EBizCharge Review

Century Business Solutions created the U.S.-based payment processing platform EBizCharge with the goal of simplifying the way companies receive and handle payments. Its emphasis on accounting, ERP, and CRM system integration sets it apart from many other standard gateways, making it the perfect choice for companies that rely on programs like Microsoft Dynamics, NetSuite, Sage, or QuickBooks. Lets read more about EBizCharge Review.

The platform accepts a variety of payment methods, such as debit cards, eChecks, ACH, and credit cards, through online, in-person, and phone channels. What really makes EBizCharge unique is its capacity to ease the burden of billing and payment collection, particularly for companies handling large-scale B2B payments or recurring invoices. While EBizCharge isn’t built for every use case; such as standalone eCommerce or retail-first environments; it’s a powerful choice for companies seeking smoother AR processes and deeper software integrations.

Key Features and Functionality | EBizCharge Review

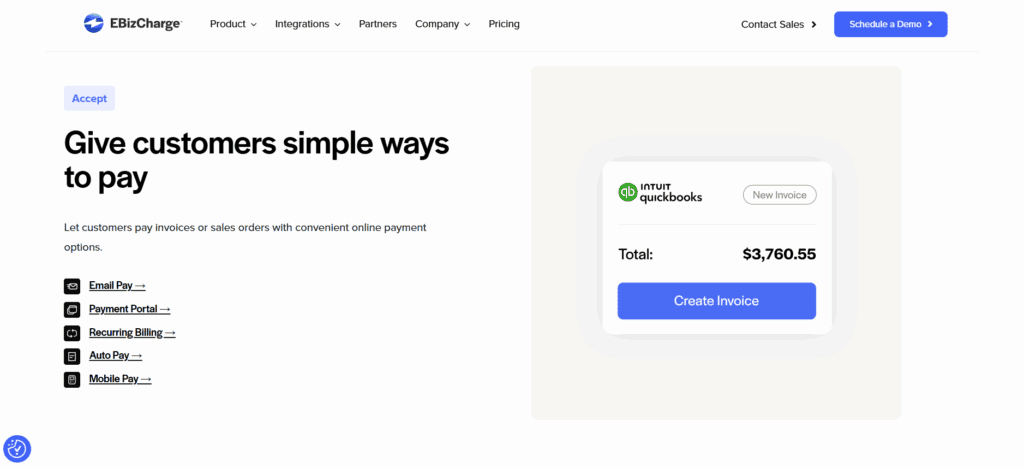

EBizCharge comes equipped with tools that go far beyond basic payment acceptance. Its core gateway supports all major cards, ACH payments, and eChecks, but it also offers automation features, integrated invoicing, and analytics. A standout feature is the secure customer payment portal, which allows clients to view and pay invoices online. This not only accelerates collections but also improves the customer experience. Businesses can send email payment links, configure recurring billing, and even apply surcharges where permitted. The dashboard offers real-time visibility into transactions and can export data for accounting, forecasting, or compliance. Mobile payment support also enables teams in the field to collect payments conveniently.

Perhaps most valuable is the reduction in manual entry. When paired with ERP software, payments are automatically posted to corresponding invoices, eliminating errors and saving time. EBizCharge also stores payment credentials securely through tokenization, simplifying repeat transactions without compromising data security. While it may lack retail-centric features like hardware POS integrations, for B2B firms and service providers, the platform delivers most of the core capabilities they need.

Seamless ERP and Accounting Software Integrations

One of the main reasons for EBizCharge’s popularity is its extensive integration capabilities. For popular accounting and ERP systems like QuickBooks, Sage, NetSuite, Microsoft Dynamics, SAP Business One, and Acumatica, the platform provides pre-built plugins. Users can process payments straight from within their accounting software thanks to these integrations. For instance, QuickBooks users can include “Pay Now” links in their invoices, and payments will sync instantly. This close integration guarantees ledger accuracy, lowers administrative burden, and minimizes reconciliation problems.

