Moneris Review

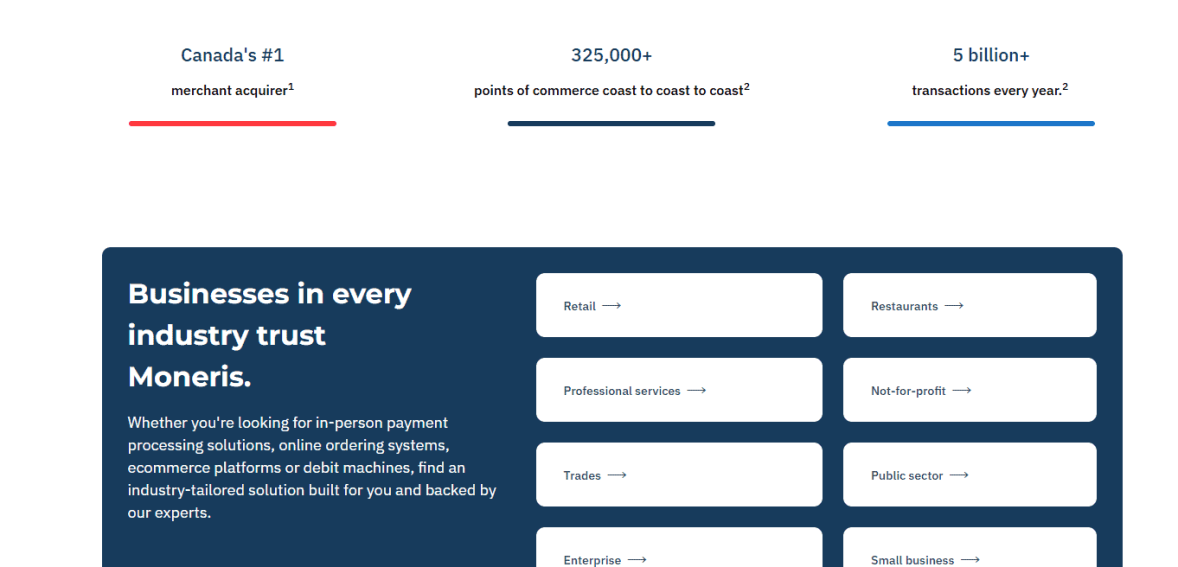

Moneris is one of the most trusted payment processors in Canada. Founded in 2000 as a joint venture between the Royal Bank of Canada and the Bank of Montreal, Moneris has become the go-to solution for over 350,000 businesses. Its entire focus is on Canadian merchants, with solutions for industries like retail, hospitality, healthcare and professional services. Lets read more about Moneris Review.

Being a domestic company gives Moneris a deep understanding of Canadian financial regulations and customer expectations. Moneris integrates with the local banking infrastructure which can be a big advantage for merchants who want to be aligned with familiar institutions. This allows the company to serve businesses of all sizes, from single location shops to national brands.

Moneris offers in-store, online and mobile payments. With a strong emphasis on compliance, fraud prevention and customer support, it gives businesses the tools to manage payments securely and efficiently. But some small businesses may find its contract terms and pricing not as transparent as expected. For businesses that value institutional backing and local support, Moneris is a competitive option.

Payment Processing Services and Capabilities | Moneris Review

Moneris offers a full suite of payment services tailored for different business types. Whether you run a physical store, accept payments online, or operate on the move, Moneris has solutions to help streamline your operations.

The platform supports all major card networks, including Visa, Mastercard, American Express, and Discover. It also integrates with Interac for debit payments, which is a preferred method among many Canadian customers. In addition, it is compatible with Apple Pay and Google Pay, making it easy to accept mobile and tap payments.

What sets Moneris apart is its unified platform. Businesses can manage transactions across in-store, online, and mobile channels from one interface. This simplifies reporting and reduces the complexity that often comes with juggling multiple systems. Moneris also offers features like recurring billing, invoice-based payments, and support for digital gift cards.

