PaymentCloud Review

PaymentCloud has a reputation in the merchant services industry as a provider that works with high-risk and low-risk businesses. Many payment processors focus on mainstream merchants and leave businesses in industries like CBD, supplements, subscription services or adult entertainment with limited options. PaymentCloud bridges that gap and creates a space where businesses of all profiles can get reliable payment processing. Lets read more about PaymentCloud Review.

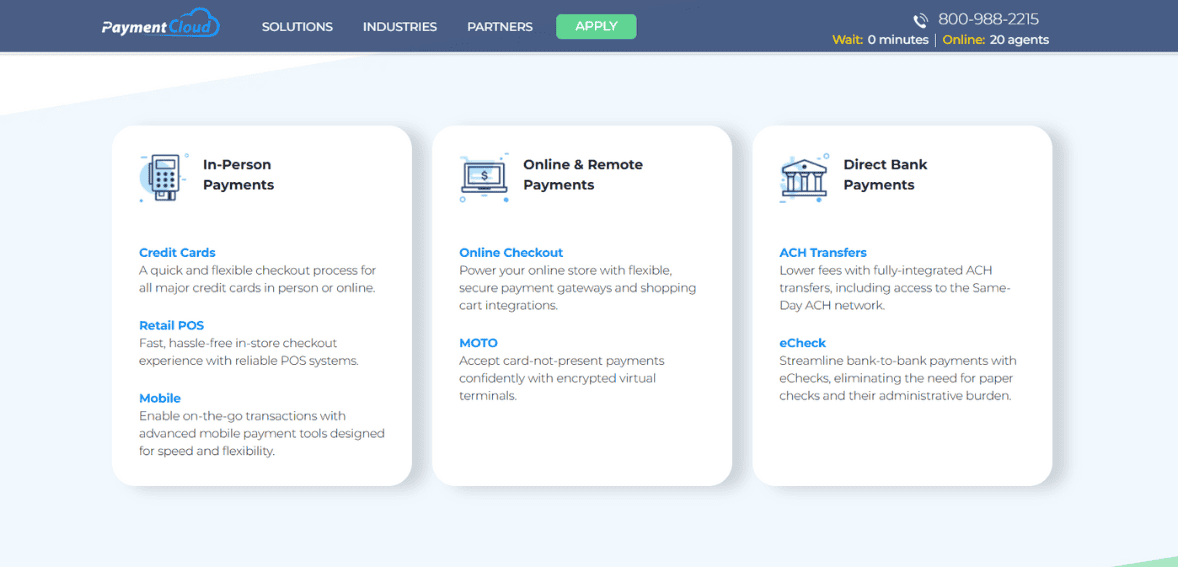

At its core, PaymentCloud allows merchants to accept credit and debit card transactions, ACH payments, eChecks and recurring billing. It services e-commerce businesses and physical stores with payment gateways, terminals and POS solutions. The company also focuses on compliance and fraud prevention which is key for merchants in regulated industries.

For high-risk merchants, PaymentCloud is a lifeline. Many providers decline accounts based on risk exposure but PaymentCloud has partnerships with multiple acquiring banks and third-party processors to find a match. Low-risk merchants benefit from its strong customer support and wide integration ecosystem. This dual appeal is why it’s so popular.

In today’s competitive market, PaymentCloud’s willingness to work with tough industries without neglecting traditional businesses makes it a versatile choice. By balancing flexibility, compliance and customer service it has created a unique reputation among payment processors.

Company Overview and History | PaymentCloud Review

PaymentCloud was founded to solve a common problem in the payments industry: lack of support for high risk merchants. While most processors avoid businesses in high risk industries, PaymentCloud started by working with them directly. This early focus quickly set the company apart and made it a go to name for merchants with limited options.

Over time PaymentCloud expanded beyond high risk services to offer solutions for low risk and mid risk businesses as well. By partnering with acquiring banks, payment gateways and hardware providers it created an ecosystem that serves a wide range of merchant needs. This inclusive approach has been a key to its growth.

Based in California the company operates nationwide and serves e-commerce businesses and traditional storefronts. The team is often praised for taking a consultative approach, guiding merchants through the application process and helping them understand the complexities of payment acceptance.

What really sets PaymentCloud apart is its flexibility. While most processors have rigid guidelines, PaymentCloud’s network of banking partners allows it to create custom solutions. This flexibility has allowed it to grow steadily and become a well known name in the industry. Today PaymentCloud is a bridge between merchants and financial institutions, enabling commerce for businesses that would otherwise not have access to banking services. Its reputation is built on inclusivity, flexibility and a customer first model.

