Checkout.com Review

Checkout.com is a prominent financial technology company that specializes in providing comprehensive digital payment solutions to businesses worldwide. Founded in 2009, it has rapidly evolved to become a key player in the fintech industry, serving a diverse range of clients, including major corporations like Netflix, Pizza Hut, and Coinbase. Lets read more about Checkout.com Review.

The company was founded in Singapore in 2009 under the name Opus Payments, with the goal of helping Hong Kong merchants with their payment procedures. It made a strategic move in 2012 to take advantage of the growing European fintech market by changing its name to Checkout.com and moving its headquarters to the UK.

Swiss entrepreneur Guillaume Pousaz is the founder and CEO of Checkout.com. Born in 1981, Pousaz initially pursued studies in mathematical engineering and economics but left academia in 2005 to explore opportunities in the payments industry. His vision and leadership have been instrumental in steering Checkout.com to its current status as a fintech powerhouse.

Checkout.com is headquartered in London and has established offices across six continents, reflecting its commitment to a global operational footprint. In 2020, the company expanded into the Australian and New Zealand markets by acquiring the Australian company Pin Payments.

Checkout.com has established itself as a major player in the global digital payments market by means of consistent innovation and calculated growth, providing all-inclusive solutions that meet the changing demands of companies everywhere.

Services and Solutions | Checkout.com Review

Checkout.com provides a comprehensive suite of payment solutions designed to help businesses process transactions efficiently and securely. From payment acceptance to fraud prevention and global payouts, the platform offers a range of services tailored to meet different business needs.

Payment Processing

Checkout.com supports the acceptance of over 150 currencies, making it a reliable option for businesses operating in multiple regions. It allows merchants to process payments through major credit cards, including Visa, Mastercard, and American Express, as well as various local payment methods. This flexibility ensures that customers can complete transactions using their preferred payment options, enhancing the overall checkout experience.

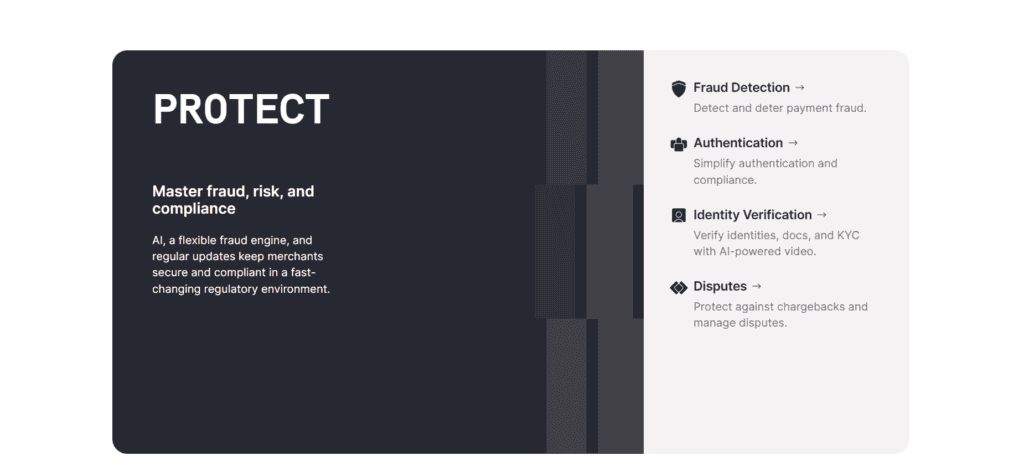

Fraud Detection and Risk Management

To help businesses minimize fraud and comply with industry regulations, Checkout.com integrates AI-driven fraud detection tools. These tools analyze transactions in real time, identifying suspicious activities and preventing unauthorized payments. Additionally, the platform provides compliance solutions that assist businesses in meeting global regulatory requirements, reducing risks associated with payment processing.

