Stripe Review

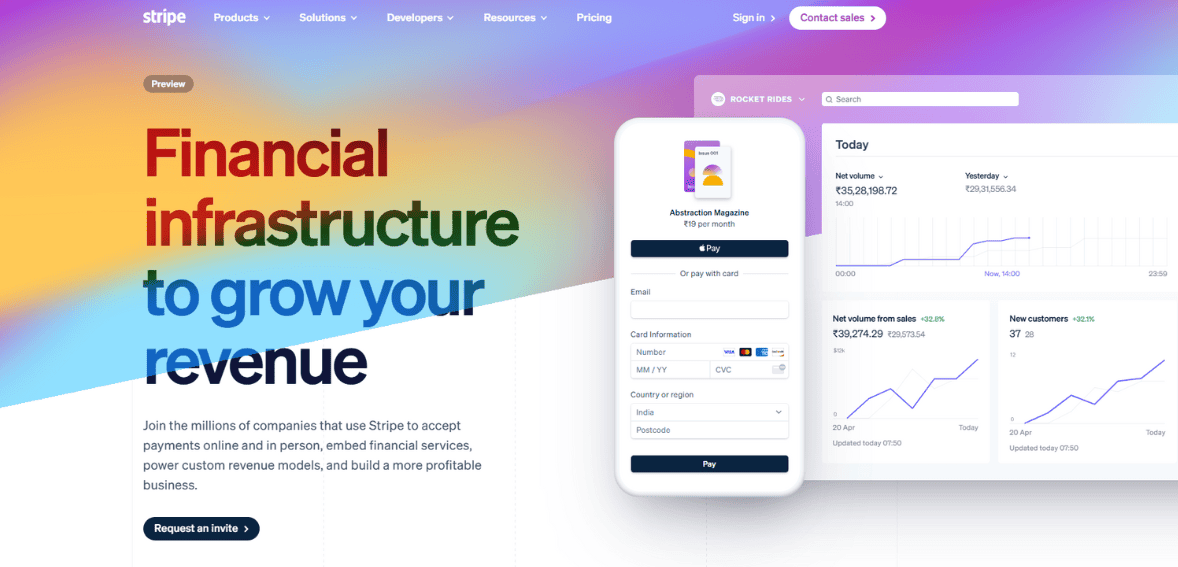

Stripe is one of the biggest names in payment processing. Founded in 2010, it became the go to for online businesses due to its simple developer tools and global capabilities. Unlike many other processors, Stripe built its reputation on being adaptable and integratable, making it attractive to startups and enterprises. Today Stripe powers millions of businesses around the world, including e-commerce stores, subscription platforms and digital service providers. Lets read more about Stripe Review.

What sets Stripe apart is its focus on a polished front-end checkout experience and a robust back-end infrastructure. It’s designed for scalability, so a small business can start using Stripe with just a few transactions and scale to enterprise levels without needing a new provider. Its global reach, multiple currency support and developer first solutions have made Stripe the dominant force in fintech. This review takes a look at Stripe’s features, pricing, usability and pros and cons to help you decide if it’s the right choice for your business in 2025.

Company Background and Market Position | Stripe Review

Stripe was founded by brothers Patrick and John Collison to simplify online payments for developers. Over the years Stripe evolved from a startup friendly solution into a global financial technology company with one of the highest valuations in the industry. Its growth reflects the rapid shift of commerce to online platforms.

In the competitive payments space Stripe has a unique position. While PayPal focuses on consumer wallets and Square on point of sale, Stripe carved out a niche by targeting developers and online first businesses. Its API driven model differentiates it from legacy processors that are stuck in the past. Stripe’s platform now goes beyond payments, offering financial tools, banking as a service and solutions for marketplaces.

Stripe’s position is strengthened by being in more than 40 countries and supporting over 135 currencies. This global footprint makes it the go to choice for international businesses. While competitors like Adyen and Worldpay challenge Stripe in the enterprise space, Stripe’s simplicity and depth has allowed it to win both small businesses and large corporations. Its brand recognition and adoption by big companies adds to its credibility, making it one of the most important players in fintech today.

Core Features of Stripe

Stripe offers a comprehensive suite of features that cater to different aspects of online payments. At its core, Stripe enables businesses to accept payments via credit cards, debit cards, digital wallets, and localized payment methods. Its integration with online stores is smooth, whether through direct APIs or prebuilt plugins for platforms like Shopify, WooCommerce, and Magento.

