Worldpay Review

Worldpay is one of the most well known payment processors, serving millions of merchants worldwide. Born as a card payments pioneer, the company has evolved into a global leader over decades of innovation. Today Worldpay operates across multiple regions, allowing businesses to accept payments in-store, online and through mobile channels and support multiple currencies and payment methods. From small shops to multi-nationals, businesses rely on its infrastructure for secure and efficient transactions. Lets read more about Worldpay Review.

The company’s scale and reliability makes it attractive to large enterprises. However, like most big processors, Worldpay isn’t without its downsides. Some merchants like its global reach, others don’t like its pricing complexity, long term contracts and inconsistent service.

Company History and Evolution | Worldpay Review

Worldpay’s history goes back to the 1980s when it was founded in the UK to help businesses accept card payments in a market just starting to adopt electronic transactions. Over time it expanded internationally and became one of the biggest brands in payment processing, driven by technology, a strong customer base and growing demand for secure solutions.

A turning point came in 2019 when Fidelity National Information Services acquired Worldpay for over $40 billion, creating one of the largest fintech companies in the world. The acquisition gave Worldpay access to FIS’s resources and scale. In 2023 FIS announced it would spin off Worldpay, reaffirming its position as a standalone payment processor.

These corporate changes show Worldpay’s ability to adapt in a fast changing industry. With the rise of digital wallets, mobile payments and fintech challengers, Worldpay has consistently updated its offerings to stay relevant. However, changes in ownership and structure leave some merchants uncertain about its long term stability and pricing models.

Core Payment Processing Services

At its core Worldpay allows businesses to accept payments in multiple ways, from card-present transactions at the point of sale to online and mobile wallet payments. The company processes billions of transactions every year, that’s how big and robust its infrastructure is.

Brick and mortar merchants benefit from its in-store solutions for chip, swipe and contactless payments. Online sellers get a robust payment gateway, recurring billing tools and international acceptance through multi-currency processing. Mobile capabilities also extend Worldpay’s reach to retail and delivery services.Fraud screening and security is built into its processing, merchants are protected from chargebacks and unauthorized transactions. Smaller businesses may find it more complex than newer competitors but Worldpay has depth, customization and scale.

Merchant Account Features

Worldpay uses the traditional merchant account model, so businesses get a dedicated account for payment processing. This is better for high volume merchants. Detailed reporting is a big plus. Merchants can analyze transaction data, track sales trends and reconcile settlements with precision; useful for complex businesses. Analytics also shows peak sales periods and preferred payment methods.

Settlement times are quick, funds are in a few days, some merchants report occasional delays. Chargeback tools are available but vary by industry and volume. Contract requirements are key. Many Worldpay accounts have long term agreements with early termination fees; not good for merchants who want flexibility. While the account features are robust, businesses need to weigh those against the contract commitments.

Pricing and Fees

Pricing is one of Worldpay’s biggest controversies. Unlike newer providers who advertise flat fees, Worldpay uses interchange-plus or tiered pricing. Interchange-plus is considered transparent but can be overwhelming for merchants who don’t speak processing jargon.

In addition to per-transaction fees, merchants may have monthly, annual or gateway fees. PCI compliance or non-compliance fees may also apply; some businesses are surprised by these. Multi-year contracts with auto-renewal clauses add to the complexity with penalties for early termination. For big volume businesses, negotiated rates and economies of scale can make pricing competitive. Smaller businesses struggle with the lack of transparency and potential hidden fees. Careful contract review and a full fee breakdown is essential before committing.