In addition to payments, EBizCharge streamlines even the most complicated workflows in larger ERP environments by syncing customer information, invoice references, and payment statuses. The U.S.-based team at EBizCharge handles the majority of integration support, tailoring setups to meet specific business requirements. However, companies running niche or custom ERP platforms may require additional development for full compatibility. That said, for businesses using mainstream solutions, EBizCharge provides an impressively seamless setup with minimal disruption.

Security and Compliance Standards

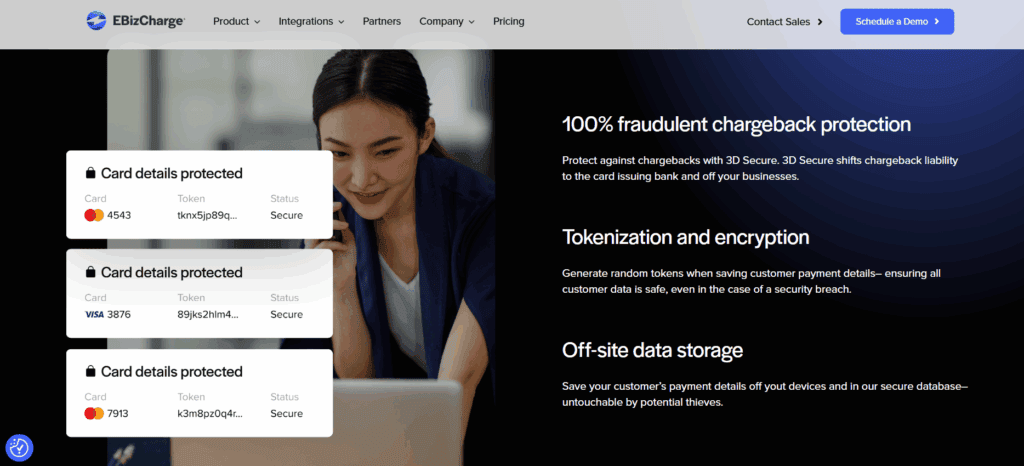

Security is a top priority for EBizCharge, which complies with PCI-DSS standards to ensure that all transaction data is encrypted, stored securely, and regularly audited. The platform uses EMV-compliant and tokenized payment processing, which replaces sensitive card data with secure tokens, greatly reducing breach risk. For businesses managing recurring billing or storing client payment information, tokenization offers a safe and compliant way to maintain customer convenience without exposing financial data.

EBizCharge also includes fraud prevention tools like AVS, CVV checks, and real-time transaction monitoring. Users can set thresholds for transaction values and receive alerts for suspicious behavior.

Its secure vault feature helps companies safely store customer payment data for repeat transactions while staying within PCI compliance boundaries. Additionally, the platform helps businesses dispute chargebacks by simplifying access to necessary documentation. Overall, EBizCharge exceeds standard security expectations, making it a dependable option for companies prioritizing data protection and fraud control.

Ease of Use and User Experience

EBizCharge is designed with the user experience in mind, even with its extensive functionality. Even for people without technical experience, the interface is simple to use, well-structured, and intuitive. Small and mid-sized businesses that might not have internal IT teams will find this especially helpful. Following integration, the system offers users guided walkthroughs to help them understand features like report generation, payment tracking, and invoicing. The learning curve is further lowered by thorough training resources, such as articles, videos, and supporting documentation. Daily tasks like sending payment links, issuing refunds, and reviewing transaction history are made simpler and involve fewer steps. Because of the platform’s configurable permissions, companies can regulate user access according to roles.

While mobile functionality exists, it is more limited than the web interface. Still, it remains a useful tool for sales or service staff on the go. One limitation is that reporting features, though sufficient for daily needs, may not meet the depth preferred by advanced users needing more granular analytics.

Payment Processing Capabilities

EBizCharge offers broad support for payment types suited to B2B and service businesses. It accepts credit cards, debit cards, ACH payments, eChecks, and recurring billing; providing businesses with flexibility in managing their receivables. A key advantage is the ability to attach secure payment links to digital invoices, allowing customers to pay instantly through a self-service portal. For recurring transactions, businesses can store client credentials securely and automate billing cycles.