One of the standout features is Stripe Checkout, a customizable payment page designed for conversion optimization. It supports saved payment methods, one-click purchases, and localized options, all aimed at reducing cart abandonment. Stripe also provides invoicing solutions, making it suitable for freelancers and service-based businesses that rely on recurring billing.

Beyond traditional payments, it offers subscription management through its Billing module. This is valuable for SaaS companies and businesses with recurring revenue models. Stripe Radar, its machine learning–powered fraud prevention system, is another notable feature that provides real-time risk assessment and protection against fraudulent transactions.

For businesses that require more advanced solutions, it enables ACH payments, buy-now-pay-later options, and even cryptocurrency acceptance through integrations. Combined, these features make Stripe more than just a processor; it is a full payment ecosystem. However, the sheer breadth of offerings can be overwhelming for smaller businesses with limited technical expertise, which is something worth considering.

Stripe Dashboard and User Interface

The Stripe Dashboard is the control center for payments, customers and account settings. It’s designed to be clean and simple so you can quickly see key financial data like transaction volume, revenue breakdowns and payout schedules. For many businesses the dashboard is more than just a reporting tool – it’s the operational hub for the finances.

You can filter transactions by status, customer or payment method which makes reconciliation and accounting a breeze. Refunds and disputes can be handled directly from the dashboard so you don’t need external tools. Stripe also offers real time analytics so you can see customer behavior, revenue trends and subscription churn rates.

The dashboard integrates with Stripe’s APIs so developers can build custom workflows while business managers can use a user friendly interface. It also supports multiple team members with custom roles and permissions which is essential for growing businesses.

But some users note that the dashboard can feel overwhelming when you first start out as there are so many features and metrics that a small business may not need. For those comfortable with data driven decision making however the dashboard is unparalleled in its clarity and control. Overall it strikes a balance between being accessible to non technical users and flexible for developers.

Payment Methods Supported

Stripe supports a ton of payment methods which is one of its greatest strengths. It accepts all major credit and debit cards including Visa, Mastercard, American Express and Discover. It also supports digital wallets like Apple Pay, Google Pay and Microsoft Pay for customers who prefer mobile first transactions.

For international businesses Stripe offers localized payment methods like SEPA Direct Debit in Europe, iDEAL in the Netherlands and Alipay in China. This means merchants can serve diverse customer bases without having to use multiple processors. Stripe also supports ACH transfers for US businesses and bank debits in several countries.

Another big plus is support for buy now pay later providers which are becoming more and more popular in e-commerce. By offering these options Stripe helps businesses capture sales that would otherwise be lost due to high upfront costs.

While the number of payment methods is impressive some businesses may find certain options restricted depending on their country of operation. It may not be the best fit for high risk industries as its acceptance policies are stricter than specialized processors. But the breadth of payment support makes Stripe one of the most inclusive solutions out there.

Developer-Focused Tools and APIs

Stripe’s reputation as a developer-first platform is well-deserved. Its APIs are some of the most powerful and flexible in the industry, so you can create custom payment flows that fit your business needs. The documentation is extensive and well-organized, so integration is relatively easy if you’re an experienced developer.

Stripe’s API-first approach means you’re not limited to pre-built templates. You can design everything from checkout experiences to subscription models exactly how you want. Stripe Elements for example lets you create custom forms with built-in security while still keeping your brand design. In addition to APIs, Stripe has SDKs for multiple languages and platforms so you can be compatible across different environments. Stripe CLI and sandbox environments are also available for testing.

But the same flexibility that’s great for developers can be overwhelming for non-technical users. Small businesses without in-house technical teams may need to use plugins or hire developers which can add costs. But Stripe’s commitment to providing the latest developer tools makes it a top choice for tech-driven businesses that need custom payment infrastructure.

Stripe Connect for Marketplaces and Platforms

Stripe Connect is one of the company’s standout products, built specifically for marketplaces, gig platforms, and platforms that manage payments on behalf of multiple vendors. With Connect, businesses can handle complex payment flows such as splitting payments between sellers, managing payouts, and complying with international regulations.