Payouts and Card Issuing

In addition to accepting payments, Checkout.com provides global payout features that let companies send money to partners, suppliers, and consumers anywhere in the world. Businesses that deal with big transactions or operate in foreign markets will especially benefit from this. Additionally, the platform offers services for virtual and physical card issuance, giving businesses more flexibility in managing payroll, expenses, and business transactions.

Technology and Integration

Checkout.com is built with a strong focus on technology, ensuring seamless integration and high performance for businesses of all sizes. Its developer-friendly approach makes it easy for companies to incorporate advanced payment solutions into their platforms while maintaining reliability and security.

API and Developer Tools

The platform offers a single API that supports multiple payment functionalities, simplifying the integration process for developers. Whether businesses need to accept payments, manage refunds, or handle payouts, everything can be done through one unified API. This reduces complexity and makes payment processing more efficient.

Furthermore, Checkout.com offers thorough documentation and software development kits to facilitate seamless service integration for businesses. By assisting developers with the setup process, these resources facilitate the customization of payment solutions to meet particular business requirements.

Platform Reliability and Performance

Checkout.com operates on a cloud-native infrastructure, ensuring high uptime and uninterrupted payment processing. This setup allows businesses to handle transactions at scale without worrying about system downtimes or disruptions.

To further enhance reliability, the platform incorporates self-healing capabilities that automatically detect and resolve issues in real time. This means that even if technical problems arise, the system can correct itself without causing delays or affecting transactions.

By combining advanced technology with developer-friendly tools, Checkout.com provides businesses with a payment solution that is both powerful and easy to integrate.

Global Reach and Localization

Checkout.com is designed to support businesses operating across different markets by offering localized payment solutions. Its global reach and in-depth understanding of regional payment landscapes make it easier for companies to process transactions efficiently while catering to local consumer preferences.

Local Acquiring

A major advantage of Checkout.com is its in-country acquiring services, which are offered in more than 50 countries. This indicates that companies can handle payments via local banks, diminishing the necessity for international transactions. By reducing international fees and currency exchange expenses, companies can cut costs while enhancing transaction approval rates. This is especially advantageous for businesses entering new markets, as it guarantees easier payment processing and an increased success rate for customer transactions.

Support for Local Payment Methods

To accommodate the diverse preferences of global consumers, Checkout.com integrates with various regional payment methods. Customers can use popular options like Alipay, WeChat Pay, and other local digital wallets, ensuring a more seamless checkout experience. This flexibility is crucial for businesses targeting international audiences, as it helps increase conversion rates and customer satisfaction.

Additionally, the platform adapts to local consumer behaviors by supporting region-specific payment preferences, such as bank transfers or installment payments. This localization makes transactions more convenient for customers and allows businesses to offer payment methods that align with market expectations.

Customer Support and Satisfaction

Customer support plays a crucial role in the payment processing industry, and Checkout.com aims to provide reliable assistance to its users. The company offers multiple support channels to help businesses resolve issues efficiently while also receiving feedback from customers about their experiences.

Support Channels

Checkout.com offers customer assistance via multiple channels, such as email, phone, and online materials. Companies can contact the support team for assistance with technical problems, account management, or general questions. Furthermore, the company provides an extensive knowledge base and documentation, enabling users to find answers to frequently asked questions without requiring direct help.

For businesses with complex needs, Checkout.com also provides dedicated account managers who can offer personalized support. This feature is particularly helpful for larger companies that require ongoing guidance and custom payment solutions.

Customer Feedback

Many customers have praised Checkout.com for its strong account management and support services. Businesses appreciate the expertise of the support team and the ability to get assistance from knowledgeable professionals. The platform’s commitment to helping merchants optimize their payment processes has been a key highlight in customer reviews.

Nonetheless, several users have expressed worries regarding response times and the resolution of specific problems. Although Checkout.com aims to offer prompt assistance, there have been some delays in resolving technical issues at times. Enhancing response times and guaranteeing quicker problem resolution could elevate customer satisfaction even more.

Overall, Checkout.com offers a solid support system with multiple channels and knowledgeable representatives. While customer feedback is generally positive, there is room for improvement in addressing concerns more efficiently.