ACH support is particularly valuable for B2B transactions, offering a low-cost, efficient alternative to card payments. The platform also supports installment plans and partial payments, which can be configured directly in the connected ERP system. That said, the system isn’t built for heavy retail use or high-volume POS operations. Those requiring barcode scanners, cash drawers, or full-featured retail checkout flows may need third-party hardware or software integrations. For businesses focused on back-office payment collection and AR optimization, though, EBizCharge delivers strong functionality.

Pricing Structure and Transparency

Regardless of the type of card or issuing bank, EBizCharge’s flat-rate pricing model offers predictable costs per transaction. For many companies, particularly SMBs, this makes budgeting and billing easier. The platform is flexible and low-risk because there are no setup fees, cancellation fees, or monthly minimums.

The precise cost isn’t made public, though; businesses must contact a sales representative to obtain a quote that is tailored to their volume and integration requirements. For high-volume merchants, flat rates might not always be the most economical choice, even though they offer clarity.

Depending on the transaction mix in these situations, an interchange-plus model may result in greater savings. It’s critical to carefully review contract details because additional features, such as surcharge modules or specific ERP integrations, may incur additional charges. On balance, EBizCharge offers a fair and understandable pricing model. Though not always the cheapest, it avoids the confusion of fluctuating interchange rates and hidden fees.

Customer Support and Service Quality

EBizCharge delivers strong customer support, with U.S.-based representatives available via phone, email, and chat. The support team is known for its technical expertise; particularly in accounting software integrations; and provides tailored onboarding assistance to new clients. Each customer typically receives a dedicated account manager during setup, helping ensure smooth implementation.

The company also maintains a knowledge base, FAQs, training webinars, and video tutorials for self-guided help. While the service quality is generally rated highly, some users have noted slower response times during busy periods, especially on live chat. Support hours are not 24/7, which may be a limitation for businesses operating across multiple time zones. Nonetheless, EBizCharge earns high marks for support overall, thanks to its informed staff and proactive guidance during the integration and training stages.

Strengths and Potential Limitations

EBizCharge’s strengths are its secure payment infrastructure, ease of use for workflows related to augmented reality, and deep integration with accounting and ERP systems. Businesses that need a dependable method to handle invoicing, automate collections, and minimize manual entry are especially well-suited for it. Growing businesses benefit from the platform’s multiple user support, custom permission enforcement, and recurring billing features. However, businesses that specialize in retail inventory management, point-of-sale transactions, or eCommerce might find the platform less flexible. The lack of upfront pricing may also make it difficult for companies to compare prices from different providers. The areas where EBizCharge excels are backend automation, secure payments, and accounting system compatibility, even though it isn’t made for every use case.

Final Verdict: Is EBizCharge Worth It?

EBizCharge fulfills its promise to make payment acceptance easier for companies that rely on accounting and ERP. It offers significant value to businesses aiming to modernize and simplify accounts receivable with features like tokenized billing, ACH acceptance, secure invoicing, and real-time reconciliation. Its usability, excellent support, and flexible integrations make it a good option for both large and mid-sized businesses. Businesses that are price-sensitive or have a retail focus might search elsewhere, but EBizCharge is a good investment for those that require ERP sync and payment automation.

FAQs

Q1: Is EBizCharge compatible with platforms like Shopify or WooCommerce?

EBizCharge can integrate with some eCommerce systems, but it’s primarily designed for ERP and accounting software. Businesses focused on online retail may prefer gateways tailored to their platform.

Q2: What fraud prevention tools are available?

The platform offers AVS, CVV checks, tokenization, and real-time transaction monitoring. It also simplifies chargeback disputes with access to transaction records and evidence.

Q3: Is EBizCharge suitable for small businesses?

Yes, particularly for small businesses using QuickBooks or similar software. While the platform is more robust than entry-level tools, the benefits of automation and integrated payments can be valuable for smaller teams.