Merchant Account Types Offered

One of the strengths of PaymentCloud is the variety of merchant accounts they offer for different business models. For low risk merchants they offer standard credit and debit card processing with competitive pricing and easy integration. Retail shops, professional services and restaurants can use these accounts to run their business.

The real differentiator is PaymentCloud’s high risk merchant accounts. Many industries are challenged because traditional banks consider them high risk due to regulatory scrutiny, high chargeback potential or reputational risk. PaymentCloud specialises in these accounts and works with businesses in industries such as adult entertainment, nutraceuticals, CBD, firearms and subscription based services.

For medium risk merchants such as travel services or online coaching platforms PaymentCloud offer accounts that balance oversight with flexibility. Their strong relationships with banking partners means they can place merchants in the right bucket, reducing the chance of account termination. In addition to physical merchant accounts PaymentCloud also offers e-commerce accounts for online stores to process payments securely. These accounts often include access to fraud prevention tools, chargeback management and recurring billing.

By offering accounts across risk levels PaymentCloud creates an inclusive environment. Merchants that would otherwise be declined can find a solution and traditional businesses can still get reliable payment processing. This multi-tiered account structure is at the heart of PaymentCloud’s value proposition.

Payment Processing Features

PaymentCloud delivers a comprehensive suite of payment processing features designed to meet the needs of modern merchants. For credit and debit card acceptance, it supports both card-present and card-not-present transactions, ensuring businesses can serve in-person and online customers alike. The platform also accommodates ACH payments and eChecks, which are particularly valuable for subscription services or businesses handling large transactions. These methods often reduce processing costs and provide an alternative to card payments.

Recurring billing is another feature that stands out. Merchants running subscription services or installment payment plans can set up automated schedules, reducing administrative burdens and ensuring timely payments. This feature integrates well with PaymentCloud’s fraud prevention systems, minimizing chargeback risks.

PaymentCloud also integrates with mobile payment solutions, allowing merchants to accept Apple Pay, Google Pay, and other digital wallets. As consumer preferences shift toward contactless and mobile payments, this flexibility ensures businesses remain competitive. For reporting, the platform provides detailed analytics, enabling merchants to monitor transaction volumes, settlement timelines, and chargeback activity. These insights are critical for making informed business decisions and improving cash flow management.

Overall, PaymentCloud’s payment features extend beyond basic processing. By including recurring billing, ACH, and mobile wallet support, it creates a versatile environment suitable for a range of industries. This functionality, paired with fraud tools and compliance features, makes the platform adaptable to both traditional and high-risk merchants.

Hardware and POS Options

For brick-and-mortar businesses, PaymentCloud offers a variety of hardware and POS solutions. Merchants can access countertop terminals, mobile readers, and fully integrated POS systems depending on their operational needs. These devices are EMV-compliant, ensuring secure chip card transactions, and many also support contactless payments like Apple Pay and Google Pay.

Mobile readers are particularly useful for businesses on the go, such as food trucks, service providers, and event vendors. These devices pair with smartphones or tablets, providing flexibility without sacrificing functionality. For larger retail operations or restaurants, PaymentCloud supports advanced POS systems that combine payment acceptance with inventory management, reporting, and customer relationship tools. This integration streamlines operations and reduces the need for multiple third-party systems.

The company also provides virtual terminals for phone or mail-order transactions, enabling businesses to manually enter card details through a secure platform. This feature is valuable for service providers or merchants with recurring clients. One consideration for merchants is that PaymentCloud’s hardware options are typically supplied through partnerships, meaning costs and compatibility may vary. However, this also allows for flexibility, as businesses are not tied to a single device type.

Overall, PaymentCloud’s hardware solutions align with industry standards, offering the security and convenience needed for today’s payment environment. Whether a small mobile operation or a large retail store, merchants can find hardware that fits their specific needs.

E-Commerce and Online Payment Gateways

PaymentCloud places strong emphasis on supporting online businesses through its e-commerce and payment gateway solutions. The company integrates with popular shopping cart platforms such as Shopify, WooCommerce, BigCommerce, and Magento. This compatibility makes it easier for online retailers to set up and manage their stores.

Its payment gateway supports secure credit card processing, recurring billing, and tokenization. Tokenization replaces sensitive card details with unique identifiers, reducing the risk of data breaches. This is particularly valuable for merchants handling recurring transactions. PaymentCloud also offers APIs that allow developers to customize payment solutions. Businesses with unique needs, such as marketplaces or specialized platforms, can integrate payment functionality directly into their systems.