For platforms like ride-sharing apps, freelance marketplaces, or multi-vendor e-commerce stores, Connect simplifies what would otherwise be a complicated process. It provides onboarding tools for sellers, supports KYC verification, and ensures payouts comply with regulatory requirements. Businesses can also choose between Standard, Express, and Custom account types depending on how much control they want over the user experience.

Another advantage of Stripe Connect is its global reach. It allows platforms to onboard vendors in multiple countries and pay them in their local currencies, reducing friction in cross-border commerce. This capability is particularly valuable for companies looking to scale internationally. The downside is that Connect’s setup is not simple. It often requires technical expertise to implement properly, especially for platforms with unique payout structures. Still, for businesses operating in multi-party ecosystems, Stripe Connect is one of the most advanced and reliable solutions available.

Pricing and Transaction Fees

It has a transparent pricing model which is one of the good things about it for businesses. In most regions the standard rate is 2.9% + $0.30 per successful card transaction. No setup fees, no monthly fees, no hidden fees for basic use so it’s good for startups and small businesses.

For international transactions Stripe adds fees for currency conversion and cross border payments. Businesses also need to be aware of fees for certain features like Stripe Billing or Stripe Connect. For example Billing charges a percentage for recurring revenue tools and Radar has costs for advanced fraud protection.

Compared to competitors Stripe’s pricing is competitive but not the cheapest. High volume businesses may find interchange-plus pricing from other providers more cost effective. Also dispute fees apply when customers file chargebacks which can add up depending on the business type. Overall Stripe’s pricing is straightforward for businesses with average transaction volumes. But businesses with thin margins or high international sales should calculate the costs before committing. The no long term contracts is a big plus for businesses still testing their growth strategies.

Security, Compliance, and Fraud Protection

Security is a critical factor in payment processing, and Stripe places significant emphasis on maintaining industry-leading standards. The platform is PCI DSS Level 1 certified, the highest level of compliance, which means businesses using Stripe do not have to manage PCI certification on their own. Sensitive card details are never stored on a merchant’s servers, reducing risk exposure.

Stripe Radar, its built-in fraud prevention tool, uses machine learning to detect and block suspicious transactions. Radar leverages data across the Stripe network, allowing it to identify fraud patterns more effectively than businesses operating in isolation. Merchants can also customize rules to reflect their specific risk profiles, balancing protection with customer experience.

Compliance extends beyond PCI. It ensures adherence to regulations such as PSD2 in Europe, including support for Strong Customer Authentication. It also manages KYC requirements for connected accounts under Stripe Connect.

While security is strong, no system is immune to fraud. Some businesses report occasional false positives in Radar, where legitimate transactions are flagged. Despite these instances, Stripe’s overall record in protecting merchants and customers is highly regarded, making it one of the safer choices for handling payments.

Stripe’s Additional Products (Billing, Atlas, Issuing, Treasury)

It has expanded well beyond payments into a broader financial ecosystem. Stripe Billing is a subscription management tool designed for SaaS companies and businesses with recurring revenue models. It automates invoicing, subscription tracking, and dunning processes, helping reduce churn. Stripe Atlas is another unique product, aimed at startups looking to incorporate in the U.S. quickly. It simplifies business incorporation, bank account setup, and compliance tasks for international entrepreneurs.

For companies interested in offering their own branded financial products, Stripe Issuing enables businesses to create and manage virtual and physical cards. This is valuable for expense management platforms and fintech startups. Stripe Treasury extends Stripe’s reach into banking services, allowing businesses to hold funds, manage accounts, and integrate financial flows within their platforms.

These additional products demonstrate Stripe’s ambition to become more than a payment processor. Instead, it positions itself as a financial infrastructure provider for the internet economy. However, not all businesses will need these services, and some may find them more complex than necessary. The value depends heavily on the business model and growth trajectory.

Customer Support and Resources

Customer support is an area where Stripe receives mixed reviews. On one hand, it provides extensive documentation, guides, and community forums that make self-service easy for developers. The knowledge base is detailed enough for most integration and troubleshooting questions. It also offers 24/7 support via chat and email. For businesses with higher usage tiers, premium phone support may be available, though it often comes at an additional cost. The responsiveness of chat support is generally positive, but some users report delays in resolving complex issues.

A notable strength is the quality of Stripe’s developer documentation, which often reduces the need for direct support. Businesses with in-house developers may find they rarely need to reach out to Stripe. However, smaller merchants or those unfamiliar with technical integration sometimes express frustration with the limited hand-holding compared to providers with dedicated account managers.