Pricing and Contract Terms

Pricing is an important factor for businesses when choosing a payment processor. Checkout.com offers a transparent pricing structure and flexible contract terms, making it a suitable choice for companies of all sizes.

Pricing Structure

Checkout.com utilizes a per-transaction pricing structure, guaranteeing that businesses only pay for their usage. The company provides competitive pricing, with charges differing depending on the type of transaction, payment method, and area. For larger firms and enterprise clients, Checkout.com offers interchange-plus pricing, potentially resulting in savings by delivering a more detailed analysis of processing charges. This pricing structure provides companies with better insight into their charges, enabling them to enhance their payment processing expenses.

While the exact pricing details are not publicly listed, Checkout.com customizes rates based on business needs, making it important for merchants to request a quote to understand the exact costs.

Contract Flexibility

One of the advantages of Checkout.com is its contract flexibility. Businesses are not locked into long-term contracts and can operate on a month-to-month basis. This allows merchants to use the service without the worry of long-term commitments. Additionally, Checkout.com does not charge early termination fees, giving businesses the freedom to switch providers if their needs change.

This level of flexibility is particularly beneficial for startups and growing businesses that need adaptable payment solutions. With no strict contracts and a clear pricing structure, Checkout.com provides a straightforward and transparent approach to payment processing.

Security and Compliance

Security is a top priority for any business handling online payments, and Checkout.com takes significant measures to ensure safe and compliant transactions. The platform follows strict financial regulations and implements advanced security protocols to protect customer data.

Regulatory Adherence

Checkout.com adheres to international financial regulations, establishing itself as a reliable payment processor for companies operating across various nations. The firm complies with industry regulations like PCI DSS, which guarantees the secure management of cardholder information. Moreover, it adheres to anti-money laundering and KYC regulations, assisting businesses in remaining compliant with legal obligations.

By meeting these regulatory standards, Checkout.com provides businesses with a secure payment environment while reducing the risks associated with fraud and non-compliance. This is particularly important for companies operating in highly regulated industries that require strict adherence to financial laws.

Data Protection

To safeguard customer and transaction data, Checkout.com employs advanced security measures, including encryption and tokenization. Encryption ensures that sensitive payment information remains protected during transactions, while tokenization replaces card details with unique identifiers, minimizing the risk of data breaches.

The platform also uses AI-driven fraud detection tools to monitor transactions in real time and identify suspicious activities. These security measures help prevent unauthorized access, reduce fraudulent transactions, and protect both businesses and their customers.

Focusing heavily on data protection and compliance, Checkout.com offers companies a dependable and secure payment processing service. Its dedication to adhering to international regulations and enforcing strong security protocols guarantees a secure experience for both merchants and their clients.

Market Position and Competitors

Checkout.com has established itself as a major player in the payment processing industry, offering a range of solutions for businesses worldwide. With strong financial backing and a competitive position among industry leaders, the company continues to expand its presence in the global market.

Valuation and Funding

In 2022, Checkout.com reached a valuation of $40 billion, making it one of the most valuable fintech companies. This rapid growth is fueled by significant funding rounds and increasing demand for online payment solutions. The company’s ability to attract high-profile investors highlights its strong market potential and innovative approach to payment processing.

Checkout.com’s success is driven by its focus on seamless transactions, fraud prevention, and global payment acceptance. As e-commerce and digital payments continue to grow, the company remains well-positioned to capitalize on emerging opportunities in the financial technology sector.

Comparison with Competitors

Checkout.com faces competition from major players in the payment processing sector, such as Stripe and Adyen. Although Stripe is recognized for its payment solutions that are friendly for developers and widely used by startups, Adyen focuses on serving enterprise clients with a significant focus on omnichannel payments.

Compared to these competitors, Checkout.com differentiates itself by offering tailored solutions for businesses of all sizes, focusing on localized payments, global reach, and advanced fraud protection. The company’s flexible pricing and strong compliance measures also make it an attractive choice for businesses looking for a reliable payment partner.