While its capabilities are comprehensive, the cost structure varies depending on transaction type and volume. Larger businesses with consistent sales may benefit from competitive rates, but smaller operations might find better deals through providers with simpler, flat-rate models.

POS Solutions

Moneris delivers a range of POS solutions that cater to both small and large businesses. From basic countertop terminals to advanced smart devices, its POS offerings are designed to handle day-to-day transactions with ease and speed.

Traditional countertop terminals work well in fixed-location stores. These devices process chip, tap, and swipe transactions and are known for reliability. Wireless terminals, on the other hand, offer mobility for businesses like restaurants and mobile service providers. They enable payments from anywhere within a location, which enhances convenience for both staff and customers.

Moneris Go, the company’s smart terminal, is a standout product. It combines payment processing, inventory tracking, and sales data into one compact device. Running on Android, it includes a built-in receipt printer and supports Wi-Fi and cellular connections, making it ideal for modern retail environments.

Many of Moneris’ POS solutions integrate with business tools such as accounting software and inventory systems. This reduces manual work and ensures real-time data access. However, the initial investment in hardware and the potential for long-term contracts may be a drawback for businesses seeking more budget-friendly or short-term options.

E-Commerce and Online Payment Gateway

For businesses with an online presence, Moneris has e-commerce capabilities. Whether you have a fully integrated e-commerce site or just need to accept online payments, Moneris has multiple tools to support digital transactions. One of the options is the hosted checkout page which allows merchants to accept payments without coding knowledge. For developers and tech-savvy businesses, Moneris has APIs and SDKs to support custom checkout experiences and deep back-end integration.

Moneris works with popular e-commerce platforms like Shopify, WooCommerce, BigCommerce and Magento. This makes it easy for merchants to connect their existing stores to Moneris’ payment gateway. The gateway accepts all major credit cards and digital wallets so customers can pay with their preferred method.

Security features like tokenization, 3D Secure authentication and fraud prevention tools are built into the gateway. Merchants can also offer recurring billing for subscription based services. While these features are great, smaller businesses without technical support may find the setup more complex than all-in-one platforms designed for ease of use.

Mobile Payments and On-the-Go Solutions

Moneris offers flexible mobile payment options for businesses that need to process transactions beyond traditional storefronts. These solutions are well-suited for mobile vendors, tradespeople, delivery services, and pop-up retail setups. It Go functions as both a stationary and mobile terminal. It is a standalone device with a touchscreen, built-in printer, and support for chip, tap, and swipe payments. It also works with Apple Pay and Google Pay, allowing contactless payments.

The Moneris mobile app lets merchants turn smartphones or tablets into payment terminals when paired with a card reader. This is a practical and cost-effective option for businesses with limited hardware needs or those requiring a backup solution.

Transactions made through mobile devices are encrypted and automatically synced with the merchant’s Moneris account. This ensures secure processing and centralized reporting. However, the cost of mobile hardware and processing fees may not be as low as some app-based fintech alternatives. For businesses operating in Canada that prioritize security and bank-backed reliability, Moneris’ mobile tools are a solid option.

Payment Security and Fraud Prevention Tools

Moneris places strong emphasis on keeping payment data safe. As a Canadian company backed by major banks, it ensures full compliance with PCI DSS standards and includes security features designed to protect both merchants and customers.

A core component of Moneris’ security approach is tokenization, which substitutes sensitive card data with unique identifiers during transactions. This protects payment information from being exposed during the process. The platform also uses end-to-end encryption to safeguard data from the point of entry through to authorization.

Fraud prevention tools are built into both in-store and online systems. Merchants have access to features like CVV verification, address verification, and 3D Secure for online transactions. The Moneris iGuard system monitors for suspicious activity and allows merchants to apply automated rules that flag high-risk payments.

