Zoho Books Review

Zoho Books is a cloud based accounting solution for small and medium sized businesses looking for an affordable all in one solution to manage their finances. Part of the Zoho ecosystem (which includes CRM, HR and productivity apps) it’s perfect for businesses already using Zoho tools but also works as a standalone product. With automation, invoicing and compliance features it competes with bigger names at a lower price point. Lets read more about Zoho Books Review.

Where Zoho Books stands out is in its usability and integration. It covers the expected essentials (expense tracking, bank reconciliation, reporting) and adds extras like project billing and tax compliance. It’s a versatile option across industries but especially useful for freelancers, startups and growing companies that want streamlined financial processes without the complexity of enterprise systems. It may not have the name recognition of QuickBooks or Xero but Zoho Books has earned credibility as a reliable and affordable alternative.

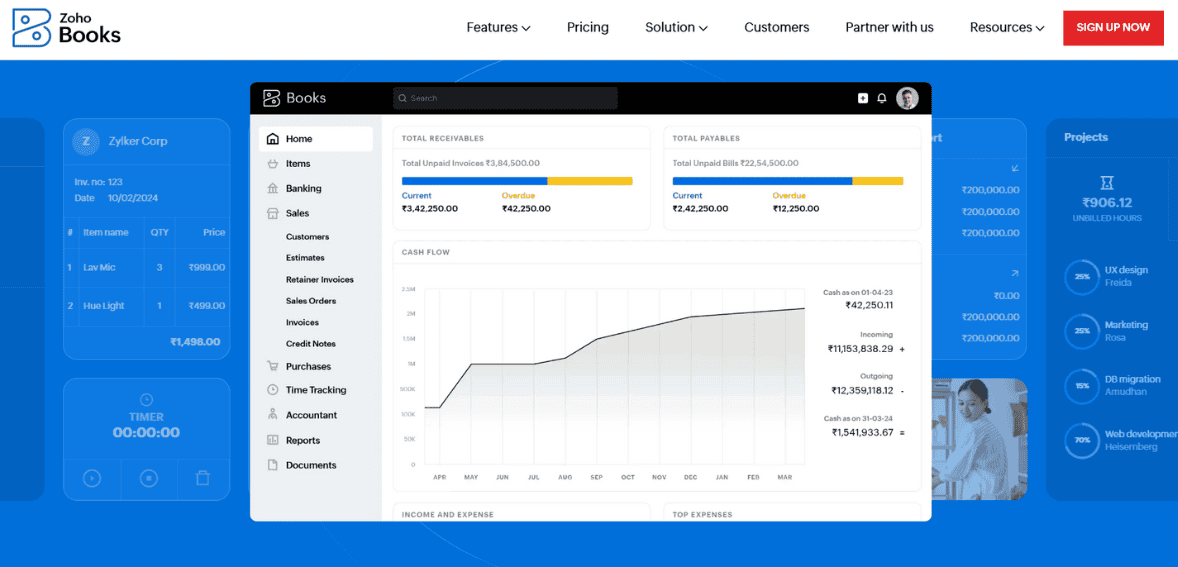

User Interface and Ease of Use | Zoho Books Review

Zoho Books is designed to be simple but not simplistic. On login the dashboard shows income, expenses, invoices and cash flow and the sidebar has banking, reports and invoicing. This helps non-accountants get started quickly. Setup is easy with guided steps for importing data, linking bank accounts and configuring taxes. Tutorials and sample transactions make onboarding a breeze. Unlike older accounting tools that feel rigid, Zoho Books has a modern interface that makes managing money less scary.

For advanced users it offers flexibility through workflow automation, customizable invoice templates and multi user permissions. Some users say the many features can feel overwhelming at first but most find it intuitive after a while. The balance between beginner friendliness and customization is one of Zoho Books’ greatest strengths.

Invoicing Capabilities

Zoho Books makes invoicing professional and easy. Templates can be branded with logos and colors and fields for client details, taxes and payment terms make creation a breeze. Recurring invoices save time for subscription based businesses. Automatic payment reminders reduce late payments and integration with multiple gateways lets clients pay directly from invoice links. Multi currency support automatically manages exchange rates so you don’t have to in international transactions.

While capable it may not be suitable for larger firms that require highly specialized billing workflows or deep contract based billing features. For most small to mid sized businesses though the invoicing is more than enough; automation, professionalism and speed.

Expense Tracking and Management

Zoho Books makes expense tracking easy. Businesses can categorize expenses, assign to projects or mark as billable to clients. Mobile receipt scanning saves time by auto uploading and categorizing expenses. Bank statement imports and transaction matching simplifies reconciliation and reports can be filtered by vendor, category or timeframe for more insights. Approval workflows add an extra layer of control.

Though more complex procurement processes may find it basic, it covers what most small and medium businesses need. Real time tracking and integration with billing ensures expenses aren’t missed, improves financial reporting accuracy.

Banking and Reconciliation Tools

Bank integration allows auto import of transactions, reduces manual entry. Zoho Books suggests matches between imported bank activity and recorded entries, simplifies reconciliation. Custom rules and categorization options reduce repetitive work.