Fraud prevention is integrated into the gateway, with tools to detect suspicious activity, monitor chargebacks, and flag risky transactions. These safeguards are crucial for online merchants, especially those in high-risk industries. For global e-commerce, PaymentCloud supports multi-currency acceptance, allowing merchants to expand internationally. While cross-border processing can involve higher fees, the availability of this feature opens doors for businesses looking to reach new markets.

In essence, PaymentCloud’s e-commerce support is designed to balance flexibility, security, and scalability. By offering robust gateway integrations and fraud protection, it provides merchants with the tools to compete in a rapidly growing online marketplace.

High-Risk Merchant Services Specialization

High-risk merchant services are at the heart of PaymentCloud’s identity. Many businesses are classified as high-risk due to chargeback potential, regulatory requirements, or industry reputation. Examples include CBD, nutraceuticals, adult entertainment, firearms, subscription services, and debt collection.

Traditional processors often refuse to work with these industries, leaving merchants with few options. PaymentCloud has built a niche by embracing them, forming partnerships with banks and processors that are open to high-risk accounts. Its team helps merchants prepare thorough applications, highlighting compliance measures and risk management strategies to improve approval chances.

The company also provides chargeback mitigation tools, fraud monitoring, and guidance on reducing transaction disputes. These services are essential for high-risk businesses, as excessive chargebacks can lead to account termination. While fees for high-risk accounts may be higher due to increased risk exposure, PaymentCloud’s willingness to work with these businesses makes it a valuable partner. It often becomes a lifeline for merchants who have been declined elsewhere.

At the same time, PaymentCloud does not solely focus on high-risk industries. Its ability to balance high-risk specialization with low-risk support creates a more inclusive platform than many competitors. For high-risk merchants, however, this specialization remains its defining feature.

Security, Fraud Prevention, and Compliance

Security is a critical concern for any payment processor, and PaymentCloud integrates several measures to protect merchants and their customers. The company is PCI DSS compliant, ensuring that merchants meet industry standards for data security. Tokenization and encryption are standard features, protecting cardholder information during transactions and storage. These tools are especially valuable for businesses handling recurring billing, where sensitive data is stored for future payments.

Fraud prevention tools include transaction monitoring, velocity filters, and alerts for unusual activity. These systems help merchants identify suspicious behavior before it leads to chargebacks or losses. For high-risk merchants, these safeguards are particularly important, given the industries they operate in. PaymentCloud also provides chargeback management services, guiding merchants through disputes and helping them reduce their frequency. While chargebacks cannot be eliminated entirely, proactive monitoring and dispute handling can significantly mitigate their impact.

Compliance support is another area of focus. For industries subject to regulatory scrutiny, PaymentCloud helps ensure that payment practices align with relevant laws and banking requirements. This reduces the risk of sudden account closures or fines. Overall, PaymentCloud’s emphasis on security and compliance reflects its understanding of the challenges merchants face. By combining PCI compliance, fraud detection, and chargeback management, it creates a safer environment for businesses across both high-risk and traditional sectors.

Pricing and Fees Structure

Pricing with PaymentCloud varies depending on the merchant’s risk profile, industry, and processing volume. Unlike some processors that advertise flat-rate pricing, PaymentCloud often uses interchange-plus or tiered pricing models. This allows for flexibility but can make it harder for merchants to predict exact costs.

For low-risk merchants, rates are generally competitive with industry standards, covering transaction fees, monthly fees, and possible setup costs. For high-risk merchants, fees tend to be higher due to increased risk exposure. These may include higher per-transaction rates, rolling reserves, or longer contract terms.

One common concern among merchants is transparency. Because pricing is customized, businesses must work directly with PaymentCloud to receive quotes. While this ensures tailored solutions, it can create uncertainty for merchants comparing providers. In addition to processing fees, merchants may encounter costs for hardware, chargeback handling, and PCI compliance. Understanding the full scope of fees is important before signing a contract.

Overall, PaymentCloud’s pricing reflects its positioning in the market. It is not the cheapest option available, but for many high-risk merchants, access to reliable processing outweighs cost concerns. For low-risk merchants, competitive rates and strong service can make the value proposition worthwhile.

Integrations and Third-Party Compatibility

PaymentCloud’s value extends through its integrations with third-party platforms. For e-commerce, it connects with Shopify, WooCommerce, Magento, and BigCommerce, allowing merchants to seamlessly manage online stores. In terms of business software, it integrates with accounting tools like QuickBooks and CRMs such as Salesforce. This helps businesses streamline financial management and customer relationships.