In short, Stripe’s support structure aligns well with its tech-first audience. For businesses seeking proactive account management and personalized assistance, it may not be as strong as traditional processors. Still, the combination of resources and 24/7 availability makes it suitable for most use cases.

Pros of Using Stripe

Stripe’s advantages are numerous, and they explain why it has become one of the most trusted processors in the market. Its developer-friendly infrastructure is unmatched, making it ideal for businesses that want flexibility in designing custom payment flows. The platform’s global reach and support for a wide range of payment methods allow businesses to scale internationally with minimal friction.

Another major advantage is Stripe’s transparency in pricing. With no hidden fees or long-term contracts, businesses can start and scale without being locked into inflexible agreements. Its fraud prevention tools, security compliance, and additional products like Billing and Connect further strengthen its value proposition.

For subscription-based companies, SaaS providers, and marketplaces, it provides specialized tools that are difficult to match. Its ecosystem continues to evolve, meaning businesses gain access to new financial tools without switching providers. That said, its greatest strength; technical depth; also serves as a differentiator. For businesses with the right resources, it delivers a level of customization and scalability that few competitors can rival.

Cons and Limitations of Stripe

Despite its strengths, Stripe is not without limitations. One of the primary drawbacks is its complexity for non-technical users. While plugins exist, the full potential of Stripe often requires developer involvement, which can increase costs for smaller businesses. Another limitation is Stripe’s strict industry restrictions. High-risk sectors such as firearms, adult content, and certain subscription services may not be eligible, forcing businesses in those areas to seek alternative processors.

Pricing, while transparent, can also be a drawback for businesses with high transaction volumes or international sales. The standard flat-rate model may not be as competitive as interchange-plus pricing offered by some providers. Chargeback fees and dispute resolution processes can also feel rigid to merchants dealing with frequent disputes.

Finally, some users report that customer support lacks the personal touch found with traditional merchant service providers. For businesses expecting dedicated account management, this may be a shortcoming. Overall, these limitations highlight the importance of evaluating Stripe based on specific business needs.

Ideal Business Types for Stripe

It is particularly well-suited for online-first businesses, such as e-commerce retailers, SaaS platforms, and digital marketplaces. Its support for subscription billing makes it a natural choice for software companies and membership-based services. Startups benefit from its scalability and the ability to integrate advanced features without switching providers as they grow.

Global businesses also find Stripe valuable due to its multi-currency support and localized payment methods. Companies operating across borders can manage diverse payment flows without the complexity of multiple processors. Marketplaces and gig-economy platforms, in particular, gain significant advantages from Stripe Connect.

On the other hand, businesses in high-risk industries or those primarily reliant on in-person transactions may find Stripe less suitable. Traditional processors or POS-focused solutions may offer better pricing or tailored support. Similarly, very small businesses with no technical expertise may prefer plug-and-play processors that require minimal setup. In summary, it is best for businesses that value flexibility, scalability, and global reach. For companies with more basic payment needs, it may feel like overkill.

Final Verdict

It remains a leading payment processor due to its developer-friendly tools, transparent pricing, and wide feature set, supporting everything from basic payments to subscriptions, marketplaces, and banking services. It is particularly strong for startups, SaaS businesses, and global companies looking to scale. However, it is not ideal for all merchants; its technical complexity, higher costs for some models, limited support, and restrictions on high-risk industries can be drawbacks. Ultimately, Stripe’s value lies in its scalability and versatility, making it a top choice for ambitious, growth-oriented businesses, while simpler or more affordable alternatives may better suit others.

FAQs

Q1. What makes Stripe different from other payment processors?

It stands out for its developer-first approach, global reach, and wide range of financial products beyond payments. Unlike providers that focus mainly on point-of-sale or consumer wallets, it offers unmatched flexibility for creating custom payment solutions.

Q2. Is Stripe suitable for small businesses or only for large enterprises?

It caters to both, but small businesses without technical resources may find it complex. It is ideal for startups planning to scale and enterprises that need global payment infrastructure.

Q3. What are the main drawbacks of using Stripe?

The biggest drawbacks are higher costs for some use cases, limited support for high-risk industries, and the need for technical expertise to unlock its full potential.