While good for small businesses, businesses with multiple accounts or very high transaction volumes may find it less robust than specialized reconciliation software. Some regional banks may also require manual imports. Despite these limitations, Zoho Books’ reconciliation features reduce errors, improves accuracy and saves time, making financial oversight easy for business owners and accountants.

Project and Time Tracking

Zoho Books ties financial management to project work by allowing task assignments, time logging and billable hour tracking. Service based businesses; like agencies or consultancies; can link tracked time to invoices. Budgets can be set, progress monitored and actual hours compared to planned hours. Team members can log work through the mobile app, making it convenient for remote teams. Though not as advanced as dedicated project management tools, it’s a way to combine billing and time tracking without needing multiple tools.

Tax Management and Compliance

Zoho Books simplifies tax handling by supporting systems like GST, VAT, and sales tax. Regional compliance settings, such as GST in India, are built in. Multiple tax rates can be applied to transactions, and reports help prepare for filing deadlines. Its limitations mainly involve global coverage; some regions still lack localized features, requiring manual adjustments. Still, for most small to mid-sized firms, Zoho Books reduces the complexity of compliance and lowers the risk of errors.

Multi-Currency and Global Support

For businesses working internationally, Zoho Books includes multi-currency invoicing, expense tracking, and reporting. Exchange rates update automatically, reducing manual effort. Clients benefit from being billed in their own currency, which speeds up payments. Integration with international gateways further supports global operations. While it lacks advanced features like currency risk management, it simplifies cross-border accounting for small and medium enterprises.

Automation and Workflow Customization

Automation is a highlight of Zoho Books. Workflows can be set for recurring invoices, payment reminders, or expense approvals. Custom rules let businesses tailor processes based on conditions like invoice size or client type. Though complex workflows may require a learning curve, the automation tools save time, reduce errors, and standardize operations. For most businesses, this balance of flexibility and usability is a major advantage.

Integrations and Ecosystem Compatibility

Zoho Books integrates smoothly with other Zoho apps, creating a unified platform for sales, operations, and finance. Third-party integrations with Stripe, PayPal, G Suite, and Office 365 extend its utility. APIs allow custom connections for unique business setups. While its marketplace is smaller than QuickBooks or Xero’s, it provides enough options for most use cases, especially for businesses already using the Zoho ecosystem.

Mobile App and Accessibility

The mobile app for iOS and Android brings key features to handheld devices: invoicing, expense tracking, receipt scanning, time logging, and reporting. Offline functionality ensures data syncs later, making it practical for mobile teams. Though some advanced desktop features aren’t mirrored, the mobile app provides strong flexibility and convenience for users who manage finances on the move.

Reporting and Analytics

Zoho Books offers standard financial reports; profit and loss, balance sheets, cash flow; along with detailed insights like tax liabilities, project profitability, and expense categories. Custom filters and scheduling make it easy to distribute insights to stakeholders. The visual dashboard with charts highlights trends at a glance. While larger enterprises may require deeper analytics, Zoho Books provides more than enough for small to mid-sized companies to make data-driven decisions.

Pricing and Value

Zoho Books is known for affordability. Plans range from budget-friendly tiers with essentials to higher tiers with advanced features and more users. Discounts are available on annual subscriptions, and a free trial helps new users test it out. User limits on plans may add costs for larger teams, but overall, Zoho Books delivers excellent value when compared with larger competitors.

Customer Support and Resources

Support is offered via email, chat, and phone (in select regions). Self-service resources; knowledge base articles, guides, and video tutorials; are comprehensive. Zoho also maintains a helpful community forum and offers webinars and training resources. While some users feel personalized support could improve, especially for complex queries, the mix of official support, peer forums, and learning tools gives most businesses ample guidance.

Pros and Cons

Pros:

Affordable compared to competitors

Strong invoicing, expense, and tax tools

Automation and integrations with Zoho apps

Mobile-friendly with multi-currency support

Cons:

Limited global tax coverage in some regions

Smaller integration marketplace compared to QuickBooks/Xero

User caps on plans may limit larger teams

Some accountants are less familiar with Zoho

Final Verdict

Zoho Books is a practical, cost-effective accounting tool for freelancers, startups, and small to mid-sized businesses. It combines usability, automation, and strong integration into one platform. While not as entrenched globally as QuickBooks or Xero, its feature set and affordability make it a strong alternative. Large enterprises with highly complex needs may need more advanced systems, but for growing businesses, Zoho Books offers a powerful balance of simplicity and functionality.

FAQs

Q1. Is Zoho Books suitable for freelancers as well as larger businesses?

Yes. Freelancers benefit from simple invoicing and expense tracking, while larger firms can use its automation, multi-user access, and integrations.

Q2. How does Zoho Books compare with QuickBooks or Xero?

Zoho Books is typically more affordable and integrates tightly with Zoho apps. QuickBooks and Xero offer wider accountant familiarity and marketplaces, but Zoho holds its own in value and ease of use.

Q3. Can Zoho Books handle compliance for international businesses?

Yes. It supports multiple currencies and tax systems like GST and VAT. However, some features vary by country, so certain regions may require manual adjustments or external support.