Its payment gateway and APIs provide developers with flexibility to build custom integrations. This is particularly useful for marketplaces, SaaS providers, or businesses with unique workflows. For merchants using POS systems, PaymentCloud supports integration with widely used hardware and software providers. This ensures that businesses can choose solutions tailored to their industry without being locked into a single vendor.

Overall, the integration ecosystem is designed to make PaymentCloud adaptable. Whether a small retailer, an online subscription service, or a global e-commerce operation, merchants can connect their preferred platforms. This flexibility adds to its appeal, particularly for growing businesses looking for scalable solutions.

Customer Support and Service Quality

Customer support is a significant factor in evaluating a payment processor, and PaymentCloud receives generally positive feedback in this area. The company provides phone, email, and chat support, with a reputation for responsiveness and attentiveness.

Merchants often highlight the onboarding experience, noting that PaymentCloud’s team takes a consultative approach. This is particularly valuable for high-risk businesses navigating the complex approval process. Guidance on preparing applications, compliance, and integration reduces friction and increases approval chances.

Ongoing support includes assistance with technical issues, chargeback disputes, and hardware troubleshooting. The availability of dedicated account managers further enhances the experience for some merchants, ensuring personalized attention. That said, like many processors, PaymentCloud does receive occasional criticism regarding delays in issue resolution or a lack of transparency in pricing. These concerns are not unique to PaymentCloud and are common in the industry, especially among providers handling high-risk accounts.

On balance, PaymentCloud’s reputation for support is above average. Its willingness to guide merchants through challenges and maintain consistent communication contributes to its credibility as a merchant services provider.

Pros and Cons of PaymentCloud

Every payment processor has strengths and weaknesses, and PaymentCloud is no exception.

Pros:

Specializes in high-risk merchant accounts, serving industries often turned away by others.

Wide range of integrations with e-commerce, accounting, and CRM platforms.

Strong emphasis on compliance, fraud prevention, and chargeback management.

Good reputation for customer service and onboarding support.

Cons:

Pricing transparency is limited since fees are customized.

High-risk accounts can involve higher rates, rolling reserves, or restrictive contracts.

Hardware is sourced through partners, which can mean variable costs and compatibility.

No simple flat-rate pricing model for merchants seeking predictability.

Overall, PaymentCloud offers strong benefits, especially for high-risk businesses, but merchants should carefully review contract terms and pricing before committing.

Ideal Business Types for PaymentCloud

PaymentCloud is particularly suited for merchants who fall into industries classified as high-risk, such as CBD, nutraceuticals, subscription services, and adult entertainment. For these businesses, its expertise, banking relationships, and risk management tools are invaluable. At the same time, PaymentCloud also works well for low-risk and mid-risk businesses. Retail shops, restaurants, service providers, and online stores can benefit from its integrations, customer support, and competitive pricing structures.

Startups may find PaymentCloud appealing due to its consultative approach during onboarding. Guidance on compliance, fraud prevention, and chargeback management is especially useful for businesses new to payment processing. Large enterprises may also consider PaymentCloud, particularly if they operate across multiple risk categories. Its ability to tailor solutions and scale with business needs makes it flexible enough for growth.

In short, PaymentCloud is best for businesses that need reliability, risk tolerance, and integration options. While high-risk merchants are its core audience, the platform’s inclusive approach makes it suitable for a broad range of businesses.

Final Verdict

PaymentCloud stands out in the payment industry for serving both high-risk and mainstream merchants. It helps businesses often rejected by traditional processors while offering robust tools like ACH processing, recurring billing, fraud prevention, and numerous integrations. Its consultative onboarding and strong support enhance value, especially for high-risk clients. However, pricing transparency is limited, with customized quotes and variable hardware costs posing challenges. Despite this, PaymentCloud’s inclusivity, security, and adaptability make it a solid choice; providing reliability for low-risk merchants and crucial access for high-risk ones; offering a strong balance of flexibility, compliance, and customer service across diverse business types.

FAQs

Q1. Is PaymentCloud suitable only for high-risk businesses?

No. While PaymentCloud is best known for high-risk specialization, it also serves low-risk and mid-risk merchants, offering flexible solutions across industries.

Q2. Does PaymentCloud require long-term contracts?

Contract terms vary depending on the merchant’s risk profile and banking partner. Some accounts involve multi-year agreements, while others may offer more flexible terms.

Q3. What payment methods can businesses accept with PaymentCloud?

Merchants can accept credit and debit cards, ACH payments, eChecks, and mobile wallets. The platform also supports recurring billing for subscription-based businesses.