickly.

Multi-Currency and Cross-Border Payments

A notable strength of Adyen is its capability to handle multi-currency transactions. Companies that operate in various countries can receive payments in more than 150 currencies while enjoying favorable foreign exchange rates. This functionality reduces conversion losses and improves the payment experience for overseas customers. Moreover, Adyen’s ability to handle cross-border transactions guarantees seamless processing without any unexpected delays or concealed charges.

Pros and Cons of Using Adyen

It offers a range of benefits, but like any payment processor, it also comes with certain drawbacks that businesses should consider before adoption.

Pros:

Global Reach: Adyen supports over 150 currencies and provides seamless cross-border transactions, making it ideal for international businesses.

Transparent Pricing Model: The Interchange++ model offers cost-efficient pricing for high-volume merchants.

Omnichannel Payments: Businesses can unify online, in-store, and mobile payments into a single platform.

Advanced Security: With PCI DSS Level 1 compliance, AI-driven fraud detection, and 3D Secure 2.0, It ensures secure transactions.

Customizable Integrations: Developers can leverage robust APIs, SDKs, and plugins for a tailored payment experience.

Cons:

Complex Pricing: The Interchange++ model, while beneficial for large businesses, can be difficult to understand for smaller merchants.

Not Ideal for Small Businesses: Lack of flat-rate pricing and a steeper learning curve make it less accessible for smaller enterprises.

Limited Live Support: It primarily focuses on enterprise-level clients, meaning smaller businesses may experience slower response times.

No Instant Payouts: Unlike PayPal or Square, It does not offer instant withdrawals, which can impact cash flow for some businesses.

Online Reviews and Merchant Feedback

Adyen is generally well-regarded in the payment processing industry, particularly among enterprises and high-volume merchants. Many businesses praise its seamless integration capabilities, transparent pricing, and global transaction support. Users frequently highlight Adyen’s robust fraud prevention tools and comprehensive analytics, which help merchants optimize their payment strategies.

Nonetheless, certain small and medium enterprises have observed that the platform’s intricacy can be a disadvantage, particularly for individuals not acquainted with the Interchange++ pricing structure. Furthermore, customer support has received varied feedback, as large clients benefit from dedicated account managers while smaller companies experience slower response times.

Despite these concerns, It maintains strong ratings on review platforms such as Trustpilot, G2, and Capterra, reflecting its reputation as a powerful and reliable payment solution. Businesses that prioritize scalability, security, and international payment support generally find Adyen to be an excellent investment.

Subscription and Recurring Billing

Adyen provides powerful tools for businesses operating subscription-based models. Its recurring billing features enable merchants to automate payments, send reminders, and manage customer subscriptions efficiently. The platform also supports flexible billing cycles, allowing businesses to customize payment schedules according to customer preferences. This makes it an ideal solution for SaaS companies, membership services, and digital content providers.

Fraud Prevention and Compliance

RevenueProtect: AI-powered fraud detection that reduces chargebacks while minimizing false declines.

3D Secure 2.0 (3DS2): Compliance with PSD2 regulations for added transaction security.

Data Protection: Ensures compliance with GDPR and CCPA for secure handling of customer data.

It also invests in continuous security updates and regulatory compliance, helping businesses stay protected against emerging threats.

Conclusion

Adyen stands out as a powerful, scalable payment processor offering direct acquiring, multi-currency support, and advanced fraud prevention. While ideal for large enterprises, its complexity may not suit small businesses requiring simpler solutions.

Companies looking for a reliable, high-efficiency payment processing solution will find Adyen an attractive option, especially for international activities. Through its creative strategies and dedication to safety, It remains a frontrunner in the payment processing sector.

FAQs

1. What industries benefit the most from using Adyen?

Adyen is best suited for e-commerce, retail, travel, hospitality, and digital services. Large enterprises with high transaction volumes benefit from its global payment infrastructure, fraud prevention tools, and cost-effective pricing model. Businesses requiring omnichannel capabilities also find Adyen’s unified payment processing advantageous.

2. How does Adyen ensure transaction security?

Adyen employs multiple security measures, including PCI DSS Level 1 compliance, tokenization, and advanced encryption. Additionally, its RevenueProtect system utilizes AI-driven fraud detection to prevent unauthorized transactions while minimizing false declines. Merchants also have access to 3D Secure 2.0 authentication for enhanced customer protection.

3. What are the settlement times for merchants using Adyen?

Adyen typically processes settlements within two business days, although this may vary depending on the region, payment method, and bank policies. Businesses can customize their payout schedules for daily, weekly, or monthly settlements, optimizing cash flow management.

4. Is Adyen suitable for small businesses?

While Adyen primarily caters to mid-sized and large enterprises, small businesses can also use the platform. However, its pricing structure may be more complex than flat-rate models like Square or PayPal. Businesses with lower transaction volumes might find simpler solutions more cost-effective.

It upholds stringent security standards and is PCI DSS Level 1 compliant. Unlike competitors relying on external security solutions, It employs end-to-end encryption and tokenization to safeguard transactions.