Despite strong competition, Checkout.com continues to gain market share by providing a balance of technology, security, and global payment support. Its rapid valuation growth and increasing adoption indicate that it is a strong contender in the fintech space.

User Experience and Interface

A smooth and intuitive user experience is essential for businesses managing payments, and Checkout.com offers a well-designed interface that simplifies financial operations. With a focus on usability and customization, the platform caters to businesses of all sizes.

Dashboard and Reporting

Checkout.com provides a user-friendly dashboard that allows businesses to monitor transactions, track payment performance, and access real-time analytics. The clean and organized layout makes it easy to navigate, ensuring users can quickly find the information they need.

The reporting tools provide essential information on payment patterns, assisting businesses in refining their processes and recognizing possible problems. By analyzing transaction details, chargebacks, and revenue trends, businesses can make informed decisions to enhance their payment strategies.

Customization and Flexibility

One of Checkout.com’s strengths is its ability to offer tailored solutions based on a business’s specific requirements. The platform supports a range of customization options, from API integrations to payment flow adjustments, allowing businesses to create a payment experience that aligns with their needs.

Whether a company operates in e-commerce, subscription services, or marketplace platforms, Checkout.com provides the flexibility to configure payment settings, manage risk parameters, and adapt to different customer preferences. This adaptability makes it a suitable choice for businesses looking for a scalable and customizable payment solution.

Pros and Cons

Checkout.com is a robust payment processing solution that provides companies with various features to streamline transactions and enhance security. Nevertheless, similar to any service, it possesses both benefits and disadvantages that companies ought to take into account.

Advantages

One of the biggest strengths of Checkout.com is its comprehensive global payment solutions. The platform supports over 150 currencies, multiple local payment methods, and in-country acquiring in more than 50 countries. This makes it an excellent choice for businesses operating internationally.

Another major benefit is its advanced fraud detection capabilities. Checkout.com uses AI-driven tools to monitor transactions in real time, helping businesses prevent fraudulent activities. The platform also ensures compliance with industry regulations, reducing security risks and improving trust with customers.

Additionally, Checkout.com provides a flexible and customizable payment experience. Its API allows businesses to tailor payment flows, integrate seamlessly with existing systems, and access real-time analytics to optimize operations.

Disadvantages

Although Checkout.com has its advantages, it poses some possible challenges for small enterprises. Its solutions are very advanced, making them potentially better suited for medium and large businesses than for small startups. Certain companies might consider the onboarding procedure complicated, particularly those lacking technical skills.

Another common concern is customer support delays. While Checkout.com offers multiple support channels, including email and phone, some users have reported slow response times when dealing with urgent issues. Faster resolution of support requests could enhance the overall user experience.

In general, Checkout.com is a robust payment processor that offers wide international reach and security features. Nevertheless, small enterprises might need to evaluate if their products meet their requirements, and enhancements in customer support could increase its dependability.

FAQs

Checkout.com is a widely used payment processing platform, and businesses often have questions about its features and capabilities. Here are some commonly asked questions and their answers.

How does Checkout.com handle international payments?

Checkout.com provides local acquiring in over 50 countries, enabling businesses to process transactions more efficiently. By supporting payments in more than 150 currencies, it helps reduce cross-border fees and improves authorization rates. This ensures smoother transactions for international businesses, making it easier to accept payments from customers worldwide.

What integration options does Checkout.com provide for developers?

Developers can integrate Checkout.com into their systems using a single, unified API, which simplifies the payment process. The platform also offers comprehensive documentation and SDKs, making it easy to add various payment functionalities. Whether businesses need to manage transactions, process refunds, or handle payouts, Checkout.com provides a seamless and flexible integration experience.

How does Checkout.com ensure the security of transactions?

Security is a top priority for Checkout.com. The platform uses AI-driven fraud detection tools and risk management systems to monitor transactions in real time and prevent fraudulent activities. Additionally, Checkout.com complies with global financial regulations, ensuring all transactions are processed securely and in line with industry standards.