While the security tools are robust, some advanced options may require extra setup or are reserved for larger merchants. Smaller businesses may need guidance to make the most of these features. Overall, it provides a strong security framework that helps protect against fraud and ensures compliance with Canadian data protection laws.

Reporting, Analytics, and Business Tools

Moneris supports business decision-making with a suite of reporting and analytics features. These tools are accessible through the MyMoneris portal, which allows merchants to view transactions, generate reports, and track sales metrics in real time. The portal provides insights into revenue trends, customer behavior, and product performance. Businesses can analyze data such as hourly sales, best-selling items, and average transaction values. This visibility can help optimize operations, staffing, and marketing strategies.

Merchants can export reports for use with external tools or accounting software. Scheduled reporting options are also available, reducing the time spent manually compiling sales data. While the analytics are useful for most users, they may not offer the depth of segmentation and forecasting that more advanced analytics platforms provide.

Moneris also supports customer loyalty features and gift card campaigns. Businesses can create repeat business opportunities by tracking spending history and offering rewards. While these tools are helpful, they are more basic compared to dedicated CRM systems. Still, for small to mid-sized businesses, they add value without additional software costs.

Customer Support and Service Experience

Moneris offers support through phone, email and live chat. Support is available 7 days a week and Moneris also has a self-serve knowledge base with user guides, FAQs and troubleshooting articles. Canadian businesses get support from people who understand local needs and banking systems. It also offers onboarding assistance for businesses setting up POS systems or integrating with e-commerce platforms.

Larger businesses may get assigned dedicated account managers who can offer more personalized advice. For smaller merchants support response times are generally good but some users mention inconsistent experiences depending on the issue or time of day.

The MyMoneris portal allows merchants to track support tickets and follow up on service requests. While Moneris is generally reliable, issues around billing or hardware replacement sometimes get negative feedback. But its local support model is a big plus over some of the global support centers offered by other competitors.

Pricing, Fees, and Contract Terms

Moneris uses a combination of fixed fees, transaction charges, and hardware rental costs. Pricing details are not always available publicly, so it’s important for prospective customers to request a custom quote and review contract terms closely. Typical pricing includes a setup fee and a monthly charge that covers access to the platform and terminal rental. Transaction fees vary by card type. Debit transactions tend to be cheaper than credit cards, which incur a percentage-based charge plus a small per-use fee.

Other fees may include early termination penalties, PCI non-compliance charges, and costs for chargebacks. Contracts often run for three years, and breaking the agreement early can result in significant fees.

For larger businesses, Moneris may offer negotiated pricing that bundles services for better value. However, startups and smaller merchants might find more predictable pricing with flat-rate providers. Transparency remains an area where Moneris could improve, especially for businesses comparing multiple payment processors.

Pros and Cons of Choosing Moneris

Moneris is a strong Canada focused payment solution backed by two of Canada’s biggest banks. Their integrated services cover in-store, online and mobile transactions with robust security and local customer service. For businesses looking for institutional reliability and long term support Moneris is a good option. They are especially good for merchants who value compliance, advanced fraud tools and broad integration.

But the downsides are limited transparency on pricing, long term contracts and setup costs that may not be suitable for smaller or newer businesses. Some of their tools may not have the same level of user experience as newer software driven competitors. It is good for established Canadian businesses looking for a bank backed all in one payment processor. Those with low transaction volumes or flexible needs may prefer providers that offer simpler terms or lower costs.

FAQs

Q1. Is Moneris only available in Canada?

Yes, it operates exclusively within Canada and focuses on serving Canadian merchants with localized solutions.

Q2. Does Moneris offer month-to-month contracts?

Moneris typically provides multi-year contracts. While promotional offers may include more flexible terms, it’s important to verify before signing.

Q3. Can Moneris be integrated with my existing e-commerce platform?

Yes, it integrates with popular platforms like Shopify, WooCommerce, and Magento, and also offers APIs for custom integrations.