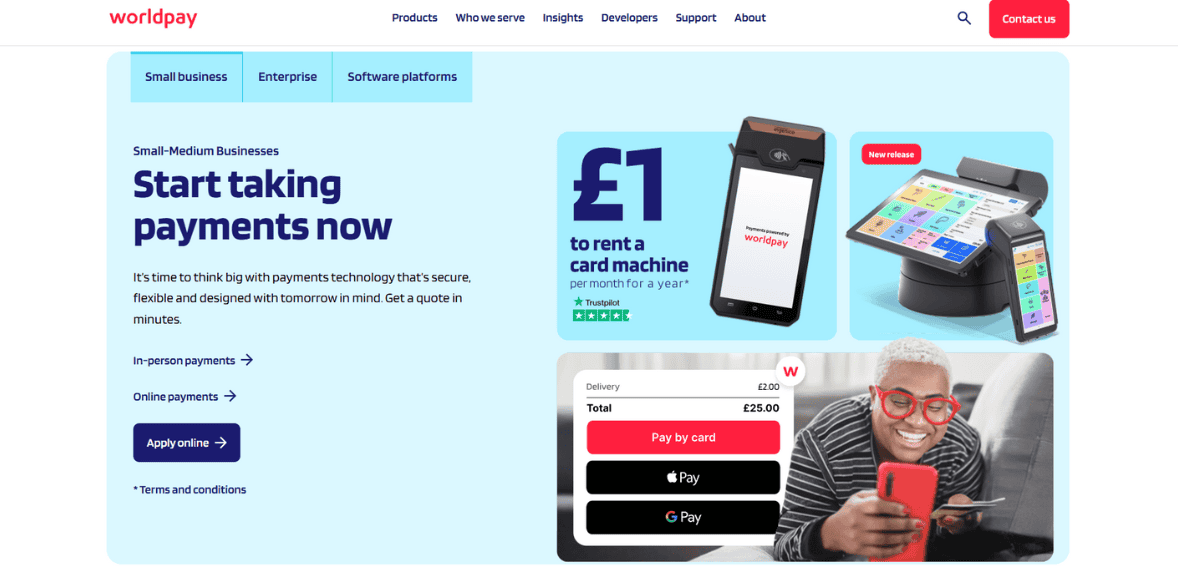

Hardware and POS Systems

Worldpay has a wide range of payment hardware and POS systems for different industries. For retailers, countertop terminals support chip, swipe and contactless. For mobile merchants, portable and wireless terminals connect via Wi-Fi or cellular. Smartphone compatible readers are low cost and flexible. Their POS software goes beyond payments to include inventory management, customer tracking and reporting; useful for retail and hospitality. Worldpay hardware also integrates with many 3rd party apps; more flexibility for businesses.

The downside is cost. Hardware costs can be high and some merchants are locked into long term leases. But the overall range of POS solutions is competitive and suitable for businesses from small shops to national chains.

Online and E-commerce Capabilities

For online businesses, Worldpay’s e-commerce tools are a strong selling point. Its payment gateway supports multiple currencies and methods, integrates with platforms like Shopify, WooCommerce, and Magento, and accepts digital wallets such as Apple Pay, Google Pay, and PayPal. Recurring billing is another strength, making it an excellent fit for subscription-based models. Fraud prevention measures add an additional layer of protection for both merchants and customers.

Still, smaller businesses may find the system harder to configure without technical expertise, and fees for online payments can be higher compared to flat-rate competitors. Nevertheless, for global reach and recurring billing needs, Worldpay’s online capabilities are robust.

Security and Compliance Standards

Worldpay maintains strong security standards, including PCI DSS compliance, tokenization, and encryption. These measures protect sensitive cardholder data during storage and transmission. Real-time fraud monitoring powered by machine learning helps detect unusual activity, though configuration may require technical support.

Merchants must stay compliant to avoid additional fees, which can be a burden for small businesses lacking IT resources. Still, Worldpay’s security practices are aligned with industry best practices, giving merchants confidence in the safety of their transactions.

Integrations and API Flexibility

Worldpay’s APIs and integration tools allow businesses to connect payment processing with third-party platforms, custom applications, ERP systems, and accounting tools. This flexibility benefits enterprises needing complex or tailored solutions.

Advanced functions such as tokenized payments, subscription billing, and multi-currency processing make global expansion easier. However, the integration process can be more technical than with newer, developer-focused platforms, creating challenges for smaller merchants without in-house expertise.

Customer Support and Service Quality

Merchant feedback on Worldpay’s customer support is mixed. Large businesses often benefit from dedicated account managers, while smaller merchants sometimes report long wait times or difficulty resolving issues.

The company provides multiple support channels, along with tutorials and compliance guides, though these may not always substitute for timely human assistance. Onboarding can be smooth for some merchants but lengthy for others, depending on business size and complexity.

Pros of Using Worldpay

Global reach with multi-currency support.

Comprehensive services covering in-store, online, and mobile payments.

Strong security and fraud prevention.

Advanced features such as recurring billing, analytics, and API integrations.

Cons and Limitations

Complex and sometimes opaque pricing.

Long-term contracts with early termination fees.

Inconsistent customer support experiences.

Significant hardware and leasing costs.

Ideal Business Types for Worldpay

Worldpay is best suited to mid-sized and large businesses that process high transaction volumes or operate internationally. Enterprises benefit from negotiated rates, global reach, and advanced tools such as recurring billing. Small businesses or startups may find the complex pricing, contracts, and equipment costs prohibitive. For them, simpler, flat-rate providers may be a better fit.

Final Verdict

Worldpay stands out as a global payment processor with decades of experience, advanced security, and a comprehensive suite of tools. It is particularly attractive to enterprises and international businesses that prioritize scale, global reach, and sophisticated features. At the same time, its complexity, long-term commitments, and inconsistent support can make it less appealing for small merchants seeking straightforward, flexible solutions. Ultimately, Worldpay remains a reliable partner for businesses that value infrastructure and global capabilities, but it is not the best fit for everyone.

FAQs

Q1. Is Worldpay suitable for small businesses?

Yes, but many small businesses find the pricing complexity and contracts challenging compared to flat-rate providers. Careful cost evaluation is recommended.

Q2. Does Worldpay support international payments?

Absolutely. It supports multiple currencies and operates in numerous countries, making it ideal for global businesses.

Q3. What are Worldpay’s biggest drawbacks?

Complex pricing, long-term contracts, and variable customer support are the most common concerns, particularly for smaller merchants.